Before Polycub launched I wrote a bit of a rant about the pendulum on CUB that was implemented. This pendulum sucked yield from the liquidity pools (BNB/CUB BUSD/CUB) and pumped it into the kingdom because the kingdom had pretty low yield.

Yes well, the kingdom had a low yield for a reason... and that reason is obvious. There's more than 70% of all CUB in the kingdom, and rewarding the degenerates by providing them with yield in a pool that adds zero liquidity to the protocol is... incorrect. Turns out I was right the entire time.

I was told I didn't know what I was talking about, and the pendulum was a pendulum, and it would swing back and forth. It hasn't. It isn't. All of the numbers are exactly the same since it went live and none of the multipliers on the frontend update to reflect the changes, so we are all flying blind with this thing in the background manipulating our inflation with pretty much zero indication as to what it is actually doing.

I said the pendulum implementation was a bad idea, and I was right. With the polycub launch right around the corner, it was painfully obvious that we needed MORE liquidity, not less. It was incredibly obvious that there would be high volume. Lots of buying and lots of selling. And in response to that known need for more liquidity, the pendulum squeezed the liquidity pools and made them even smaller.

Look what happened, price crashed from 37 cents to 20 cents. Oops. Everyone assumed money would enter CUB because the airdrop was a good deal. Well I guess the deal of getting 10000% yield on the first day of Polycub launch was a little bit better than that eh? The polycub launch sucked liquidity out of CUB and LEO pretty hard because that's exactly what the launch financially incentivized everyone to do. Whoopsie daisy.

But hey, polycub yield is declining, and everything is equalizing a bit more, so we are in a good spot now. Water under the bridge. I have a lot more to say about this situation, but it requires an entirely new post, so some other time. Basically the pendulum is a great idea, but it should be stabilizing token price or market cap, not trying to stabilize yields. Some tweeks here are definitely required, but again I'll talk about this some other time when I have more information.

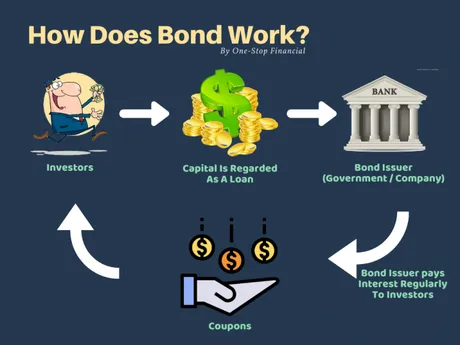

Bonds

Take a look at the infographic above. Bonding is launching soon for polycub and cub, and that's an exciting thing. It can only add value to the protocol in the long run. I've come to realize this is another reason why the pendulum is absolutely necessary for the technologies about to be rolled out.

Imagine if you're about to buy a bond from CUB with your LP tokens, but that action is actually less profitable than simply leaving them where they are at? How counterproductive! The pendulum will be able to increase yield to bonds when they are in high demand, and decrease them when they are low demand. This kind of elasticity is desperately needed in the DEFI arena. Anything that provides robust stability is a godsend.

But what is a bond?

A bond is a loan. And what are loans for? Loans exist so the entity taking out the loan can leverage it into more value than the interest they have to pay back. So the real question we have to ask ourselves is... can the protocol actually use that money to generate more value than is owed back? Somehow I doubt it, but truth be told I have no idea how it works. Need a more detailed explanation.

In the seemingly likely event that bonds are not leveraged by the protocol to create more value than they have to pay out, this turns into a bit of a Social Security situation, where the system we are building isn't sustainable, but ends up being profitable in the short term at the cost of long term dilution. However, even if this was true, as traders in an opt-in financial system, we can just trade around this outcome pretty easily.

Honestly if I was designing a bonding system, the only bonds available would be permanent bonds. In my mind, that's really the only way for the system to gain maximum value: by never giving the principal LP tokens back, and forever creating a vault with infinitely increasing liquidity inside it. Of course the yield provided for locking your LP tokens forever would... have to be pretty high, especially considering they have to compete with 80% APR (again assuming the pendulum doesn't gut this number).

When you loan your money to the government for a 5% interest rate, it's not hard to imagine the government getting the better end of that deal. For example, if inflation was 5%, when they pay you back, they actually didn't lose any value whatsoever if they were able to retain the value of the original principal. Governments and corporations have all kinds of ways they can monetize a loan over a long timespan.

Looking at crypto, what can an automated vault do to leverage a loan into more value than what is owed back? Especially considering that the return has to be competitive with an 80% return after just one year? Yeah, gonna go ahead and venture a guess that's not going to happen.

However, this is crypto. Perhaps locking up liquidity for a year does in fact have the kind of exponential value we are looking for. This is especially true if we receive a ton of money from the outside, which seems to be the ultimate goal of all cryptos these days (rather than building it from within). Thus, locked LP tokens could end up being a pretty big deal if the HIVE/LEO/CUB ecosystem gets as much attention as we expect it to over the next couple of years.

At the end of the day I don't know exactly how bonding will work, so I'm really talking about my ass here. These are simply the kinds of things we need to be thinking about as it pertains to the game theory of such implementations. Thus far, I've always appreciated Khal's vision, so honestly I assume to be shocked with new information that I wasn't privy to before writing this potential FUD piece. It would not be the first time.

At the end of the day I have a ton of value locked up across this entire ecosystem, and obviously I have a huge incentive to see it succeed. Unfortunately we all know that success in crypto is wildly uncertain and volatile, and requires quite an iron stomach and, dare I say, diamond hands.

Conclusion

Crypto is ugly, and we have a lot of work to do. We aren't going to figure this stuff out unless we test it in the field. Game-theory can only go so far. At the end of the day, we now have the tools to easily control our currencies better than a central bank. Now it's just a matter of figuring out how to manipulate these things properly to create maximum value for the communities that use them.

The pendulum is a great idea. Being able to manipulate our yield to the places it needs to go is an obvious requirement going forward. Assuming static pre-determined variables are going to work over long timespans is a foolish notion. Imagine the FED deciding ten years in advance when they will raise and lower interest rates, and never altering course based on relevant information? That's the kind of strategy that would instantly hurdle the world into another Great Depression.

Yield must be fluid and dynamic, and thus the pendulum is a great idea. It just needs to be properly programmed to put yield in the right place at the right time. Imagine how much money we would have all made if a bot was trading DCA trading Bitcoin for us based off of the greed/fear index. That thing is surprisingly accurate.

Buy moar, peasants!

The combination of the pendulum and bonding should be very interesting indeed. While other DEFI networks bleed out to zero, Leofinance shows that they will keep grinding, rain or shine, and build contracts with actual value (not some random Goose egg token that's designed to fall to zero). It's been a bumpy ride, and there are many more bumps to deal with, but we are headed in the right direction.

Posted Using LeoFinance Beta

Return from DEFI Pendulum & Bonding to edicted's Web3 Blog