Behold, the smuggest person on the Internet!

We've all seen this guy before.

I personally know like half a dozen guys that look and talk just like this.

Ah, intellectualists! So smart. So so smart.

Could never be wrong, amirite?

Picking apart crypto and talking trash is the easiest thing ever.

It's easy because crypto is inherently inefficient by design. All one has to do is point to the inefficiencies and be like: "See this!? It should be more efficient!" lol... what? Yeah okay... Got any more brain-busters?

What's much harder is to see where crypto is going and separate the noise from the global narrative that we are being ushered into. Complaining about the problems isn't really going to get us anywhere. We can't complain and just expect the problems to go away.

Let's complain about everything and offer no solutions.

I tried to take notes while watching this video, but hot damn did I fall off hard toward the middle and end. Now I have to come back up here to the top and sort out this clusterfuck I have created. Much like the original poster, my timelines are all out of order.

So it begins:

- Target Audience is people who don't know any better.

- Explains everything from the ground up.

It's very clear that this video exists for people who don't know much if anything about cryptocurrency. That's why it's so long. He explains Bitcoin, then mining, then Ethereum, then Greater Fool's theory, NFTs, then DAOs... and a million other things in between. Essentially it is just one gigantic rant about everything wrong about crypto, without any admission that crypto solves a problem, which should be inherently nonsensical for a unicorn asset that consistently doubles in price and adoption every year. What we see in this video is the inevitable backlash of crypto adoption that happens when the space makes great strides forward. Two steps forward, one step back.

- Bitcoin Too slow and expensive to handle commerce. (10:45)

- Buying/selling drugs is the only use case (11:00)

- High fees, rapid price flux, multi-hour transaction times.

By focusing only on Bitcoin, he's able to forge a lot of good arguments against crypto by ignoring everything else. Funny thing is: that he doesn't just focus on Bitcoin, he focuses on old-school 2013 Bitcoin and acts like it can only be used for drug dealing and gambling... even though this is 2022 and the ultimate reason he's made the video is 2022 levels of adoption that make the previous argument null and void.

- "Changing of the guard."

- No, there is no guard.

- No, Jordan Belfort only recently started liking crypto 11:45.

- https://www.cnbc.com/video/2018/08/23/jordan-belfort-breaks-down-crypto-fraud-and-warns-investors-to-run.html

- https://www.youtube.com/watch?v=nWYwlvLxoGA&ab_channel=CoinDesk

- Time Jumping again: institutions have always been involved.

- Same players in crypto as legacy banking.

- Same problems as legacy banking.

In this note I recall him talking about Bitcoin simply replacing one oligarchy with another rather than actually than empowering the people in a unique way never before seen. There is some merit to the argument... but what is this "new guard" he talks about? Hilariously enough he then conflates the new guard with the old guard and acts like institutions got in on the ground floor and that new tokens aren't being created every single day.

The "time jumping" is hilarious.

He acts like Jordan Belfort (Wolf of Wallstreet) was always an advocate of Bitcoin because he's a scammer and Bitcoin is unregulated and he's banned from trading securities so of course he loves it. That's why I found the video of him in 2018 saying Bitcoin was a scam and he knows what manipulation looks like, and then a recent video of him flipping and admitting that he doesn't know how it didn't die but now that all the institutions are on board he is in it to win it. Meanwhile... this guy acts like Belfort has always been involved, even though he only just recently flipped. Hilarious.

- 13:00 "Cryptocurrency does nothing to address 99% of the problems with the banking industry; because those problems are patterns of human behavior; their incentives, their social structure, their modalities. The problem is what people are doing to others, not that the building they are doing it in has the word 'bank' on the outside."

"Same Incentives and social structure."

Anyone in crypto knows this is easily one of the most damming statements one can make. It shows a complete lack of understanding of both systems. We control the incentives like never before, whereas previously we had zero control. Yes, there are scams. Yes, there are greedy people, but to conflate these two apparatuses as the same institution with a different label? Guy must be smoking crack. I feel like there is so much more to say here, but I already have too much to say. This is easily the most egregious statement of the entire video, so I'll leave it at that.

