The word itself has a negative connotation.

A simple search on the word 'debt' reveals that people seem to not like it very much. This ball-and-chain image seems to be quite common, along with a slew of advice on how to manage debt and get out from under the crushing weight of it.

But people seem to forget that debt is awesome.

If it wasn't awesome then people wouldn't take the deal. It is not debt's fault that people often woefully mismanage their assets. Just like everything in a scalable economy, the value that debt dangles in front of our faces is thought to be greater than the price we pay later.

How would we buy a big ticket item like a car or a house without debt? How would we start a business without debt? Surely there are ways to go about it (crowdfunding/donations/securities) but a loan from a bank is the standard way of going about these things for a reason. It's the convenient option that makes the economy go round.

The entire modern economy we live in today is debt-based.

Debt is the oil that lubricates the entire economic machine. Even cold hard cash is debt, which is something that is very hard for people to wrap their heads around (to the point that many still believe that cash is a paper representation of gold or petrol). If we have cash in our pocket we own the debt, but ultimately on a mathematical level all cash is owed back to the bank from which it came... with interest.

So there is actually negative actual value cycling throughout the economy in the form of currency. In other words more than 100% of all cash in existence is debt. We need more debt to be printed just to pay off the outstanding debts of today. People like to freak out over the national debt going up year over year, but get this is the standard. The idea that the national debt would decline year over year is a fantasy rooted in not knowing how the financial system actually operates, as much as we'd like to chalk it up to "corrupt politicians" making bad decisions.

The national debt will not decrease, nor does it need to.

Ironically, cryptocurrency will end up propping up this seemingly unsustainable system when nations start collateralizing it and minting derivatives from it. Because that's the only thing required to issue more debt: collateral.

The ends justify the means.

This is another term with a negative connotation. Everyone likes to focus on when the ends do not justify the means; when the sacrifices we make ultimately were not worth it in the end (like trading freedom for security and ending up with neither). But to make the claim that the ends never justify the means is simply foolish and naïve. If that was true the entire concept of an "investment" would be a false narrative in all situations. A successful investment always implies that the ends justified the means, by definition.

Taking a look at Bitcoin

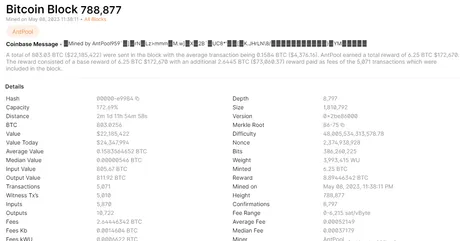

Bitcoin can do a lot of things that people think it can't do. For example if someone tried to steal your money and transfer it to another wallet a bot could detect that on the chain and override the thief's transaction using a higher fee. If the thief was running their own bot to counter with an even higher fee, this becomes a mutually assured destruction scenario, with near 100% of the entire balance being used for the on-chain operation fee.

Of course that operation fee goes straight to the miner that minted the block, so in theory if the top mining pools got together they could easily refund these thefts back to the rightful owner (assuming a random agent didn't mine the block in question). The point being that with enough layer-zero consensus even Bitcoin can do account recovery. Will that ever actually happen? I doubt it, but who knows what kind of crazy stuff mainstream adoption will bring.

"Bitcoin can't scale"

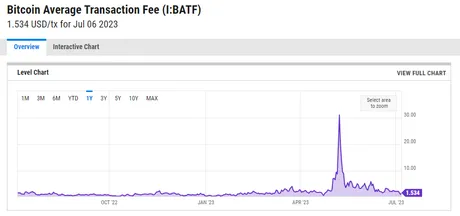

As the USD price of Bitcoin goes up, so do the transaction fees. This leads many to think that Bitcoin can't scale. Of course that assumes that the blocksize will never increase, which is thin at best. Also the entire concept is based on the idea that USD will always be the unit of account we are using to measure all value, which again seems thin. The actual amount of Bitcoin it takes to transact will essentially crab-walk forever, if not trend downward.

In addition, the entire concept that Bitcoin is somehow separated from the rest of the crypto ecosystem is perhaps the most ridiculous notion of all. It doesn't really matter if Bitcoin becomes a club for rich people only. In fact that seems to be exactly what Bitcoiners want anyway.

Debt-Based accounts though?

In a way a network like Bitcoin already has debt-based accounts. Every wallet is assumed to exist, and if you ever want to spend your money you'll have to pay the fee, but that's not really what I'm trying to get at here.

Hive is more interesting in that the owner key technically "owns" the account. Not only can the posting and active key be shared with others, but also simply the authority to these keys can be delegated to other accounts. The ability to sign the posting key of one account with another is significant.

Accounts as NFTs/real-estate

I often refer to Hive accounts as NFTs, but we can also think of them as digital real-estate. The account itself is like a property, with the name of the account being the address. Considering Hive is pretty extensible and easy to build on this digital real-estate can be expanded in ways that haven't even been conceived yet. Everything we do on our account is connected to our account.

Does debt make sense in crypto?

