This is a message we will hear echoing over and over again across multiple timelines, philosophies, and religions.

- People should be kind.

- People should share.

- People should give more to their community than they take.

- People should forgive trespasses against them.

- People should not be greedy.

Give what you can; take what you need.

In fact these are the very tenants of communism itself. Everyone should just share everything and do their part to make society a better place. Everyone getting along, kumbaya, so on and so forth happily into the sunset.

So simple!

Not quite how it works out here in the real world, is it? Time and time again we see that communism is extremely lucky to scale up to even 1000 people before the blatant corruption of the leadership sets in. The thing that most people think is communism... absolutely is not communism. It is an abomination. See: China.

At the core of the problem lies tribalism.

Humans are not designed to give a shit about 1000 people, let alone a million or even a billion people. We have our friends and we have our family and that's pretty much it. Once the tribe in question becomes too large it breaks off into splinters with every one of those splinters competing with each other. This creates a lot of friction when one of those splinters is already in control of the others within a pyramidic hierarchy.

Related to this problem is the concept of nepotism.

Okay so say you're going to boot up a communist group and everything is going great. Everyone is working really hard and doing their part. Friendships are forged, so on and so forth. One day you catch a good friend of yours exploiting the system for personal gain. What are you gonna do? Rat them out? Most people wouldn't. Probably a better chance that you'd join in on the activity than to put a stop to it.

And even if you did flip what is the community going to do? Kick them out of the group? The point here is that it's much much easier to let people into a group than it is to kick them out of it. The social dynamics of the human race ensure this to be true in all cases. At the end of the day when the planning and enforcement are done by people eventually we are going to run into problems of corruption. The chance of this corruption festering grows exponentially as the group grows in number and in power.

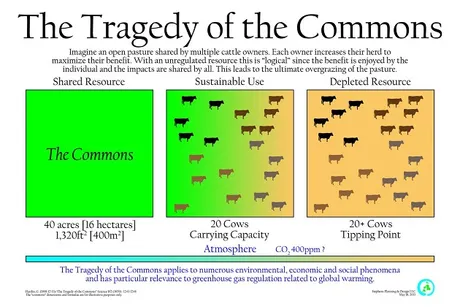

The Tragedy of the Commons is also a reason why communism breaks down when faced with reality. At the end of the day it all comes down to greed. Statistically no matter how awesome the community is there's always going to be that one person that fucks it up for everyone else. This is why we can't have nice things.

Rather than trying to fight against these social constructs and our very nature, it is rather much smarter to lean into them and create governance structures that are in fact not controlled by people at all. Cryptocurrency is the foundation of this movement. We are creating digital governments that are enforced by algorithms. Soon we may even see governments that are enforced by AI.

For example: what if someone cloned Hive, stripped the reward pool from the users, and gave it to AI? What if that AI was then manipulated by the users via governance votes? Could it work? Maybe?! Do I think it's a good idea? Probably not, but bad ideas are going to happen whether we want them to or not. That's the nature of the bleeding edge of technology.

In theory social credit scores are an awesome idea.

Great incentivization mechanic to promote citizens to do the "right thing". But who decides what is right and what is wrong? And then we see it play out in practice in China and people are getting their face scanned to get a sheet of toilet paper from a public bathroom. How did it go so wrong? Again when people are in charge we can assume they are going to mess it all up. People control AI, and the AI will reflect that until someone actually builds one without such ridiculous bias.

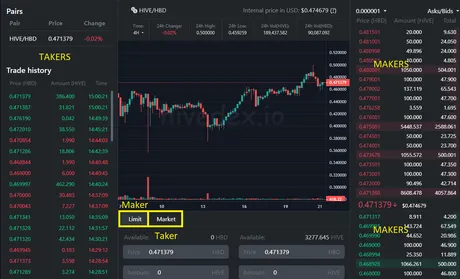

In the context of orderbooks:

Taking the Hive internal market for example, those who place market orders want to make a trade right now this second. These people are the takers. They put in an order and liquidity disappears from the books as the trade is processed instantly. Those who put liquidity on the books with limit orders and wait for those orders to fill are the makers.

It's important to note that every trade needs both a maker and a taker to actually become an exchange of assets. However, Hive is a great example of a network with notoriously low liquidity. Token price can pump x2 out of the blue because people want what they want when they want it. Add to this the idea of curation training an asset (aka manipulation) and we really start to see fireworks.

