There's been a lot of talk over the past few months as to the sustainability of HBD's 20% yields. Of course many point out that the 20% yields are "obviously" not sustainable. I already talked about this in multiple posts, but surprisingly there is still much more to say about it.

Of course 20% is not sustainable within the legacy economy.

This is what most people get hung up on. When banks are offering us 0.5% interest on savings accounts at best then how is it possible that HBD can give 20%? Except we've been providing this yield for what? Two years now? We've already done it and people are still saying it's impossible. Funny that.

https://twitter.com/i/spaces/1lPJqBkdpkwxb

After a bit of searching I finally found the debate between @theycallmedan and Andrew Quinn on Twitter about this issue. I listened to the entire thing back on April 24th, and it was an interesting discussion to be sure. There were a lot of good and bad claims made on both sides. I'm trying to listen again for some examples...

-

Theycallmedan talks about bonds on Hive as if they already exist.

-

22 minutes in Andrew Quinn brings up an example of Hive hitting the debt-cap limit at 30%, then the price of Hive crashes 50%, and then proceeds to say that Hive's debt has just doubled... completely ignoring what a debt-cap means. Dan never corrects him although his response is pretty good (we already went through this exact scenario).

-

28:30, "Demand has to be there for peg to return." This was in reference to HBD demand... which isn't true. Obviously if the haircut is the only thing pushing down the price of HBD then at worst it is a lack of demand for Hive itself that is pushing down HBD. However, even in a situation where Hive price doesn't go back up HBD can still recover without without a higher market cap of Hive. The entire point is that HBD can stabilize itself without relying on Hive going up. This has already been proven in the field.

-

29 minutes in Quinn talks about the Long Term Capital Management fund that thought it could out-gamble the stock market in the 90s. They couldn't... and that's a "financial parable" of how we can't outperform the market... lol really? What about Bitcoin? It's been going x2 or better every year since it was invented. +100% is exponentially more than 20% year over year. Are we all going to pretend that Bitcoin hasn't done this already for over a decade? Comparing crypto to the stock market is a fool's errand. See: Dot Com

-

31 minutes in Theycallmedan makes the claim that if HBD is being dumped on the internal market for Hive this actually increases the price of Hive, which sounds extremely wrong to me... at least I think it shouldn't be said so confidently. For the most part the spot price of Hive is governed by the Binance/Mandala liquidity pool (and maybe Huobi & definitely UpBit). The liquidity on the internal market is still a drop in the bucket compared to these other pools. Hive price doesn't move on the internal market: rather it is HBD's value that goes up and down even though it isn't measured in this way on the frontends. Still, the concept is still sound in terms of it not inflating more Hive tokens into the ecosystem.

Analysis

All in all this was a very good conversation and it was nice to see a logical debate of sorts. Of course it can't really be called a debate because if it was Dan basically destroyed Quinn on a topic he knows nothing about, and was able to make mildly outlandish claims without any kind of pushback. It's a long discussion but I've listened to it twice now and it was worth it.

Getting back on track.

This post is actually supposed to be about how we can make HBD completely sustainable no matter what variables fly our way. The real question is: what variables are subject to change and how should we react to them? We have to assume that we're going to be quite bad at figuring out this economic policy as we stumble through it for the first time ever. This post is meant to serve as a preemptive warning system for environmental changes to the Hive landscape.

Thus far we've been quite lucky with the 20% yield.

We initially set it to 20% to compete with UST and other stablecoins... and now all those stablecoins have been vaporized by the bear market. Meanwhile, HBD stood tall and didn't falter an inch during the bear market, which is a huge achievement that many even on Hive are taking for granted, even though it was our first successful bear market.

At the end of the day the only reason why 20% is still a viable number is that on a relative scale no one is taking the deal. Which is pretty hilarious when you think about it. People like Andrew Quinn talking about how a 20% yield is the best deal possible; too good to be true, and yet no one is even taking the deal. The debt ratio is still below 7%, and the cost to the Hive network to sustain that 20% yield is still about 1% per year to the Hive market cap.

And even then this assumes that 100% of all new HBD is being converted back into Hive and then being sold on exchanges. It also assumes that HBD usecases are not expanding and we don't need more HBD in circulation. As @taskmaster4450 often points out, all these assumptions are currently false. We need more HBD in circulation and 20% is the easiest way to get to where we need to be going forward. Why would be think a cryptocurrency like Bitcoin can expand 100% per year on average but there's no possible way HBD could do 20%? Think about it.

Of course once again I am assuming that variables won't change and we can keep HBD at 20% forever. That's exactly the opposite of what I'm going for in this post. How should we maneuver in response to the debt-ratio changing?

There's something to be said about how stablecoin market caps move in tandem with the market. This is counterintuitive, but absolutely true. We expect stable coin market caps to go up during the bear market as people panic sell into stables. We expect the cap to go down during bull markets as people dump stables during the FOMO.

Except it NEVER ends up happening like this. They are not inverse correlated and stables end up rising and falling together with the rest of the markets. Changes in the ratio are significant because it is an outlier rather than the norm and signal that something is going on. The HBD debt ratio is no different.

Poetically the solution to the debt-ratio is... stability.

Who'd of thunk it: the answer to stabilizing a stable-coin is stability.

What do I mean by this?

Something even Theycallmedan doesn't seem to fully grasp (I don't either) is that the number we set the debt-ratio haircut to means nothing. In the Twitter space he talked a bit about how he thinks 30% is a bit high and ridiculous. And honestly there is some truth to this... we TRIPLED the cap and have yet to test it. If the ratio increases from 7% to 30% and we hit the cap... that's bad... we are in trouble. But not because 30% ratio is high but rather the volatile movement from 7% to 30% in a short period of time is dangerous.