- 13:30 Begins describing how POW mining works.

- Again, who is the target audience?

Why do we need to know how mining works to talk about why NFTs are bad?

In many ways this is just a rant for why all of crypto is bad. And every tiny attack vector is being attacked out of context for maximum effect.

- Mining is centralized

- "More would always go to those with the resources to build the bigger rig."

- "Rather than dismantling corrupt power structures this would just become a new tool for existing wealth."

- Again totally ignores all other crypto to make this argument.

The video doesn't seem to understand that crypto mining isn't a game of having the biggest rig... it's a game of energy efficiency. A big inefficient rig with massive power consumption will not be profitable, while a tiny rig with a good power supply is profitable. Very hard to take this part seriously, which is fine because the good stuff comes later.

- 16:15 Wastes Energy

- "Huge amounts of redundant work are being done and discarded."

- "Small industrialized nation."

- Evangelists will counter that global banking also uses a lot of power (No, I will not.)

I will counter by saying that the energy consumption and redundant lottery isn't a waste at all. In fact, not only is it not a waste, but there is so much more untapped potential waiting to be unlocked. The video fails to recognize that Bitcoin creates numbers that are completely unhackable due to the fact that in order to hack them one would have to throw away valid blocks worth millions of dollars. Not only that, the byproduct of this energy consumption is heat, and heat has value.

At the end of the day Bitcoin uses the exact amount of energy it is supposed to use based on the price of Bitcoin and the amount people are willing to spend to sent it around. Again, there's a lot more to say here but so much more content left to navigate.

-

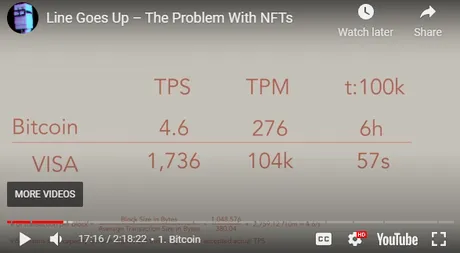

Transactions per second vs Visa

- "Fractions of a cent in electricity per transaction"

Why would you buy a pound of delicious apples for $5 when I'll sell you a thousand pounds of rotten oranges for $1?

Quality vs Quantity

People get very hung up on the fact that the legacy banking sector can process transactions for a fraction of a penny per transaction. The reality of the situation is that we can not compare a legacy banking transaction with a Bitcoin transaction in any way. It's the same as comparing apples to rotten oranges. The system we have now is so corrupt even governments can't trust each other. With Bitcoin, they can. Bitcoin is designed to transfer millions/billions of dollars between huge entities knowing that the underlying value can not be corrupted in any way. You simply can't get that with fiat.

Also, the constant harping that Bitcoin using as much energy as a small country is ridiculous. It's like saying "100,000 people died; bodies everywhere! Piles of them!" Compared to: 0.00125% of the world population died. It wasn't a big deal, these numbers are very small and happen all the time. Both of these numbers are exactly the same, but the narrative is completely opposite. Both types of portraying the data could be used in a malicious way depending on the context. This video is totally and unnecessarily alarmist, not only for no reason, but it also can't change anything about what happens next. This is inherently frustrating for all parties involved.

-

"Global banking sector vs hobby horse of a few hundred thousand gambling addicts."

-

Seriously how am I going to make it through this fucking video when he literally says something stupid at least once a minute? Jesus Christ Almighty.

He scatters this insults all throughout the video, implying that anyone involved with crypto is basically an idiot when low social IQ that can be easily tricked into being scammed. Pretty insulting and counter productive, but exactly what you'd want in order to make people afraid.

"Electrical waste is the value that underpins Bitcoin."

This is an oxymoronic paradox.

The value is underpinned by worthlessness?

One must admit that electrical consumption is not waste to make the claim that it underpins Bitcoin's value.

Again the electrical consumption isn't even wasted, as 96% of it is expelled as heat, and obviously heat has value in many contexts.

- Bitcoin will never lead the charge into a green energy future.

- Focus on power prices dropping instead of Bitcoin price going up or down.