There's also another argument to be made that Hive lacks liquidity partly due to the temptation and utility of powering up tokens while earning bandwidth, yield, and governance powers over the network. Perhaps through no fault of our own Hive is volatile simply because our market cap is relatively tiny in the grand scale of things. There are many variables to consider

What I have figured out for sure is that Hive needs as much liquidity as it can get and I'm done powering up 100% of everything I have when the network is in such a clear need of liquid tokens. I've added several deep limit orders that should catch any big pumps that come our way. As those orders fill I will then take the HBD and create another stepladder down to offer support during the dumps.

Everyone knows how difficult it is to make a profit as a day trader.

I believe that this difficultly is exponentially exacerbated by our own greed. Our mindset is totally wrong. We aren't thinking about how we can provide value to Hive, but rather how we can extract value from Hive into our own pockets. This is incorrect. We should do what Hive wants us to do. Hive will reward us. This mindset is correctly aligned with the proper incentives of voluntarist networks.

There is no reason to try to outthink the market.

Trading on an orderbook doesn't have to be this zero-sum game that most people frame it as. Within an abundance mindset we sell high, not to take gains off the table for ourselves, but rather to allow for new users to join us without pumping up the value of the token to an even more absurd level. We don't buy low because we want to capitalize on distressed sellers and siphon value from their pockets into our own. We sell low because we want to keep the price from going even lower and the community becoming even more distressed than they already are.

Buy Low; Sell High

The philosophical combination of buying low and selling high has nothing to do with making money within this context. It is to be a responsible adult in an ocean full of low-disciplined degenerates (no offense) wallowing in a scarcity mindset while gambling their life savings away hoping for magic x1000 gains.

If cryptocurrencies were actually stable and profitable all of that stress that average users experience in this ocean of volatility suddenly vanishes. Ironically this entire ideology becomes self-defeating as it becomes more successful.

Self-defeating prophecy

The more stable and profitable a cryptocurrency gets, the more people will want to ape in: creating the very volatility we were trying to avoid in the first place. There are ways to mitigate this volatility, but no one said this was going to be easy. How many DEFI templates have you seen that are a screaming success? I've have seen zero. Still waiting on someone to figure this all out.

User or Builder?

Builders are the makers and users are the takers, so it's better to be a builder, right? Again, just like with orderbooks, both sides need to exist for the ecosystem to actually work and flourish. Perhaps the common theme here is that balance and stability are actually the most important things to be focusing on.

The interesting thing about WEB3 is that we are returning to the preindustrial era where all citizens are producers and they're all consumers. Remember that one time you traded your eggs to the local cobbler to fix your shoes? Yeah, me neither. Those days are long behind us, but history seems to be repeating itself.

Flat WEB3 Architecture

Within this emergent WEB3 economy being built before our very eyes: anyone is allowed to participate in the system and get paid with network incentives. Anyone can build anything. The protocols are neutral and cannot be biased. As long as the fee is paid the operation is valid. Maximalists are losing their mind because of Ordinals over this fact. If something gets built that we don't like: too bad. This is the tradeoff. This is the Wild West 2.0. Get used to it because we are just getting started.

Conclusion

Scaling is the hardest thing in the world. It's the hardest thing in the world for crypto, and it's also the hardest thing in the world for legacy systems (corporations/banks/governments) as well. However, the scaling limitation for decentralized architecture is completely different than the scaling limitations of centralized systems.

Decentralized systems are limited by their inefficiency and their distributions. We've seen this first hand with $200 Ethereum transactions during the bull market. Centralized systems are very efficient and do not suffer from this problem. Distributions are also not a problem, as they are also centralized by design. Rather, the scaling limitation of the legacy economy hinges fully on the absence of trust and the corruption that causes that mistrust to exist.

It's clear to see that crypto is exactly what this economy needs, but the fetid corruption runs so deep that these jackals don't want to let it happen. We have quite the fight on our hands. It literally may be a fight for our lives if the situation escalates badly enough as our centralized infrastructure continues to implode. To reiterate: no one said this would be easy. Replacing the old with the new creates enough friction to start a fire.

Posted Using LeoFinance Beta

Return from Don't be a Taker; Be a Maker to edicted's Web3 Blog