Did Nakamoto know?

I almost wonder if Satoshi Nakamoto knew exactly what he was doing when he bootstrapped the Bitcoin network. Just like none of the experts understand "impermanent losses", so to do none of the crypto investors/bulls out there realize that deflationary economics are provably inferior to inflationary economics.

Here we have an interview with Mexico's 3rd richest person, Jose Rodriguez, making various talking points about Bitcoin and why it is a superior asset. At the 24 second mark...

21M supply! 21M supply!!! 21M Supply!!!!!11! omg!

Everyone foolishly latches on to the 21M hard cap like it's the be-all end-all best thing about Bitcoin. It's not. In fact, the supply cap for Bitcoin is going to turn into a huge negative going forward. It's not a good thing. It's trash, or rather, it's not trash, but it is totally neutral, which is trash compared to what everyone thinks it is.

We are entering an era where Bitcoin serves the corporations, central banks, and governments of the world perfectly. The deflationary nature is perfect for them to constantly buy up the supply and own it forever, using it as leverage for debt. The corporations and governments buying BTC today are never going to sell and they don't have to. There isn't going to be any left for anyone else, and they will continue flagrantly manipulating the price for as long as they are able with zero repercussions as this is an unregulated market that regulates itself by design.

The slow centralized development (or lack thereof) for Bitcoin (Blockstream) is also the perfect controlling mechanic for the big dawgs. The fact that security is so high and transaction fees are so atronomical (assuming worldwide adoption) points to further centralization of everything, and makes it so only custodians (banks/exchanges) can actually control the keys and still remain profitable.

So what's good about Bitcoin?

Well, first and foremost, it was first. That counts for a lot. This is a niche asset that no one is even attempting to compete with. What's the niche?

Security.

The "key" to Bitcoin has nothing to do with the supply cap and everything to do with who controls it. It is hard to control and it has very high security. That's why it's good. Not because of a hard cap, but because all the corporations, banks, and governments trying to control it will be rendered inept, and they will all come to agreement that this is a superior arangement compared to what they had before (dozens of fiat currencies built on waning trust). Again, this points to centralization (dozens of fiat currencies being consolidated into one Bitcoin network).

However, the hard cap does somewhat come into play as a form of security. Allocating inflation is an attack vector. By only allocating inflation to security Bitcoin completely plugs this potential flaw. That doesn't make it superior to other networks, it makes it safer than other networks, because again the key to Bitcoin is security and robust resistance to attack. It doesn't matter how often Bitcoin gets stomped on. It's going to perservere no matter what.

This is to say that obviously other networks will come along and take more risks, and guess what? With greater risk comes???? Yes, greater reward. It is all but guaranteed that many of these networks will rise up and flip Bitcoin's market cap sooner or later. It is inevitable. Does that mean we shouldn't invest in Bitcoin? Of course not... Bitcoin will still be more secure, and when the cryptosphere comes under attack it will ascend back to the top spot as the ultimate anchor of the network of networks.

But that's the thing about anchors isn't it? They are safe, but they are also boring during the downtime. Imagine being on a yacht on a nice sunny calm day and being obessed with how cool the anchor was. Your friends would think you were crazy. Look at those super fun "perfectly safe" wave-runners over there! Let's get this party started!

But as soon as the storm comes, guess who didn't get swept away? Yep, everyone who was holding onto the anchor. Bitcoin is the extremely conservative option that maintains dependability given a harsh environment. Absent a harsh environment many will become bored and branch out and try new things. This is why everyone should hold at least a little Bitcoin. Espcially now while we can actually afford the transaction fees.

I'm starting to believe that Satoshi Nakamoto created an inferior asset ON PURPOSE. Yes, that's right. Bitcoin is inferior. Just look at the halving event.

Why is the BTC halving event so clunky? Slashing inflation in half every four years? That is such an embarrassingly clunky option that creates totally unnecessary volatily and instability. It would have been just as easy to lower inflation a little bit every time the difficulty changed (~2 weeks) or even after every block. This would be a superior smooth transition and Bitcoin would not encounter such crazy volatility every four years. Smooth sailing.

It's almost as if Satoshi made it clunky and inferior on purpose. He created the volatility and the supply shocks built in on purpose just to generate awareness and tap into our primal greedy instincts. Everyone wants to get rich quick which as little effort as possible. Seeing people get so lucky and make so much money in such a short period of time gets a lot of attention.

