Rule of 3

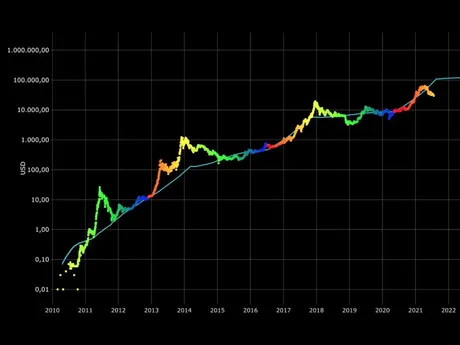

It's been a while since I've brought this up, but many events in crypto tend to happen in groups of three. Three pumps before a dump in a bull market. Three dumps before a pump in a bear market. Three days of pump on exchange listings. Three weeks of hype on fundamental speculation. Three months of up during a rally. Three years of bull market in the four year cycle.

3 days/weeks/months/years

What about decades? Is it possible that there's a thirty year cycle in crypto that we don't even know about because Bitcoin was born in 2009? I guess we'll find out in 2039. Obviously that's a long way off so better to focus on the current event at hand.

ETF approval is the rumor.

I'm seeing a lot of "buy the rumor sell the news" rhetoric on social media as it applies to the ETF approval. Funny how the average person is determined to interpret this concept incorrectly even when it's perfectly spelled out for them. The foolhardy assumption being espoused here is that ETF approval from the SEC is the "news" part of the equation, while the "rumor" is that the SEC might approve it (aka the last few months of price action up until now).

This is incorrect.

This is simply not how "buy the rumor sell the news" works in any capacity. We know this. The market is impatient and getting ahead of itself; something the market seems to do best. The "rumor" is confirmation that a fundamental development will occur, while the "news" is the fundamental development actually going live. There are many examples of this being how it works.

Given this obvious and very basic rule, it's very easy to see that "selling the news" on SEC approval is ridiculous. The approval is the rumor, and spot BTC ETFs going live is the news. This weird transition period we are in now is speculation on the rumor of the rumor, as weird as that sounds. Nobody knows for sure if the applications will even get approved (no matter how likely it seems).

However it makes perfect sense if we look at on and off-chain milestones. On-chain data shows that nobody is selling and BTC is being syphoned off exchanges. Off-chain data confirms that volume is low and hardly anyone is selling. A tiny bit of buying pressure has been slowly pushing spot up. These are not the signals of FOMO or a blow-off top, but rather the precursor foothills before the real mountain.

Back to Bakkt

The first institutional hype cycle came in summer 2019. Everyone was hyped to the moon because Bakkt was going to change everything. It didn't. The product launched and volume was tragically low. We ended up losing half of the gains we made, but also maintained a level much higher than where we started even after the disappointment. The same thing will happen with ETF approval.

This time isn't different.

Many assume that the market can not price in an EFT approval. The logic behind this sentiment is that institutions like Blackrock and Fidelity simply have so many assets under management that it would be impossible to push up BTC up in price enough to match that kind of demand. I hope my readers know better by now. Never bet on "this time is different" with actual money. It almost never is.

Speculators can push the price of Bitcoin to literally any number they choose. We do this through the process of both taking BTC off the books while simultaneously going long with our stacks to buy the BTC of others who foolishly left theirs up for sale.

The second the SEC approves the ETF I guarantee at least a +20% god candle within minutes of the rumor being sanctioned by the government. The hype of this event will last at least 3 days, and more likely will extend all the way up until the ETFs actually launch (just like BAKKT). Can the momentum continue after these funds launch their silly little derivative assets? Can they actually live up to the hype and then some? Again it's possible but there's no reason to bet on it.

Exponential trendline & Stock-to-Flow are in sync

Both of the long-term metrics that give us an idea of what Bitcoin price should be right now currently point to $100k. Obviously we are trading well below $100k, and a price increase to that level would be deemed a massive bubble by many even though it likely is not.

Unit bias and laser eyes.

A six-figure spot price is huge, and this is compounded by the fact that most Bitcoiners put laser eyes in their profile during last cycle "until we hit $100k". Everyone was sure we'd reach this milestone during the last cycle, and right when everything seemed like it was coming together 3AC, UST, and FTX happened, cratering BTC to the $16k floor with bears telling everyone to short down to $8k and below. Durp.

Needless to say I think a lot of people are going to get wrecked selling a big stack at $100k thinking they are making a smart bearish play at the right time. In fact we can easily get to this level in less than 2 weeks if the SEC actually does their job and follows the orders of the judges that bitch-slapped them in court. No promises.

There's a very real chance BTC get's into the $200k-$300k range before the halving event in April. As insane as that sounds, most other speculators have tempered their expectations and are looking toward that $100k milestone. Nobody talks about $200k or $300k anymore unless it's within the context of 3 or 4 years out. These predictions don't even align with the 4-year cycle anymore, and I think a lot of people are tired of looking like idiots with lavish predictions that are constantly proven wrong, which is one of the reasons I think it could easily happen.

I very much believe there are going to be two blow-off tops during this cycle. One in 2024 and one in 2025. The 2024 one could happen as soon as January - March. There's simply too much hype with the ETF and halving for sidelined capital to not FOMO in all at once.

fundamental vs speculative

It's good to remind everyone that fundamental gains can never outpace speculation. We've seen this play out dozens of times. The market wants to price in an event, but they inevitably overshoot it and then it crashes into the mountain. What does an overshoot of a Blackrock ETF look like? Again I'm thinking in the $200k-$300k range (x2 to x3 higher than the exponential trendline just like all the other bull markets since 2019). When combined with halving hype this is even more possible.

Halving event

April is one of the most overhyped halving events I've personally witnessed. It takes a year of lower emissions before fundamental gains to actually compound, but the market doesn't care; they want those gains now and they expect them now. Business as usual.

Conclusion

Will the SEC approve the ETF in as little as one week? Doesn't really matter. They're clearly going to do it sometime, and when they do all hell breaks loose. It will be easy to get caught up in the FOMO instead of having steady hands and making measured bets. But you can be sure the hedge funds will be doing exactly that.

Price targets matter a lot less here than time targets. The $200k-$300k range is meaningless unless it happens shortly after ETF approval. If you're looking to sell the news, definitely don't assume that SEC approval is the news. It's the rumor. ETF launch is the news.

Return from Cycle Cycle Cycle to edicted's Web3 Blog