The haircut could easily be 100%

As ridiculous as that sounds to outsource so much debt, I've already explained various reasons why HBD actually isn't debt for half a dozen reasons. We simply think of HBD as debt because that's the easiest way to somewhat explain the threat vectors associated with it when shit hits the fan.

To give an example:

If HBD was hovering at 25%-30% debt ratio for two years straight... we have no choice: we ARE FORCED to increase the haircut. The free market has spoken and the demand for HBD is higher than the current ratio. As long has we can be relatively certain that the current environment is a stable one then it is okay to increase the haircut to a higher level. This requires more than a year of charting the ratio through an entire boom/bust cycle. So I won't even suggest changing the haircut for at least... 3 years? Something like that.

What direction are we going?

There's also a big difference between HBD breaking above $1 because it hit the ratio vs breaking down below $1. Understandably most are a lot more worried about the breakdown below $1, and many cheer when the price is higher than $1, even though that can be just as damaging in the middle of a rampaging FOMO cycle that's doomed to eventually bust. We can think of that scenario as "winner's tilt" which can be just as bad as "loser's tilt".

Why are people buying?

In the case of LUNA/UST institutional investors were buying more and more UST ONLY BECAUSE of the 20% "risk-free" yields. There was no other reason to buy except for the expectation of extracting value later. As maximalists love to say: if you can't explain the yield you are the yield. That's exactly what played out on UST, and we need to avoid that scenario on Hive.

In order for a higher haircut to actually be sustainable the reason for holding HBD has to be real utility rather than greedy goblin ROI based on vapor and thin liquidity pools. We can never be sure until we lower the APR and see what happens. If the APR goes lower and nobody dumps they must be holding for another reason.

Number crunching:

So how should we manipulate the savings account interest rates in response to these threats? Certainly the particular numbers involved are largely up for debate but the general idea is universal: if the debt-ratio starts going up to alarming numbers we need to cut back the APR incentive to stack HBD. The ultimate problem with this strategy is that it requires a certain amount of clairvoyance and must be done in advance.

For example if we wait for 30% debt ratio during a bull market FOMO and then lower the interest rate after we enter a bear market FUD cycle... that's going to make the issue even worse. The FED isn't wrong when they say you should feed a recession and starve inflation. HBD APR should be high during a bear market to create demand and low during peak FOMO, which is a problem because no one is going to want to kill the FOMO party in advance to avoid a sharp-cutting bear. This kind of monetary policy requires very steady hands. Surgical even.

Basically if the debt ratio gets around to about 15% (which isn't that far away) we need to consider lowering the APR. Why 15%? Because theoretically lowering the APR at 15% ratio kills demand for HBD, creating a scenario where holders are going to convert to Hive and cash out, which will increase the ratio even further to say 20% or more. We need to allocate a buffer and assume that when we lower APR the debt-ratio will get even worse.

What should we lower the APR to?

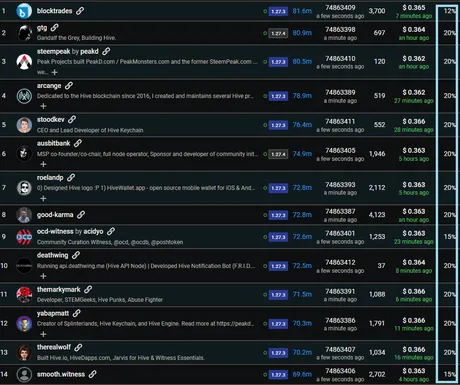

Witnesses are signaling numbers at both 12% and 15%. A 15% APR is a good response to a 15% debt ratio, as ambiguous as it is for both numbers to be the same. Once we see what the ratio does from there signals what additional actions (if any) need to be taken.

The haircut is a crutch.

We are never supposed to hit the haircut: we are supposed to manipulate our financial policy to make sure we never hit the cap in the first place. With this in mind: assume we drop interest rates back to 0% but the debt ratio is still 30% and HBD is above $1. That would be the ultimate signal that 30% haircut is way too low and needs to be increased. Not sure if that scenario is possible but the logic behind it is sound and can be extended to similar edge cases.

Conclusion

It's difficult to juggle all the variables here, but I'm quite certain that savings account APR is not going to be correctly manipulated by the witnesses when the time comes to pop our own bubble. Hive witnesses are not economists, and we have no idea what we are doing. This is an untested jungle that we'll need to stumble through one or two times before we better understand it.

Luna went x100 by using UST to leverage the network long without being able to pay back the debt. I believe the same will happen to Hive, just to a lesser extent because of all the ways the system will automatically mitigate systemic failure. Can we really expect Hive witnesses to pop the bubble early on purpose during the middle of a FOMO cycle? I highly doubt it. In fact I highly doubt that even I will suggest such a thing when the time comes. Although I'd like to think that I'm more responsible than that... no promises.

Of course there is always the chance that the current setup continues on unabated and our debt-ratio stays in the 5%-10% range for the next half-decade. That would be pretty ideal but we need to be ready to act just in case. We have all the tools we need to make HBD as stable as possible, and more will inevitably be built in the future. That's the advantage of a permissionless network.

I feel like I still haven't brought up certain points I wanted to talk about, so maybe I still have another post to write about this topic. I think I touched on most of it though. At the end of the day we simply need to keep our eyes open and avoid being blinded by fear, be it FOMO or FUD in either direction. Stability (in all aspects) is unsurprisingly the key to maintaining a stable-coin.

Return from Debt-Ratio Sustainability Over Time to edicted's Web3 Blog