I often talk about the doubling curve.

- It's a simple concept.

- Hardcore Bitcoin support is doubling in value every year.

- I use an anchor of $100 in 2013 to calculate it.

- It's been the most accurate indicator ever ever ever.

Every time we spike above the curve and I tell everyone it will come back down, they ignore me. Every time we crash to the curve or flash-crash under it like COVID March 2020 and I say it is safe to buy, and everyone is suddenly wondering if it will crash 50% more. It doesn't... and if it does the recovery is swift and impeccable without fail.

2022 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $27733 | $29867 | $32,000 | $34133 | $36267 | $38400 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $40533 | $42667 | $44800 | $46933 | $49067 | $51200 |

Time to celebrate?

It looks like we've gotten back to the curve for the first nice since November 2020, doesn't it? We actually haven't because the way I calculate the curve is dumb. You can see that each jump is linear. Rather than figure out how to calculate it correctly I'm just drawing a straight line from one year to the other instead of an actual curve.

To be fair drawing a curve with straight lines isn't the worst way to do it. For the most part it works out just fine, because as soon as we get to a new year we get caught up to the curve and the linear chunks double to the next level. This year each month is moving up about $2000 and come January I would recalculate it and start moving up the number by around $4000 each month in 2023.

How inaccurate is the linear iteration of the curve?

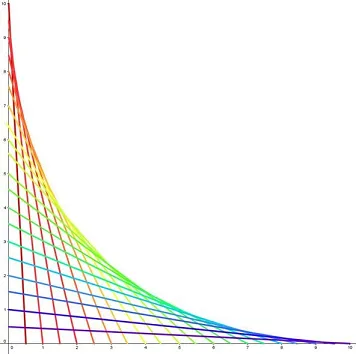

Well we all know what an exponential curve looks like. At first the number will move up slowly and even might be on par with a parabolic curve and even far behind a linear line at the beginning. However, as time passes the curve slopes upward faster than a straight line could ever hope to achieve.

This means when I calculate each month at the same slope with a straight line, the numbers that appear earlier in the year are much higher than they should be. The actual curve will start slow and then ramp up toward the end of the year, with only the final number being correct (in 2022 this number is $51200 by the EOY). How can we fix this?

I realized today that my laziness in calculating the real numbers is not worth it. After thinking about it for a second I realized the equation for the doubling curve:

$y = $100 * 2^x

Where 'x' is how many years past the end of 2013 (beginning of 2014) we are and 'y' is the price of the doubling curve. This is a shockingly simple equation that I should have been using this entire time.

Checking the work.

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| $12.8k | $25.6k | $51.2k | $102.4k | $204.8k | $409.6k | $819.2k |

- 2020 is 7 years after 2013 2^7 x 100 = 12800

- 2026 is 13 years after 2013. 2^13 * 100 = 819,200

So it works...

But more importantly it also works for all the days in between. Meaning we can use this equation to calculate the exact value of the curve for today.

We know that we are 127 days into this year, and when we divide by 365 we get 0.3479452. 2021 is 8 years past 2013, and we are 0.3479452 into this year. Add them together and we get 8.3479452.

2^8.3479452 * 100 = $32,582

So while my napkin-math says the doubling curve is above $34k, the actual curve is actually still at $32,582. We still haven't touched it, but we are getting very very very close.

The most poetic outcome.

The blood-moon eclipse of every year has been a huge turning point for crypto in one direction or the other. In 2020 it appeared on November 30th of a price of $19600, the EXACT level Bitcoin was at the peak of the 2017 mega-bull run. We proceeded to ascend to $40k from there and then onto $60k into the next year. Then the next blood-moon in 2021 signaled the top around $60k. Now we are getting another blood-moon in 7 days time.

The most poetic outcome would be for Bitcoin to hit the doubling curve on the May 15th blood-moon and for us to enter a wholly unexpected bull run even though the entire economy is crumbling around us. With a mercury retrograde in play to sweeten the deal in terms of nonsensical price action, perhaps that's what will actually happen. The pipe dream is real!

In 7 days the curve will move from $32,582 to $33,018.

And thus a crash to $33k in a week would be the perfect way for this to all play out. Definitely something to lookout for.

