Elon Musk paid $192 per daily active user

Twitter reported an average of 229 million daily active users in the quarter, which was about 14 million more than a revised 214.7 million daily users in the previous quarter.

So I was just thinking about this today...

And the expected income is like $1.4 Billion annually. That's exactly what social media does... turns everyone into a Matrix data battery. On average you expect to extract like $5 from each one of your users per year in exchange for "free" service. That's how WEB2 operates.

These numbers really make me realize that Musk's play with Twitter is not only extremely long term, but also a massive gambit. Then again I guess all capitalistic models rely on these razor thin margins paying off eventually. It's pretty crazy though doing the math and realizing what that analysis means.

Damage inflicted on LEO ecosystem

When I was talking major shit about the Polycub launch I made the claim that serious damage was done to the entire ecosystem. I believe we have evidence of that damage already, with the market cap of CUB dropping to $1.5M for the first time ever. Before that we were rangebound between $2M and $5M since inception. LEO has also taken a massive hit, and combined all three of these networks have less than a $5M market cap. Pretty crazy honestly. But at this point it's also an opportunity to "buy the dip" as they say. Assuming we degens actually have money outside the ecosystem to do so (we don't).

I've done a bit of capitulating lately because my stack continues to bleed and I have no reason to believe that the greater economy is going to do me any favors anytime soon. Sold some chunks of CUB into BUSD and then leveraged that BUSD to pull more CUB out of the kingdom into the LP. Surprisingly the price hasn't gone down at all. I think there's actually quite a bit of support at this low level but I'm tired of getting caught off guard.

If I'm being honest now is probably the worst time to be making this move (as always) but meh I'd rather be safe than sorry. I need stable coins to make sure I don't get completely wrecked. Also I haven't messed around with pHBD/USDC on Polycub yet but that's looking like a pretty killer option at this point.

Taking a salary in Bitcoin

I've been greed gambling it up since December 2020. I used to own a good chunk of Bitcoin, but the ability to buy Hive at 200 sats was just too damn good. Even though Hive has gone x10 against Bitcoin during that time, I still never bought back any of my Bitcoin, which was greedy as hell and I realize I need to slowly fix this problem. I'll be DCAing very slowly into Bitcoin, and if Bitcoin hits the doubling curve at $34k I'll be forced to make a big play to get more because that's the level that Bitcoin holds and the alts get stomped into the dirt.

@tonimontana #2399 doing some good maths in Discord

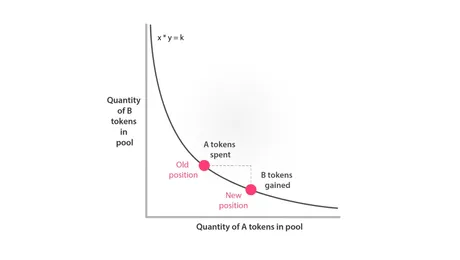

He basically ran the numbers on if we implemented the pHBD/USDC LP on Curve protocol, and the results look EXTREMELY promising. For those of you who don't know the normal AMM curve equation looks like this:

What does it mean?

Well traditionally the default AMM equation is k = y * x, but there are these math ninjas out there like Curve protocol who are manipulating the equation to get certain results. Those results include outcomes like mitigating impermanent losses or increasing liquidity in a certain range at the cost of reducing it outside that range.

It's now been shown mathematically that Curve protocol can be used to vastly increase liquidity of the pHBD/USDC peg. What's the drawback? Liquidity decreases lower than k = y * x curve when the price of HBD breaks the peg too hard. How hard? A 30-40 cent range. That's 60-70 cent HBD or $1.30-$1.40 HBD where the new equation starts being outperformed by the old one.

The implications of this are that there is almost ZERO drawbacks to using Curve equations for the pHBD/USDC liquidity pool on Polycub (which is already doing very well). The 3.5 day conversions on Hive (HIVE >> HBD ; HBD >> HIVE) are already good enough to keep HBD well within that range the vast majority of the time. This means once pHBD/USDC is implemented on Curve we are just going to get a ton of extra liquidity basically for free with zero drawback. This creates a positive feedback loop, because the more liquidity HBD has the more stable the peg will become anyway. Pretty epic honestly. Good times.

Also some changes with the stabilizer on Hive have changed as well. The range for buying and selling HBD has been tightened, which should also further increase the stability of our stable coin. Everything seems to be lined up to make HBD a real contender in the field of algo stable coins.

CUB vs PCUB

pCUB is basically a testnet for CUB. Everything developed on pCUB can be tested safely outside the bounds of CUB and then ported in when it proves it's worth in the field. This is just the nature of EVM programming, everything is compatible with everything. That's the super power of ETH, BSC, Polygon, and EVM in general. Buy buy-the-dip range for polycub is getting very near ($1M MC). I plan on buying that level all the way down to $0.5M (should it get that low). Volatile network is volatile.

Conclusion

The LEO ecosystem has gotten pretty hammered in terms of market cap. Might be a good time to buy, but penny "stocks" are volatile as hell. All I know is that development is happening pretty damn fast, and while the economy looks like a dumpster fire and we all might get wrecked on paper, such an event would only accelerate development even further. Bear markets are for building.

The same is true for Hive in general. So much is going on here and we are still scraping that 80 cent support line with a potential threat down to 50 cents. Honestly, it's time to derisk a bit. Bitcoin is the best risk vs reward asset on the planet, and we are already only 13% away from the doubling curve that's been in affect for the last decade. Everything points to long-term viability of alts but there's no reason to go down with the ship during the next impending recession. Be careful and maintain a balanced position during this time of extreme uncertainty.

Posted Using LeoFinance Beta

Return from Doing some Maths to edicted's Web3 Blog