Introductory market watch.

It's actually pretty crazy that I called the dump on the 10th and today's candle with pinpoint accuracy. $39k and $38500, retail is quaking in their boots while I'm madly bullish over the next few weeks and subsequent months after that. Another lower low has been forged.

It's pretty crazy how ever since retail got involved that all of the obvious supports and resistances have been coloring outside the lines. The market crashes right below the obvious support line and then pops right back up, or breaks the obvious resistance and then crashes right back down below it.

These sharks really know how to exploit retail amirite? I think we need to assume this will just keep on happening. None of the obvious lines we draw are relevant anymore... or at least they are totally relevant but we just have to assume institutions are going to continues exploiting them and coloring outside our perceptions for maximum pain.

It looks like we've experienced the full bottom out.

Which is exactly why I was so compelled to write that speculation post so quickly after my first one yesterday. These things happen so fast if you blink they are gone. The shifting sands are real.

But you know what's really fun about littering speculation posts inside of real ones? In a year or three I'll look back and this post and be like, "lol Bitcoin was only $40k back then". This has already happened to me multiple times (I wrote so many speculation posts when BTC was $4k-$10k). Wen $400k?

Main post: What is DEFI 2.0?

The concept of DEFI 2.0 is a simple one. DEFI 1.0 was all about generating massive hype and monetizing AMM yield farms in the craziest and most unsustainable way ever. Yield was allocated everywhere in a mad dash for cash. Empires were created and decimated within months. Man, that was some crazy stuff.

But what did we learn?

I believe DEFI as a whole has learned very very little as to the failures of the 1.0 iteration of the system. Why do I think this? Because they haven't taken steps to fix them or even to address what they are correctly/accurately.

Printer go brrr

It's like when you ask someone about how central banks work and they tell you "printer go brrr, buy Bitcoin". Well I mean... sure, that's good advice, but for the wrong reason. Inflation isn't happening right now because money is being printed (money supply going up). It's happening because many of our supply lines have been absolutely ravaged by politicians making very foolish decisions (product supply going down).

This can't be fixed with higher interest rates. The FED is powerless.

It's happening because we experienced a "deadly pandemic" and "Putin/Russia bad". Unfortunately, to blindly believe the propaganda as gospel is to delegate control to the very leaders causing the problem in the first place. As with anything, the ultimate problem is unchecked greed, and there is no easy fix to that one.

DEFI 1.0

So to say the problem with DEFI 1.0 was that "printer go brrr" ends up being just as ridiculous as saying the problem with inflation is "printer go brrr". Assuming this is the problem and then trying to solve it using false information isn't going to work. The problem must be actually understood in order to be fixed, and I 100% guarantee that nobody in crypto understands the problem because no one in crypto is actually taking the steps to create the real DEFI 2.0.

And thus, the DEFI 1.1 was born under the 2.0 moniker.

The thing that people are calling DEFI 2.0 is really just DEFI 1.1. There's nothing special about it. It's not a new version. It doesn't stand alone. Most importantly: it DEPENDS on DEFI 1.0. Fully 100% dependent on the old system.

Imagine marketing a product as a 2.0 product that couldn't exist without the 1.0 version. That's exactly what every crypto claiming to be DEFI 2.0 is doing. The thing that is being called DEFI 2.0 doesn't work without leeching off of other networks for yield. It is parasitical and absolutely depends on the 1.0 version. If we think that DEFI 1.0 is doomed to fail, then we also must assume that DEFI 1.1 is also doomed to fail, because it depends on a system that's going to fail. Simple as that.

Example of actual 2.0 upgrades:

- Torches to the lightbulb.

- The horse to the car.

- The printing press to the Internet.

Adults? Well those are just Kids 2.0! ... what?

We are going to solve this by printing less money! Yeah! Smrt! Are we 2.0 yet?

The audacity of doing so little work and marketing a 2.0 upgrade...

The "solution" to DEFI 1.0 being unsustainable and burning out is the obvious "printer go brrr" solution (based on a false premise). It's not going to work, because that isn't the problem. Thus, current iterations of DEFI 1.1 (aka 2.0) assume that they can "become sustainable" by "printing less money". And this is where a lesson in economics is required.

+EV vs -EV

Any given action in gambling or crypto economics has a positive estimated value or a negative one (or they balance out at 0). Either the inflation we allocate to LP pools has positive value, or it has negative value. Unfortunately, there is no way to measure this number, and it is completely unknown and buried in an array of thousands of variables all interacting within a complex economy. It's not that easy to employ Occam's Razor and shave the variables down using control groups like normal science would (or perhaps it is easy we just don't actually do it yet). In any case, there is a lot of guesswork that goes into which variables at which values create the maximum EV for the network. This is the ultimate goal of any cryptocurrency or professional gambler (I played a lot of poker back in the day).

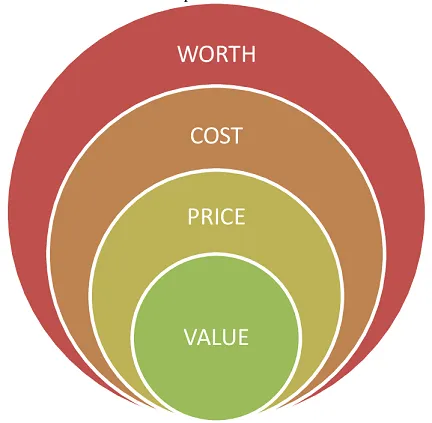

Price is what you pay, value is what you get.

Ew did I just quote Warren Buffoon? Ah well boomers can't be wrong all the time.

Barring the blatant ageism...

