No one says it anymore.

Remember when people used to say 'diamond hands'? What happened to that? Number goes down and people stop saying it? Isn't the exact scenario and context that the term is designed for?

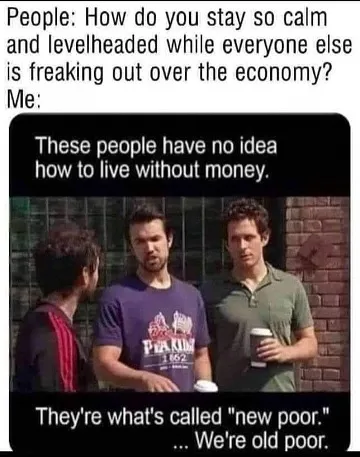

This really gives us insight into the psychology of these markets. In a society ruled by imperialism and artificial scarcity, fear is the main driver of all control. Fear of missing out. Fear, uncertainty, and doubt. Fear of being punished or ostracized. Fear of never having enough. Fear of getting sick. Fear of getting trapped at the bottom of the pyramid or the corporate ladder. All motivations reduced down to negative emotions and the capitalization of them.

Not great

We can see that this strategy often fails and has skyrocketing diminishing returns. At a certain point people get tired of being afraid. They get desensitized to it. A virus ten times more dangerous than COVID could pop up tomorrow and the response to it would be, "I don't care; I'm over it."

The effectiveness of fear is also strongly correlated to how much people have left to lose. People who have nothing left to lose can not be controlled by fear. That's why it's very important to keep a population comfortable and distracted with the magic picture box and the internet and power and running water and food. Take away the things that allow people to turn a blind eye to all the BS, and you're gonna have a hard time controlling them.

CPI

Report came out today. 8.3% is the number everyone is fussing about. Expected was 8.1%, so we see a dip. No surprises there. But also everyone just plasters this number everywhere and acts like CPI means inflation, as if they are the exact same thing.

If you check the reports, the analysis of the data is all over the place and ridiculous. Which is it? Is inflation cooling or isn't it? Why would gas going down after summer be factored into 'inflation' going down? Gas prices ALWAYS go down after summer. Why would someone try to exclude food and energy from the number? Food and energy are essential assets and matter more than all the other numbers combined.

We can see that CPI data is less than worthless when it comes to making decisions about the economy. It's all manipulated smoke and mirrors. It's obvious. Just look at the graph above. The 70's and 80's must have been the worst depression ever. Nope, that was the birth of the personal computer and the internet. The economy was booming.

In the early 1980s, the American economy was suffering through a deep recession. Business bankruptcies rose sharply compared to previous years. Farmers also suffered due to a decline in agricultural exports, falling crop prices, and rising interest rates.

See that?

Look how easy it is to spin a story.

I think the real question we have to ask ourselves is... does any of this really matter to us personally? The housing crisis had zero effect on me. I don't remember 2008 and 2009 as a bad time. Only as a moment in history that other people had a bad time. All this talk of inflation and recession and food shortages and energy crisis? Again, I'm not feeling it. It just sails right over me. I look around and wonder... "Wait, what is everyone actually complaining about? I don't get it."

And it's easy to say that crypto has been hit hard by this, but it absolutely hasn't. Hundreds of scams and illegitimate illiquid exchanges going under is not a downer. Overleveraged greed monsters getting flushed down the toilet does not decrease the value of what we are building here. VCs getting wrecked and bad business models being exposed and utterly destroyed is not a problem that needs to be avoided.

Too Big To Fail

That's what people don't get. In the legacy economy, we pump tax dollars and other subsidizes into keeping these zombie institutions alive even though we should be biting the bullet, letting the forest burn down, and rebuilding on top of something more sustainable. Crypto does this every bear market. The legacy economy does not. They are not the same, even if the number going down looks the same on a chart. The chart is a lie. Crypto is antifragile. The legacy system it is connected to that it intends to disrupt, is not. We just need to do the math and hodl to stay on top.

What was this post about again?

And the follow-up?

did he hodl? COURSE I DID!

Fuck yeah this kid really jacks you up.

Keep those diamond hands. Keep em shiny.

What ever happened to that Isaac Miller guy?

- Low-profile Bitcoin millionaire? Check!

- Douchebag rich-guy Aviators? Check!

- Realizes that having money doesn't solve all the problems? Check.

- Wants to see this world transform into the potential that everyone can see but no one has realized yet? #deep

Looping back to scarcity and fear.

Crypto is going to empower a lot of people to wake up and realize that something is very wrong with the world. How many people out there are just grinding out the days, working a full time job, and have their energy and spirit sapped and nothing left for anything else? It's a lot.

Crypto is going to unlock a certain potential to the point where we realize we no longer have to operate on a fear-based and scarcity-based mindset. That transition to abundance and cooperation is a major one, and people are going to wake up to the fact that a lot of the things they thought were acceptable no longer are. A major paradigm shift is coming, not just to the economy, but to society itself and the way that we interpret the world at large. Entire philosophies will shift in ways that never have before.

Conclusion

DIAMOND HANDS. Ride it to zero. Put your money on the table and light it on fire. It's gone. Forget about it. That's how we do business round these parts. Don't be the guy that says 'diamond hands' at $50k but then at $20k you're wondering if you should sell it all. Look at how many people did that! It's ridiculous. How hypocritical can one be? Don't trade with the herd. The herd is dumb. Just trade against Jim Cramer. You'll be fine.

Posted Using LeoFinance Beta

Return from DIAMOND HANDS! to edicted's Web3 Blog