In many ways it does and it many ways it does not. Crypto degens are no stranger to the notorious "liquidation email", to the point of it becoming a meme within the space. The volatility and low liquidity of crypto make it difficult to use as collateral... for now. There's no telling what might happen with bigger liquidity pools or crypto that stabilizes itself without the need to piggyback on USD or another fiat currency.

What is the collateral of a credit card?

We call this usury, which is frowned upon and even banned in religious texts, and for good reason, as it can literally lead to debt slavery. However, times have changed, and I myself have simply not payed back $10k worth of credit card debt dated back. What was the penalty for such crimes? A bad credit score for half a decade, and that was it (which ended up being a penalty of zero because I didn't need a credit score during those years).

In any case, the collateral used for something like a credit card is what we called "unsecured". This keyword denotes that there is no collateral securing the loan, and the only collateral backing it is a promise to pay the money back based on our credit score. Reduced down to the most basic form: the collateral for credit cards is KYC. This makes it difficult for crypto to issue loans because the entire point of these networks is to provide open anonymous permissionless accounts that can be opened by anyone in any country. All that's required is an internet connection.

However, I have a reputation on Hive, and so do many others, so the opportunity to issue something like credit cards on permissionless networks may present itself sometime in the decade to come. It's hard to say. The more decentralized reputation systems that get created, the easier this will be.

At the same time why would anyone ever loan anyone else any money when they can park their stack into something like the HBD savings account to earn 20% yields? That 20% yield is a guarantee for as long as the witnesses keep voting for it. Again, it's possible that the incentives may never align to create such debt-based systems within crypto, which is honestly fine as long as crypto keeps gaining value exponentially for all participants. No need to get a loan from someone else if you're already a multi-millionaire. Especially such funding methods can simply be tokenized and sold like any other crypto.

Today 'property' values are low.

Currently it would make zero sense to buy and sell Hive 'real'-estate because those property values essentially round to zero. Resource credits are free, and it's not hard to find a frontend that will create an account for free either. Yes well, enjoy it while it lasts, because by definition of decentralization it will not last forever. Imagine trying to run 100 copies of something like Facebook all at once. It's simply not possible. At a certain point concessions have to be made and resources become scarce.

In fact Hive is no stranger to exploiting the account creation system for money. Used to be you'd get delegated 20 HP for creating a new account so you had RCs to transact on chain. Then a single bad actor comes in and mints thousands of accounts, each of which controls 20 HP, allowing the reward pool to be exploited.

We solved this issue with RC delegations, but the account creation process is still exploitable. This is the disadvantage of offering free service to the masses. Inevitably someone will come in to exploit that generosity, even if there's no real financial benefit to do so (just to be a dick). We've seen this happen since the beginning of the Internet. Trolls gonna troll.

Which is why eventually Hive will have to come up with a sustainable solution for issuing accounts. Giving them away for free will likely be unthinkable in 5-10 years (unless we know the individual personally or they are KYCed somehow to mitigate Sybil attack). Luckily, as the title implies, we can give accounts away on credit.

In fact frontends like LEOfinance already have the infrastructure to do this to a certain extent. Lite accounts create a situation where the user logs in with a traditional username/password while a LEO server secures their keys. The keys are only transferred to the newbie when they request them and actually figure out what they are doing.

It would be just as easy to withhold the owner key from Lite Account holders until they agree to pay the required fee. This could be anything. USD, Hive, HBD, delegation, witness vote, LEO, or some other random token that was earned by the account.

The point being is that Hive is quite powerful in that we can issue credit to non-KYCed users without having to worry about being exploited by a Sybil attack. In the event of such an attack the frontend can simply reclaim all their accounts back from the attacker and reissue them into the open market. This is actually a sustainable way of doing things that avoids derelict accounts clogging up the chain and single users controlling thousands of accounts on the dime of our developers.

Of course one of the biggest problems to reselling a Hive account is the property address itself. No one's going to want to use an account named @botmcgee4857873. So perhaps certain naming conventions are in order, but with the advent of AI something like that might be very easy to set up to make sure accounts that are getting created, bought, and sold are actually ones that have a bit of staying power within the ecosystem.

Again, we have to come at this with the expectation that Hive and other networks are going to get at least 8 digits of accounts being added to the system. That's tens of millions... on the low end. It won't be easy to manage that kind of adoption if organized inefficiently.

Conclusion

This is not my first time discussing this issue, and it probably won't be the last. Again, a lot of these concepts are before their time and really only apply to mainstream adoption scenarios. However, it's tricky even defining what mainstream adoption is for a network like Hive. What is it? 50 million users? Does everyone realize that MySpace still has 6 million of users? That's still more than Hive has, so it's clear we haven't even come close to getting where we need to be or even implemented the logistics required to get there.

At the end of the day debt and collateral go hand in hand. Whether that collateral exists as a house (secured) or a person's reputation (unsecured) it all boils down to the same thing: trust. Trust that the collateral and the implied guarantees granted by it will yield profitable results to the lender. It's only a matter of time before crypto ecosystems figure out how to leverage these concepts into their own platforms. Obviously I'd like to see our network on the bleeding edge.

Return from Debt Based Account Distribution to edicted's Web3 Blog