First of all, I've already debunked multiple times this idea that Bitcoin wastes energy. It consumes exactly as much energy as it's supposed to consume given the inherent value of the network. If the price of Bitcoin goes up because the market says it has value, the value of mining automatically goes up and Bitcoin expends more energy to bolster it's security. This is a requirement considering more money on the line requires more security. Making the claim that allocating resources to security, especially when that security is directly tied to raw value, is again foolish and naïve.

From here, my notes start to devolve.

The video was so long that I couldn't keep up with everything, and it was quite irritating as well. The points he makes from this point onward are much harder to disprove and the video just drags on and on and never ends:

18:18-24:37 Ethereum

This section was actually pretty good. It talks about the idealistic vision of Ethereum and why things like putting health records on the blockchain would be very difficult if not borderline impossible in addition to stupid. Then again, ETH isn't a privacy chain so that's an easy argument to make. Health records must be private. Once again we see this pattern of picking the lowest hanging fruit and not really giving any credit whatsoever to what Ethereum has accomplished over the years (like allowing anyone to make a token and monetizing AMM with yield farms which in turn provided exponentially larger liquidity pools when compared to an orderbook model). Also EVM has been cloned over a dozen times already, so making the claim that this tech is garbage is obviously false. Failed tech doesn't get copied over and over and over again. Imitation is the highest form of flattery, especially in tech.

27:00 Proof of Stake

- Rewards wealthy

- Better energy efficiency.

- Centralized block production (minimum 32 ETH).

Actually I rather like this description of Proof-of-Stake.

It actually helps me realize why DPOS is such a superior solution.

30:00

Talks about "man in the middle attacks" and why supply chain solutions are much easier said than done. Again, pretty good arguments. I'm also not a fan of supply chain solutions using blockchain. It makes no sense because the physical product is centralized in reality and we don't want that data to be public.

Gas wars

Another reason why DPOS and feeless architecture is superior.

1:1 Tether Peg

Seriously people need to stop talking about the Tether peg. There is a reason why Tether still has the top market cap, and it has nothing to do with if the money is pegged 1:1 with dollars in a bank. Bitfinex does the best at keeping the token stable and providing the most liquidity. That's all that matters.

It's naïve to think that we can't peg stable coins using crypto as collateral (or even the value stored within the corporation itself, like a stock). We can. We do. It's happening right now. Get over it. The 1:1 peg doesn't matter. This is especially true considering dollars in the bank don't even exist because it's a fractional reserve being loaned out to someone else.

Greater Fool's Theory

He makes the claim that because there isn't enough liquidity to exit the market everyone is just hoping others will arrive on the scene with exit liquidity... Again, I have to ask, who is his target audience? Billionaires? lol.

Of course there's more to the Greater Fool's argument than that. He's saying these are all speculative and worthless assets. Ah, well, that's cool, you can be wrong, again. Of course I'd have to write a book to prove it so I'll just leave it at that for now.

The entire structure of cryptocurrencies at their basic level of operation is that they're designed to deliver the greatest rewards to the earliest adopters.

Ah, so close!

This is a problem and applies to many cryptocurrencies, especially ones that tout a 'superior' deflationary model. Number go up! However again, this statement lacks vision. Cryptocurrencies don't have to be deflationary. The network controls inflation. I've already worked out a solution to this exact problem that I will hopefully employ on Magitek. By vastly allocating more inflation to the LP pools we force early adopters to shove their money into the LPs, where they will be for sale to the new adopters. Thus, the early adopters share the burden of growth by accepting impermanent losses during periods of expansion.

Coincidentally this solution also allows crypto to have elasticity and associated stability that most crypto lacks. By manipulating rates, yields, and inflation we can fix a lot of these problems that this guy seems to believe will exist forever, frozen in time as he tries to claim that Bitcoin can only be used to buy LSD from Silk Road. Seriously it's hard to get over such flagrant bias.

The biggest problem with the Greater Fool's Theory and it's application to cryptocurrency is that it assumes that value can't be built from within. It assumes in advance that crypto is a scam and then uses that 'evidence' to show that it is a scam. It assumes that the only thing that matters is USD going in and USD coming out of the protocol, implying that crypto is just a tiny meaningless subset of fiat. Uh huh, let's circle back in ten years and see what happens.