In the same vein, Bitcoin having very low inflation allocated 100% to network security is the SAFEST option. Bitcoin doesn't have to worry about inflation being allocated to bad actors or to people who are going to spend it foolishly without bringing value to the network (just look at Hive and all the crazy downvote scenarios). By eliminating inflation, Bitcoin eliminates risk, but that also eliminates reward. That is totally fine, this ship absolutely needs an anchor. Bitcoin is it.

Bitcoin can not scale

I don't care what anyone says, the only way for Bitcoin to scale is to become massively more centralized. Lightning Network Bitcoin is basically just another coin they are calling Bitcoin. The security vectors introduced by Lightning basically make it not Bitcoin. Might as well just use another chain entirely, because that's what the LN is. Same would go for smart-contract networks and whatever else. Stop trying to upgrade the anchor into a spaceship; it's not going to happen. Bitcoin has a very niche purpose, and it serves that purpose well.

To recap:

Things that make Bitcoin inferior to up & comers:

- Deflationary hard cap & economics

- Halving event every four years (volatility)

- Centralized snail-paced development

- High security that comes at extreme cost

Nakamoto genius?

At this point it's almost as if Nakamoto knew this was going to happen and leaned into the outcomes we are seeing today. The very institutions Bitcoin was supposed to break are simply capitulating and buying out the network. By all accounts, it seems like that's going to work out for them quite well in the long term. No one can stop them from buying, and the inflation of the network is so small now (rounds to zero) that once they buy all the Bitcoin they'll simply own and control it forever.

It's only a matter of time. Imagine the price of one BTC at $20M and this is easy to imagine. They can print USD to infinity. At a certain point, all the small fish will sell out and be permanently priced out of the market.

But again, Bitcoin is a totally inferior asset compared to what some of these other networks could become in the future. The key is distrubution. Whoever has the best distribution of tokens is going to have the best kind of decentralization possible. You can't get that kind of distribution with a deflationary asset. It is known. People are going to horde it; they already are.

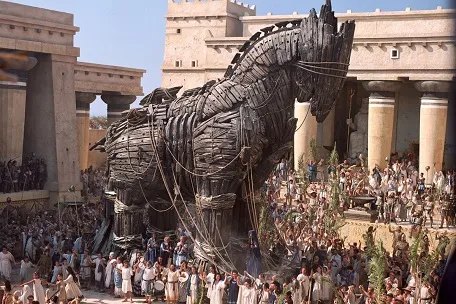

It seems like such a trojan horse for the entire financial system. Just when they think they have it all figured out Bitcoin starts dropping on the market cap and they'll have to start all over again. Superior distributions and tokens that can actually maintain stability and act as a unit of account are going to take over. That means hyper-inflationary assets are the future. Such irony.

We've all seen how this plays out. Expect the unexpected. We've seen Doge get into the top ten, much to the dismay of the entire ecosystem. We've seen how exponential value can be created at the drop of a dime. Reality doesn't care about theory. Just because Bitcoin is the most secure network of all time doesn't mean it's going to stay number one on a speculative market cap. In fact, that's exactly why it won't be number one going forward. No one actually cares about security until that security fails. Many of these network's security won't fail, even though they have less than Bitcoin. In a very real sense Bitcoin has too much security and sacrificed too much in the name of safety, but at the same time that's exactly what this ecosystem needed.

Market watch

Bitcoin is clearly messing with me. We are so close to breaking back to the upside and reversing this potential "bear market". Of course in hindsight all anyone will see is 10 days of correction and all these silly notions of a bear market will all but dissapear.

Conclusion

This is not a competitive space, and Nakamoto was one of the few entities that had the foresight to build accordingly. What they created was the safest asset possible. They must have known that not-as-safe assets would rush in to fill the void and create more value on top of everything else.

The future of currency is hyperinflation, but not hyperinflation controlled by a central authority, but tokens minted and spent by the underlying community itself. The future of currency is defi and printing a lot of money that helps expand the network. Bitcoin isn't that, and that's fine. I starting to think that Satoshi realized that the whole time. They didn't create an environment, but rather just one creature within that environment that can support thousands of animals in a completely sustainable manner.

Posted Using LeoFinance Beta

Return from Did Satoshi Create an Inferior Asset on Purpose? to edicted's Web3 Blog