https://coindoo.com/makerdao-raises-stablecoin-dais-stability-fee-to-3-5-percent/

https://cryptosumer.com/2019/03/08/makerdao-users-vote-to-raise-stablecoin-dais-stability-fee-by-2/

https://cointelegraph.com/news/makerdao-users-vote-to-raise-stablecoin-dais-stability-fee-by-2

How is the fee collected? Is it an APR?

Is it a flat fee at the time of creation?

Thanks for nothing crypto news :D

https://www.reddit.com/r/MakerDAO/comments/93adqj/faq_stability_fee_raise/

So I went out and found this Reddit post about the stability fee which seems pretty good even though it's seven months old.

There are three components to the Stability Fee, which address three risks that need to be compensated for:

- The first is purchasing power risk, compensated by an inflation premium.

- The second is credit risk, what MKR face when diluted, which is compensated through a credit premium.

- The last is operational or stability risk, which requires a policy tool component to compensate for stability enforcing operations.

Why is the Governance Fee called the Stability Fee now?

In the Single-Collateral Dai iteration of the system there were two proposed usage fees; the Stability Fee (also called PETH fee because it went to PETH holders) and the Governance Fee where value would accrue to MKR holders through token supply contraction. Prior to the launch of Single-Collateral Dai, an audit revealed that the PETH fee could be gamed, so it was set to 0%. Instead, the Governance Fee was introduced to mimic the original mechanism in a simpler, less flexible form; a fixed rate fee.

Because some of the advanced functionality of the Stability Fee is being activated now, we will no longer be referring to the accrued fees on outstanding dai as the ‘Governance Fee’.

This clears up a lot of confusion for me because I thought the stability fee and the governance fee were two separate things.

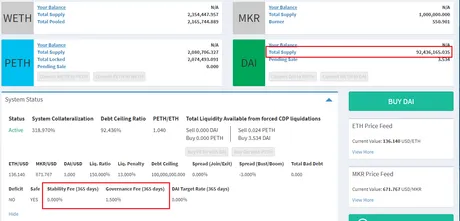

A stability fee and governance fee are listed at https://dai.makerdao.com/. Perhaps the site just hasn't updated in a while. When I read that the "stability fee" was being increased 2% to 3.5% but then I see the stability fee at 0% and the governance fee at 1.5%, I was rightfully confused.

Where do the proceeds of the Stability Fee go?

MKR holders benefit from part of the collection of the Stability Fee as it is sent to the burn address, thereby lowering the total supply of circulating MKR.

For example, based on an outstanding supply of 55 million Dai, and we assume that dai debt has been held for 1 year, a 2.5% Stability Fee would burn 1.3 million USD in MKR tokens.

This confirms that the stability fee is simply the governance fee with a new name. When I was first researching the MakerDAO the stability fee was 0.5%. It's pretty amazing that we can be offered the opportunity to give ourselves a loan with such a low APR, and zero KYC and AML regulation.

Does the Stability Fee apply to existing CDPs or just new ones?

The Stability Fee changes will be applied to all new and existing CDPs.

This Reddit post gives me a lot of good insight. For starters it shows that the MakerDAO is more interested in keeping Dai holders happy than keeping Dai creators happy. Maintaining the $1 peg is their primary concern. It is a stable coin after all.

An added bonus to this is that raising the APR of Maker lowers the amount of Maker coins in circulation. This increases the value of Maker through the process of deflation. "But wait!" You're thinking; if Maker holders control all the governance decisions won't they just choose to keep increasing the stability fee to line their own pockets? Nope.

Checks and balances.

The MakerDAO already has a history of lowering the APR fee back down to 0.5%. Why would they do this? Isn't there a conflict of interest? Not really.

In the grand scheme of things, Maker's value does not increase that much from the APR being charged. The majority of value comes from development and subsequent community usage, just like all other crypto projects. Also, many Maker holders are also Ethereum holders, and they use their own platform to give loans to themselves. Why would they vote they charge themselves more money?

The MakerDAO's primary concern is maintaining the Dai peg at $1. If they continued to raise the APR fee then the peg would raise to higher than $1 and break the peg. The MakerDAO already has a history of lowering the fee. That Reddit post is seven months old and exists in response to the last time this happened.

The MakerDAO even tried to raise the fee incrementally this time. In February they raised the fee twice from 0.5% to 1% to 1.5%. These movements had little affect on the liquidity problem, so now they are playing hardball and raising it to 3.5%.

By raising the APR of self-granted loans, the MakerDAO slightly decentivizes leveraged margin trading. These are people looking to create Dai and then immediately spend it on another coin. Once people looking to hold Dai outweigh those looking to margin trade, the stability fee will be decreased back to 0.5%.

What does this all mean?

You know what else was happening 7 months ago when Maker was raising its governance fee? I was writing this:

The 50 million Dai debt cap had been breached and the MakerDAO was essentially forced to double it or the demand for Dai would continue to increase and it would break its peg again. Guess what day that was?