These schemes around crypto tokens cannot create or destroy actual dollars, they can only shift them around. If you sell your crypto and make a profit in dollars, it's only because someone else bought it at a higher price than you did. And then they expect to do the same and so on and so on ad infinitum. Every dollar that comes out of cryptocurrency needs to come from a later investor putting a dollar in. Crypto investments cannot be anything but a zero sum gam, and many are actually massively negative sum. In order to presume a crypto investment functions as a store of value we simultaneously need to suppose an infinite chain of greater fools who keep buying these assets at any irrational price and into the future forever.

Oh, wow! Such insightful mega-quote.

Does it explain how this is any different from the stock market? Hm, no... it does not. Rather, it assumes that all value that is, was, or ever will be, is dollars (and only dollars), and that value can not be built from within. Only dollars have value. Such a tedious and obviously wrong assumption.

Anyone who's been in crypto for a while knows that this absolutely is not a zero-sum game and that we are building value from within and creating abundance. This mega-quote within the video that is supposed to be a powerful piece of supporting evidence ends up being one of the most damming things about it. It shows a complete disconnect and lack of understanding of, not only how crypto works, but of how fiat/liquidity works and of how stocks work and of how value works in general. Mind blowing.

The idea that the value of a cryptocurrency can't go up unless whales "pump USD into it" is inherently false on every level. The price is set by people who control the token. If tomorrow everyone decides that BTC is worth $100k, then BTC will be worth $100k. The nuances of supply, demand, liquidity, and market cap are completely lost on people like this. They think that the only way the price can go up or down is if market-takers move the market in a certain direction. This completely ignores all the market-makers, who are the real people in charge of the price 99% of the time.

And we're only 40 minutes in... gah!

Prepare for further devolvement of my notes as I really start to lose interest.

It's NFT time!

Considering I'm not really bullish on NFTs unless they are linked to gaming this should be good. He does open with the idea that his copy of a book is a unique copy even though there are other copies of the same book... which seems... thin.

He then goes on to talk trash about all the celebrities that capitalized on NFTs and sold their old memes more six figures a JPEG. That's fun, I agree that people are greedy, but again he misses the global point of NFTs and the direction that we are going (which was obviously going to happen in advance).

Now he's talking trash about how the JPEGs are stored on centralized servers. Again, yeah... obviously. That's worthless. These are not difficult arguments to make, but they are also pointless. To assume that JPEGS stored on a centralized server are the 'future' of NFTs is... dumb, but he makes that exact argument because it's low hanging fruit that's easy to attack with zero vision as to where this is going.

... However many minutes later...

He's still rambling on and on about how 'NFTs' are synonymous with JPEGs on Ethereum. This was another obvious thing that was going to happen. Focus on the scams to make the argument stronger. Completely ignore the direction the technology is headed in.

It's important to note that NFTs are worthless unless there are frontends that enforce the rules of the NFTs. This is why gaming is going to be the clear winner, but everyone who talks trash about crypto only sticks to the scams on Ethereum "art"... because obviously. Low hanging fruit is low hanging.

55:00 In it for the community

Now he's talking about accepting all the Discord invites and 'research' he did on the NFT communities. Pretty funny actually. I did not know there were this many... lol. No wonder why there is such a backlash.

The product is pretty insubstantial and basically non-existent.

Hm, yes... will it always be that?

Again, this video has revealed itself as the backlash of all the bullshit that has been going on in crypto. I would say this is a totally normal and predictable backlash, but that doesn't mean that the content therein is valid. In fact, we can be sure that this fishtailing is just as false as the BS they are calling out. That's how fishtailing works. The baby is being thrown out with the bathwater.

I'm also somewhat offended that he claims to have been part of the community when all he did we join Discords all with the sole intention of talking shit and making zero connections with community members. I guess it's not surprising but it is disappointing. I'm sure he'd have nothing nice to say about the Hive community either. Probably better than a random NFT Discord though.

