A note about liquidity

In my last post I talked about HBD bonds and how they might be leveraged into the Hive ecosystem. Bonds would be NFTs and tradable on a secondary derivative market to create liquidity. However, something I forgot to mention is that this also indirectly increases liquidity for Hive itself. If demand for Hive debt goes up, Hive price also goes up. If Hive price goes up, liquidity goes up; not in terms of Hive but in terms of USD. If Hive magically went x100 suddenly we'd have x100 liquidity on the USD side even with the same amount of tokens being bought and sold as their are today.

Some notes on HF26

Apparently the HF has gone through very smoothly today. It seemed like it hadn't because I was able to claim 5 account tokens with 20% of my RCs... which is the same as it was before. However I'm not fully sure of how the changes work. It might take a few days of claiming for the RC cost to skyrocket x15 as I was told it would.

This makes me feel very good about the 4500 account tokens I have banked. It's possible that in a few years time these account tokens will be quite valuable, as creating an account become harder and harder to do in order to avoid data bloat. will be interesting to see how it all plays out.

One-Block irreversibility

Looking forward to testing this feature. I sent some Hive to Mandala but alas, the wallets are still down. It will be interesting to see if the money gets unlocked faster automatically by the is_irreversable status in the API. I expect this should be the case, so sending Hive to exchanges will suddenly be available instantly. Not that waiting 60 seconds is a problem, but it is a bit of a flex compared to other chains for it to happen near instantly.

Especially true because BTC and ETH can still be technically rolled back after the required number of block confirmations (it just becomes very unlikely). With this new code it basically becomes impossible without a hardfork that forces the issue after the fact (which is even more unlikely).

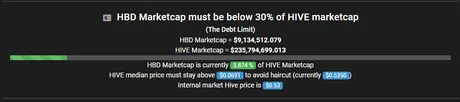

30% haircut

This is the one feature I asked for. In hardfork25, I asked for almost every feature that was implemented. HF25 seemed like it was designed just for me. This time my only ask was that we increase the haircut (I'd also like an internal market AMM but that's a lot to ask and requires inflation to be printed).

Receipts please!

Ah well here you go!

HBD: 10% Debt Haircut is Too Low

Dated January 8, 2021, I've been begging for this upgrade for over a year and a half now. Finally we get the thing. Feels nice. If I'm being honest I shied away from making the argument that this was a good idea after TERRA LUNA crashed to zero. The reason they crashed to zero? No debt-cap limit. OOPS!

That being said I'm glad @blocktrades and the crew didn't reverse course on this one even in the face of UST crashing to zero. It's exciting to be able to triple the debt cap limit like this. This is a huge upgrade for anyone holding HBD, as it ensures that the peg will not be broken unless Hive crashed into the dirt.

https://hive.ausbit.dev/hbd

Kudos to @aubitbank for making sure the HBD tracking site didn't bug out during this haircut limit increase. Looking very good.

HIVE median price must stay above $0.0691 to avoid haircut (currently $0.5350)

Ha!

Hive would have to crash to sub 7 cents before the HBD peg broke to the downside. How crazy is that? This, in combination with the 20% APR on HBD... means that HBD might be the safest place to get yield within the entire cryptosphere. The only way this would not be the case would be if Hive crashed more than 90% further from here... which is obviously incredibly unlikely (10 cent support is uncrackable).

Funny how so few people take this deal. Degens gonna degen. Everyone wants the x10 on Hive rather than making the safe play. I can't blame them as I'm doing the same thing, but maybe after Hive gets back up to those mythical levels I'll need to rebalance my positions.

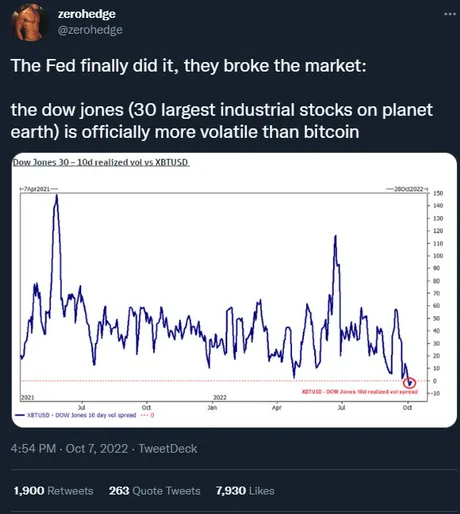

The market appears to be waiting for the CPI report in two days

Seems like a lot of short-term market action hinges on this report and the speculation derived from it. At this point it has become obvious that the report very much might not matter in terms of a rate hike, but people think it does so the market will reflect that. In my opinion, the FED is determined to create one of the worst recessions we have ever seen. Luckily Bitcoin is starting to decouple from the stock market and recent charts have shown that it may be even less volatile than the DOW JONES, which is quite impressive.

link

The support Bitcoin finds itself at today is invisible and likely very strong. There seems to be infinite buying power between the $16k-$19k range. I would be very surprised if it went any lower than $15500. We can be sure that if it drops out of this triangle the bears will be calling for $12k at best, and probably even less than that. Not gonna happen. We are already at rock bottom, and the true value of the network is still spiraling upward exponentially. It's only a matter of time before the macro resistances get busted and we spike up, regardless of what stocks and the rest of the legacy economy are doing.

Unfortunately I'm not so sure about alts... as Bitcoin could start gaining dominance again as the top liquidity provider. Hive is looking pretty solid, but with regulators and a recession hovering around, Bitcoin is definitely the most solid thing to be holding during this time. I definitely don't have enough. Still holding out hope that RUNE will make one last splash and I can exit to the safer asset.

The descending triangle comes to a point and exits the runway in about 9 days time, so we should be breaking out of it within the week. Although if the CPI report is bad there's a stronger chance we grind the $18k level again until the selling pressure is gone. Either way that macro resistance line is declining fast. We are guaranteed to break out of it very soon. Even a crash down to $16k would break it after one month's time, which seems unlikely considering the hidden buy walls and seemingly infinite support at the current level.

On the astrological side of things, we got a full moon on the 9th (Hunter's Moon) and mercury is no longer in retrograde. There are still 5 other planets in retrograde, which is pretty weird. Still, if the CPI report is any good the catalyst to the upside should be pretty intense in combination with macro resistance fading away and everything else. I cautiously await the 13th. Luckily not a Friday.

Conclusion

Hive's hardfork seems to have gone off without much of a hitch. Fingers crossed. Also it appears that this was not a sell the news type moment. Nice to see that no one is trying to pump/dump our incremental upgrades. If only we could say the same for the rest of crypto.

Posted Using LeoFinance Beta

Return from Down to the Wire to edicted's Web3 Blog