I have yet to pull any money out of crypto into my bank account for the past 3 years. I've never done it. Those glory days are coming to an end. Unfortunately, I must eventually start paying myself a tiny salary using my crypto stacks.

First of all, I've worked at Amazon less than 20 hours over the last two months. Been coasting by on these stimulus checks and the money I had saved up. My reserves are getting dangerously low.

I also have a move coming up... moving out of state. Gonna be a real pain. And expensive. Luckily I have roommates with 'real' jobs. You wouldn't believe how much resistance one gets during interviews when you drop the, "I'm a professional gambler," on them. That angle is always a net loss in the eyes of the establishment.

The last time I applied for a rental application I bought my poker bankroll with me. It was some ridiculous amount like $3000 cash. Hey I don't have traditional pay stubs but how about this wad of cash to put your mind at ease? I swear I'm not a drug dealer. That was the one time it actually worked and they just gave me the immediate green light. Not recommended for job interviews though. I've tried, and it is a disaster.

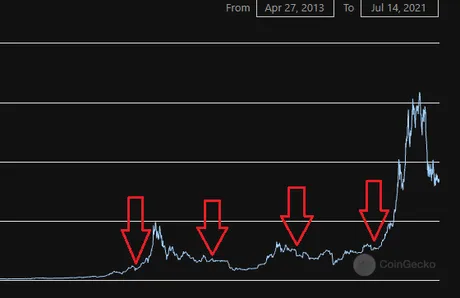

The market still looks extremely weak but I'm optimistic. People are bored at this point. Bored is good. This is the time we should be "buying the dip" if we had any money. Not when the hot knife is falling and everyone is running scared. Boredom is the perfect time to buy. Too bad I have no money, amirite? They always say buy the dip but never sell the spike. Go figure.

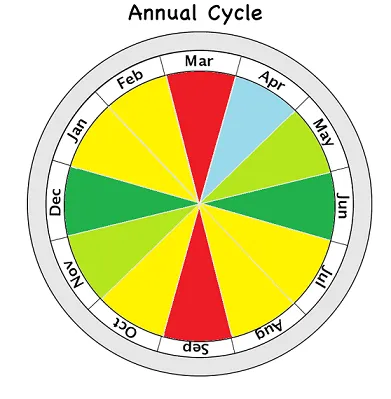

In any case, I need to sell some crypto before September, and selling now seems a bit premature. I'm thinking late August might be a good time. One can hope. I may want to sell enough to pay for my move and buy the dip in September assuming there is one.

Looking at the past history for Bitcoin, it's very clear that September has never ever been a bullish month for this risk-on asset class. At best we trade flat, and at worst we drop off a cliff. This is the most consistent month to buy in, so it makes sense for me to have some stable coins ready to go just in case.

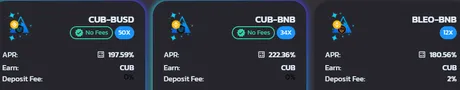

Luckily for me, I'm involved in several CUB farms. The CUB/BUSD pool is pretty much the safest place I can park my money short of directly investing in Bitcoin. It might be even safer than Bitcoin because the yield is so massive and it's half stable-coin. Of course by "safe" I mean retaining the highest value possible with as little risk to the downside. Bitcoin will always be the safest platform in terms of network security resistant to double spend attack and on-chain manipulation. That is Bitcoin's niche: security.

Getting to the point:

I pretty much have to DCA sell in August no matter what, not only to put something in my bank account but also because of this previous history with September. Hopefully that works out, but truth be told if this backfires and the market runs up... I really win either way. Hedge your bets, fellas.

The question becomes... what should I sell?

I have a very small powerdown going on Hive. 1000 coins per week. I actually earn about that much in blog rewards/curation, so my HivePower hasn't actually been going down. I could sell that, but I rather enjoy my main chain superpowers. Hive is quite the moonbag for me, and it has not disappointed.

LEO is pretty underpriced as well, and I'm also stacking up all my POB rewards. This really leaves CUB as my go-to platform as an entry and exit portal to my bank account.

The crazy part here is the tax implication. I bought the vast majority of my CUB in the $3-$5 range. Therefore, I have a huge treasure trove of CUB I could sell and declare a loss on. Pretty weird.

I also bought Bitcoin at $50k with $1000 of stimulus check. I could sell that and declare a nice loss on it as well. In addition, I have several sources of crypto (BTC/ETH/LTC/HIVE/LEO) that quality for long-term capital gains (held for a year) which I can apparently pay 0% taxes on up to $40,000 a year. So even though I need to selloff some crypto... I absolutely legally don't have to pay any taxes on it if I declare it properly. Good to know.

At the end of the day I'm quite the scrapper, and I can live off a very small amount of money per year. My part-time wages at Amazon ended up being like $12k a year, which is basically nothing in California. Well below the poverty line.

bLEO yield

I'd also like to point out the 180% yield on the bLEO/BNB farm. This yield is getting quite close to becoming the top performer. If CUB tokens gain any more value it will easily surpass the two main farms. That's when things get very interesting.

Personally my guess is that the bLEO/BNB farm can't actually surpass the main two farms by much yield, as the higher that difference gets the more heavily incentivized everyone is to jump into that farm and compete. Which is fine because the bridge needs a lot more liquidity anyway. It will be interesting to see if theory matches reality on that front.

Conclusion

This out of state move I'm undergoing is basically forcing me to quit my job and try to make a go at the whole crypto thing. Better now than never I suppose. It would have been nice to wait for a proper mega-bubble but I suppose time waits for no one.

If I just sold all my crypto today and pumped it into my bank account I could probably make it another ten years without having to work at all. Either that or the bank would haircut my account during a banking crisis and force me to invest in their failed model.

However, just surviving and getting by is no longer the goal. We should be striving to transition to this emergent economy and support it as much as we can. Put your money where your time is.

Posted Using LeoFinance Beta

Return from DCA selling in August to edicted's Web3 Blog