Borrow == Shorts

I've come to realize that borrowing an asset and shorting it are exactly the same thing the vast majority of the time. Want to buy a car or a house? You'll need a loan from the bank. Many people see their home as the ultimate investment. The borrower is shorting USD and going long on real estate. This asset is not only an investment, but also has utility because one needs a place to live regardless.

I do not necessarily believe that real estate really is an investment; at least not anymore. The entire concept seems flawed to me after everything I've learned. Why would a house go up in value over time as the materials that the house is made of continue to slowly disintegrate? How can a house go up in value when technology should be making it easier to build them? Indeed, a house can only be seen as an investment if the unit-of-account it's being measured against (USD) is going down faster than the value of the home.

Once we realize this it's easy to see that real estate isn't really a very good investment at all but can still act as a SOV (store of value) against fiat debasement. It's also important to point out that the utility of what's build on the land (a building) is often less valuable than the actual plot of land itself. After all, as population increases the amount of land in existence can only ever stay the same. The Earth isn't getting any bigger. Demand increases while supply stays the same. For now (see: demographics).

Mars perhaps?

Property tax also completely cripples the entire concept of real estate ownership and SOV. How can someone own a thing that stores value if it's actually the government that owns it while forcing you to pay them 'protection money' at gunpoint? Property tax bleeds SOV from real estate every year and most people just carry on with an, "it is what it is," attitude about it.

Point being that people are not actually allowed to assets of great importance. 'Owning' your own home is just renting from the government for a relatively cheap price. They pinky promise it's yours until they decide to legally take it back using civil asset forfeiture laws.

We are not allowed to own the means of production either. We can not own a factory that makes smartphones. We can buy stock in a company that produces smartphones, but again who actually owns that stock? More can be printed on the whim of the real owners of the company. More often than not it is the banks who end up owning the means of production at scale. Everybody sells out sooner or later.

We can't even own money.

It was a shocking revelation when I realized that physical cash in your pocket isn't money at all. It's debt. The ramifications of such a broken and busted system are really starting to reveal themselves these days, and it's actually kind of depressing. This is why an asset like Bitcoin ends up being quite a fascinating puzzle piece that seem to fill a missing niche within society.

With BTC, we can finally actually own something without worrying about other powerful players within the ecosystem manipulating the rule for solely their own benefit as we see in every other aspect of the world. At least that's the idea anyway (INB4 comment section).

How much longer until governments worldwide try to levy "property taxes" on citizens' BTC holdings? Well actually that's exactly how ETFs work apparently which is what I talked in the post I wrote 3 days ago. Hopefully the 1% or whatever it is they charge per year becomes nothing but an inconsequential nuance, but either way it will always be a stark reminder that BTC ETF holders don't actually own BTC. They own debt, (an IOU) just like the system intended.

Shorting USD

It seems like the smartest thing in the world to borrow/short as much USD as possible. After all, the value is always declining. The problem with this strategy is that loans come with those pesky strings attached called interest rates. If we load up on $20,000 of credit card debt at 30% APR (CC rates are absolutely insane these days) it's highly unlikely that such an "investment" could ever be worth it.

After all, what do people actually buy with credit cards? Clothes? Dining? Bars? Night clubs? Shoes? Vacations? None of these things are actually investments. They are just things that people might want within the economy. Consumables. Vapor.

A motor vehicle could be seen as an investment, but only if we need one to do a job. The utility is undeniable but then we trade our time for money while often making someone else rich. It's quite hard to get the upper hand in the scenario for the vast majority of the population, especially when we've been brainwashed into surrendering any and all discipline. Instant gratification and living paycheck to paycheck are the gods of this world now.

The ultimate short on USD is getting a business loan and creating a profitable small enterprise. Of course this is much easier said than done. After all: half of all businesses fail within the first 5 years. How many more are barely scraping by with little chance to expand?

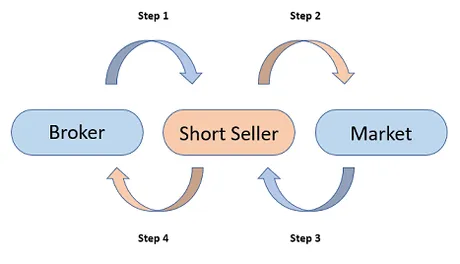

Shorting BTC (number go down)

Many are worried about 'paper Bitcoin' manipulating the market downward. After all we saw exactly how FTX played it; literally as aggressive as humanly possible. They had ZERO Bitcoin on the books and however many billion in liabilities owed back. Those who sent BTC to FTX were liquidated immediately, and those who bought BTC on FTX were issued a meaningless IOU.

Luckily, unlike gold, silver, or any other derivative known to man, anyone can take custody of BTC. Citizens can not take custody over gold. You buy gold online and what you get is a number in a database that's only as good as the reputations of the institutions that control it. Same thing with stocks. We can not withdraw a stock from an exchange and own it; that would be ridiculous. However we can do that with crypto which is very significant.

First off it means that naked shorting Bitcoin is literally impossible. A naked short is when an asset is sold that never even existed in the first place. This is how Melvin Capital got vaporized in the Gamestop short squeeze. Simply the idea that they could have been naked shorting GME incentivized the financial world's most notorious squeeze.

But because Bitcoin is a global censorship-resistant network this strategy is quite impossible. If an exchange sold more BTC than existed on their books then arbitragers would buy the cheap Bitcoin and immediately attempt to withdraw it to other exchanges in order to sell it for instant profits. The rogue exchange would then be forced to buy back BTC from another exchange if only to fulfil the arb requests, which completely undermines the entire strategy. The exchange would lose money for no reason.

There are many financial manipulations that simply can not happen with crypto because of the fact that users can take custody of it. Obviously we must continue educating the 'normies' about this and teaching them how they can secure their own assets whenever possible. Hell, perhaps one day a crypto token will pop up who's only purpose is to teach the masses how to do these things by paying them to learn. How would they stop Sybil attack while creating a circular economy? No idea. It's basically not something that can exist under the roof of current infrastructure. But development isn't slowing down anytime soon so who knows where we'll be in 10 years.

Conclusion

Over a long enough timeline, those that short Bitcoin get completely obliterated. This has a tendency to put crypto in a permanent win/win situation. Is it bad that Blackrock is getting into the spot ETF game? What happens if they print fake paper Bitcoin?

Who cares?

If they print fake paper Bitcoin they'll eventually go bankrupt over it, and if they don't then they're just another trusted party ready to adopt the new paradigm. This is the fabulous thing about the 4-year cycle and the 1-year bear market: it only takes one cycle to annihilate the majority of corruption and garbage that exists within the environment.

Essentially the only way to hedge against greedy institutions doing greedy institutional things is to cut them out of the equation. We all know the rules: not your keys not your crypto. Such a simple phrase with such powerful subtext. Never forget this fact, as the next bull will be here before you know it: whispering its greedy little secrets and promises of wealth if you just 'trust us'. Don't fall for it. We've all been doing this long enough to know better.

Return from Custody is King to edicted's Web3 Blog