Now he's talking about diamond/paper hands, WAGMI/NGMI, GM, and the culture of HODL, HFSP (have fun staying poor) in the context of creating a cult of people who don't ask questions or spread FUD around. Interesting take. It is very tight-knit and cultish, I agree.

WEB3 & Metaverse

Some more good content here, but again he assumes that the products will be controlled centrally and not by the community itself. He can't imagine tokens that are actually controlled by the community directly rather than the dev team, which is the entire point of crypto. Thus all the assumptions made to this effect are obviously false and totally missing the point.

Axie Infinity

Another easy target to attack. We already went over this one in great detail the other day. Yeah, Axie sucks. So what? Is Axie the ultimate archetype for play-to-earn, or some shitty starting prototype? Rhetorical question is rhetorical.

1:50:00 Deflation bad.

He just explained why deflation is dumb. I agree, and it's also not a defining characteristic of crypto, once again. Only 30 minutes left, thank the gods.

1:56:00 DAOs!

Talks about how the stakes are high because everything is being put on the chain... wastes no time into going into the DAO hack on Ethereum that led to the Ethereum Classic fork. Good information, if not heinously biased as always.

Yada yada yada, explaining all the vulnerabilities and complexities of governance. We know all about this on Hive. I still get the feeling that all these complaints lead to one underlying narrative: crypto has failed. But crypto hasn't failed (stronger than ever), so what's the point of this narrative? More on this later.

2:14:00 (Almost done thank god)

Claiming crypto is a fight between the top 5% and top 1%, a battle of resources between the rich and the super rich. Ends it with a comparison to MLM and Amway. Classy.

OMFG I did it.

I watched the entire thing.

The most tedious video I have ever watched.

Congratulations: me.

Analysis

If I'm being honest I'm glad I was able to get through the whole thing. This guy is really smart and knows his shit. He's done his homework. However, he falls into the trap that all crying liberals fall into: pointing out all the problems without offering up any solutions.

I guess the implied solution is to simply ignore crypto at all costs... and hope that a better solution just magically appears. Yeah... because we haven't been doing that already for the last 30 years when the Byzantine Generals Problem was presented in the first place.

I can't help but notice he didn't talk about DPOS at all, only POW and POS. 99% of the focus was on Bitcoin and Ethereum (EVM).

It's nice to see that DPOS is still an undiscovered gem that has solved most of the problems he has talked about, once again showcasing the original poster's ignorance. So many issues revolved around high fees, centralized stake, and VC money ruling everything. I wonder what he will say when Hive takes off. Probably nothing good.

Conclusion

Some people want to bitch and moan about all the problems with cryptocurrency. It's not hard. There are a lot of problems. By design actually. It's inefficient on purpose. It's volatile at the core. All new technology is.

So these grand narratives are constructed that point out all the problems and say how terrible it is without actually accepting REALITY. You know what reality says? Crypto is working: that's why we are even having this conversation in the first place. If it wasn't working we wouldn't be having this conversation because it would be just another failed technology that got thrown in the scrap heap. By not addressing the inherent success of crypto the original poster undermines his own credibility by seemingly denying reality itself.

It's amazing to me that such smart people could just gloss over facts like this... as if their words alone are going to actually stop crypto from happening. A 2 hour 18 minute video debunking crypto with 6 MILLION VIEWS within a month? That's pretty insane; kudos to you, friend! But you know what's more insane? The fact that this silly little video isn't even going to slow down this tidal wave of madness. In fact, it might even speed it up. I did not realize that complete and utter horror would be a sign that mainstream adoption was upon us, but what else should have I been expecting of a protocol that circumvents all the rules we've put in place?

Apologies for this 'debunking' not being as good as it should have been.

There was simply too much content to go over.

And if I'm being honest the original post makes some good points...

Even if they are rooted in 100% anti-crypto bias.

At the end of the day this video lacks vision as to the global narrative.

It relies on picking and choosing the frame that gives it the most credibility,

And lacks any kind of acknowledgement that crypto has already succeeded.

I guess we really have made it after all.

How else could have a backlash this strong even occurred?

Posted Using LeoFinance Beta

Return from Debunking Viral Anti-Crypto YouTube Video. to edicted's Web3 Blog