The price is safe on the curve.

Bitcoin is not oversold right now. This is an AMAZING position to be in. How many times in 2021 and 2020 did I claim that we were going to be totally fucked right now because, not only would we be deflating from a mega-bubble, but also a recession would begin. Now we are in a position where there was no mega-bubble. We are already deflated back to the doubling curve before the recession has happened yet. That's actually amazing positioning for the future.

If the doubling curve can continue to prop up the market even in the middle of a recession, the whole world is going to take note. Imagine if the stock market and/or the housing market crashes 50%, but Bitcoin recovers faster than anything else? That's the kind of event that can finally put the "not a store of value" nonsense to rest and create an entirely new wave of FOMO, even in the middle of a devastating recession.

I find it comical that the IMF is issuing warnings to all the developing nations that are adopting Bitcoin during this time. The IMF has never had anything nice to say about Bitcoin, and the fact that they act as though they are an impartial arbiter of truth when it's obvious there's a conflict of interest here is just silly.

It's also just ridiculous to tell countries that they are going to bankrupt themselves adopting Bitcoin at the doubling curve. They are the early adopters. They are the ones that are going to get filthy rich because they got there first. It's the countries that FOMO in at the top of the next mega-bubble that are going to get wrecked, not the ones that are entering now. It's so obvious yet nobody points out that this is such a high probability. Any big players that enter the market at this point are going to get filthy rich in quite short order.

There are so many institutions and governments that want to get involved right now it's not even funny. On the world scale of finance, Bitcoin is still a micro-cap and it is still very easy to pump once it gets the kind of adoption we are expecting and even starting to see today. Soon, every country, bank, and corporation will be competing for Bitcoin, and it will become wholly unattainable for the average person. Luckily we have all these alts to sweeten the deal for the rest of the population.

And that's fine

It's totally fine if the establishment co-opts Bitcoin and completely buys it out and makes it unusable for the average person. It was always going to go down like this. Disruption doesn't mean destroying every institution in the world. It means forcing them to do business our way instead of the way they've been doing it. Mission accomplished.

Bitcoin adoption means it can't be banned.

People are constantly making the claim that we are about to enter a dystopian nightmare where all crypto is banned and everyone is forced to use a CBDC. Yeah, that's not how the world works. That's not how politics works. That's not how narrative works.

Changing the narrative.

When Bitcoin goes completely mainstream this changes the entire narrative and crypto CANT be banned. It's impossible. Propaganda must be carefully constructed along narratives that are actually to be believed by the population. It's so easy to think that people at the top can do whatever they want because they get away with so much shit, but to just assume they can do whatever they want without having to work for it is a foolish and childish notion.

Politicians are masters of their craft. We look and them and call them incompetent because they don't do what we want them to do, but they are doing their actual job perfectly. Not the job they say they are doing, but the one they were actually hired to do. Anyone who thinks those two things are one and the same is gullible as hell and needs to reevaluate who they trust.

Again, if Bitcoin is mainstream it can't be banned. If CBDCs gain adoption they can't be made legal and all the other cryptocurrencies made illegal. Anyone who thinks this is possible doesn't understand politics on a fundamental level. This is especially true when we take into account that cryptocurrency is global and borderless in nature and it is literally impossible for all countries to get together and agree on how it needs to be regulated.

- No one is going to agree that the way China wants to regulate cryptocurrency is the correct way, because the way China wants the regulate crypto benefits the people that control the Chinese government. The same is true for every country. No one is going to come to consensus, because consensus was the entire problem crypto was meant to solve in the first place. You don't solve the problem with the entities who created the problem in the first place.

Conclusion

Bitcoin is on sale for the first time since 2020, and that's a great thing. Dominance has actually decreased, so alts are still outperforming. This could be signaling that we are still in the middle of an alt-market, just that we are in a bear-trap that are fleecing out the last of the paper hands.

It sounds weird even to me, but I think this Mercury retrograde and blood-moon are actually a big deal. Time will tell. Bitcoin has dangerously close to the doubling curve, and that's a great thing. The market is no longer overbought for the first time in years. Rejoice.

Posted Using LeoFinance Beta

Return from Doubling Curve In Play to edicted's Web3 Blog