There is no Secret Sauce pre-determined level of inflation that is going to somehow magically create the maximum EV for any given DEFI network. Any DEFI platform that choses their emission rates in advance is doing it wrong. Imagine if the Federal Reserve let a monkey throw a dart at a board and that's what inflation rate we were going to get. As fun as it is to joke that's basically what happens, we'd enter a recession immediately. The Federal Reserve is trying to prop up a totally broken and corrupted system, and that's a tall order. The more I research what's going on the more I realize that most people give them way too much credit and blame for how the economy operates. Everyone wants the simplest answer possible and the least amount of work to understand it. Sorry monkeys, that's not how life works.

What is the 'real' DEFI 2.0?

To me, it's obvious. The only thing that makes sense is that DEFI evolves to create it's own dynamic monetary policies that are superior to all fiat currency. That's when the crazy stuff starts happening. That's when fiat currency realizes they are totally screwed and they need to fight back with everything they have or go extinct. I 'hate' to break it to them, but the comet has already struck ground, and it's only a matter of time before they become completely irrelevant. The transition period is coming, and hot damn is it going to be awkward and ugly as hell. Authoritarian CBDCs will only fuel the fire and catalyze the event. The writing is on the wall.

- Store-of-value

- Medium-of-exchange

- Unit-of-account

We were told that it was impossible to do all three.

We were told we needed to pick two and sacrifice the third. This is no longer an accurate statement. DEFI and AMM show us the Golden Path that leads us into a future where currency can have it all: stability, dependability, interoperability, security, and exponential value creation. It's going to be a wild ride when devs begin to realize the gold mine we've all been sitting on. The icebreakers that accomplish this feat first will be copied a thousand times over. Intellectual property is no longer relevant, and that's a good thing. It's going to open up society to places it's never gone before.

So what makes DEFI 1.0 "unsustainable"?

Short answer: nothing makes it inherently unsustainable. It's perfectly sustainable and fine just the way it is. The only thing we must question is how much EV is generated from allocating yield to a certain place. Take RUNE/THORCHAIN for example. Everything on ThorChain is paired to RUNE, and that makes is wildly sustainable, because every LP becomes a blackhole that sucks RUNE into it. It's when we allocate yield to pools that don't help the network that we get into trouble. The question becomes: why did we ever do this in the first place?

Who in their right mind would allocate yield to a BTC/ETH LP? Why on earth would someone do that and then talk about "total value locked" like that's a metric that means something?

The one-trick pony.

The reason is simple. When DEFI was essentially invented on Ethereum devs needed a way to lure deep pockets into the new thing. What better way to lure an ETH whale to your project than to provide a direct pairing to ETH? The ETH whale sees that and joins the pool, and statistically he'll put a huge chunk of value into other places that moons the underlying DEFI token.

Yeah, that's not going to work anymore. The cat is out of the bag. There are thousands of DEFI networks. The same stupid gimmicks used to get money to the platform aren't going to work after they've been played out a thousand times. Allocating yield to a pool like BTC/ETH has a negative EV, every time. The network loses money, everytime. There is no sugarcoating this fact. We need to stop using the old played-out strats that never had sustainability to begin with.

Psychological unsustainability

If the token price drops 50% but you have twice as many tokens, is that unsustainable? Mathematically no, of course not. However, people are idiots and don't understand math. They see the price drop 50% and they 'feel' as though they've lost money even though the underlying dollar value (unit-of-account/store-of-value) is the same.

perception is reality

Of course if irrational monkeys 'feel' as though they are getting a bad deal, they will pull their money/value out of the network and actual losses will occur. So there is that. The psychology of all of this is wild, which is why it's so obvious that high yield algorithmically stablish coins will eventually take over. It's only a matter of time really. It's a similar reason why DOGE and SHIBA INU printed so many coins and made each coin dirt cheap. The monkey 'feels' like they're getting a good deal, and so monkey put banana into shib network. The psychology of unit-bias and the lack of mathematical understanding plays a real factor into how this is all going to play out.

Conclusion

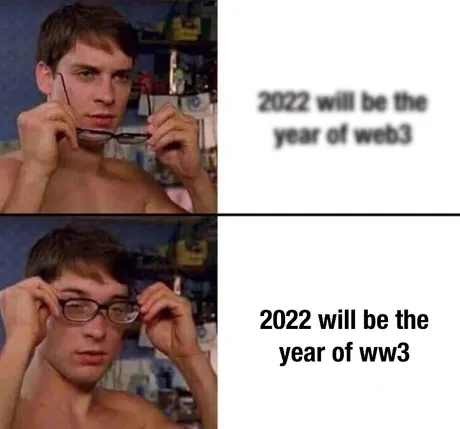

We can never trust that the developers of a product will accurately classify how good the upgrade is in real time. Already we have dipshit billionaires claiming to be working on "WEB 4.0" and "The Metaverse". These are nothing statements not to be taken seriously. Do we think anyone called World War 1 'WW1' when it happened? No, it was just "The War". Maybe we should call the next one WW3.0

If we assume DEFI 1.0 isn't sustainable, then DEFI 1.1 (aka 2.0) isn't going to be sustainable either. That should be obvious, but literally none of the devs seem to understand that simple fact, instead opting to market their leeching parasitism as "sustainability". Luckily, DEFI 1.0 is totally sustainable and real value is being built, we just need better ways of calculating EV and manipulating yields to best optimize that value generation.

Bottom line:

A 2.0 upgrade can't depend on the 1.0 version existing to sustain itself. That's not how this works, and it should be obvious. "Should"

Posted Using LeoFinance Beta

Return from DEFI 2.0 Doesn't Even Exist to edicted's Web3 Blog