July 1, 2018

That's right, this was the trough of Bitcoin's 4th dead cat bounce during the bear market.

When the MakerDAO increases its fees and raises the debt cap, this is an extremely bullish signal. It means users in mass no longer want to hold their Dai; they would rather margin trade it to buy more Ethereum or whatever other coin they are looking to acquire. This is why Dai is loosing its peg: big players no longer want to hold it.

At the same time, this still leaves a lot of Dai floating around in the ecosystem. A new debt cap is about to be broken. Just a few weeks ago the cap was at 88 million. Now it's at 92 million. Only 8 more million to go.

Speculation

I've already been saying that I think April will be a good time for crypto. We seem to be seeing a reversal of last year. Instead of a crash during Chinese New Year we see a bump up this year. I believe the same will happen during the tax season.

Combine this with Bitcoin's recent peak transaction volume and it becomes very clear that we are likely on the verge of a small pump and dump. My prediction is Bitcoin up to $5000-$6000 in April with a crash back down to $4500-$4800 after.

Recap on the importance of Dai and Maker.

If you are ever wondering which stable coin you should retreat to in order to avoid volatility, you should pick Dai for a multitude of reasons. All other stable coins in the top 100 market cap are collateralized by USD in a bank. Spoiler alert: they use fractional reserves. Therefore, the money is not safe. Only 10% is actually available in the physical bank.

Bailouts became illegal after the last financial crisis of 2009. Bail-ins are now legal, meaning that there is a very good chance that money in your bank account will be stolen with a "haircut" during the next financial collapse.

Meanwhile, Dai is collateralized by 300% Ethereum on average. This system is much more robust than a bank. It has to be to adapt to the extreme market volatility that crypto faces on the daily. More importantly, your money can not be stolen from you (except by inflation of USD of course). (However, this seems less likely due to the new legality of bail-ins.)

When you put your money into Tether, who are you supporting? What about TrueUSD, Cloud, PAX, Gemini, etc? You're supporting a centralized entity; a corporation. You are trusting them to do the right thing and putting them in charge of your money. This is a bad idea. Bad idea jeans.

https://view.yahoo.com/show/saturday-night-live/clip/4639522/bad-idea-jeans

With Dai, you are supporting Ethereum and Maker. Already more than 2% of all Ethereum is locked in CDP contracts, yet hardly anyone even knows about it yet. What happens when 10% of all Ethereum is locked? 20%? By holding Dai for its original purpose (stable coin) you can have the benefit of avoiding volatility while at the same time supporting two other open source projects. Dai holders create Ethereum holders directly. For every 1 Dai created someone else is holding $3 worth of Ether in a locked CDP smart contract.

Example usage:

You want to buy a new car. You have $100,000 worth of Ethereum but you don't want to spend any of it. You believe that crypto will continue to increase in value over time because no centralized entity can inflate its value into the dirt. So, you take your Ethereum and put it into a MakerDAO CDP. You create 30,000 Dai and buy a new car with it.

Now, 5-10 years later, you want to buy a new car. You look at your CDP and see that you still owe 30,000 Dai back plus interest. However, the Ethereum in the CDP is now worth a million dollars because Ethereum went 10x over that time period.

This is the power of the MakerDAO platform. Once you have to money to buy something you can essentially upgrade it for free over time as long as the underlying collateral continues to gain value.

Dai is just the beginning

The MakerDAO has already teamed up with DigixDAO and plan on making a new coin pegged to gold and perhaps other precious metals. I for one can't wait to return to the gold standard and diversify my assets into a coin pegged to gold.

Conclusion

Maker is officially the ERC-20 token I am most bullish on.

It hits all the markers of an amazing project:

- It is already delivering a service and being used worldwide.

- It provides an alternative to the bank-backed stable-coin craze.

- Holding Dai bolsters the value of both Ethereum and Maker.

- It's one of the few ERC-20 tokens that actually uses Ethereum instead of its own native coin.

- It's a "boring financial dapp" which I believe is Ethereum's true niche.

- The ability to give yourself a loan while avoiding USD's inflation devaluation is revolutionary.

- Already has a good history of surviving a bear market with a very good governance structure of checks and balances.

- Maker has easily ascended to the top 20 market cap (#16) and I believe it will be a top 10 coin soon™.

- It gives Steem the perfect model to turn SBD into a superior product.

Be on the lookout for Maker and Dai.

This project is going places.

Old Posts:

https://steemit.com/ethereum/@edicted/maker-and-dai-still-looking-strong

https://steemit.com/maker/@edicted/maker-will-reign-supreme-above-the-other-stable-coins

https://steemit.com/news/@edicted/makerdao-doubles-debt-cap

https://steemit.com/maker/@edicted/figuring-out-makerdao

https://steemit.com/ethereum/@edicted/binance-coin-and-dai

Return from Dai Stability Fee Increased; And? to edicted's Web3 Blog