I have a confession to make!

The day after the Hardfork (July 1st) when everyone was exploiting the curation bug... yeah, I've been doing it as well. That's no secret. My voting power has been below 10% for four days.

However, the thing I did differently is that I did not focus on posts that were about to payout. I've kept my strategy a secret until now because I didn't want any competition. Now it's too late for anyone to do what I did. Suckers!

Sneaky @edicted!

So while everyone else was focusing on posts 12-24 hours before payout, I was hitting all the tier 2 curation posts:

- Tier 1: 0-24 hours (0% penalty)

- Tier 2: 24-72 hours (50% penalty)

- Tier 3: 72+ hours (87.5% penalty)

So while everyone was scrambling to get those short-term gains, I went ahead and upvoted every post in the 24-72 hour window. If I'm right, the weight of all those upvotes are going to be x4 higher than all the ones who are voting in the third tier. Looking at everyone's blogs and voting patterns, it appears that very few people (if any) focused their upvotes to this second tier while the window was available (which it isn't anymore).

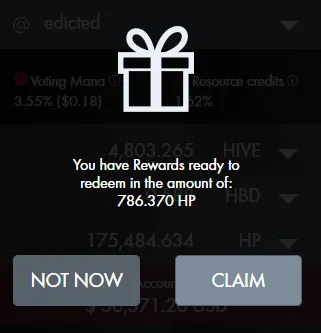

Looks like I have about 500 more HP than I should at the moment, and the real rewards haven't even kicked in yet. I'm very curious to see if this strategy actually worked... as it was a bit of a gambit at the time. I half expected a lot of upvotes from the past 7 days to be canceled/downvoted, but curators have left that money alone as it would be pretty unfair to bloggers to remove them. In fact, the blog posts from the past 7 days are all getting more upvotes as people scramble to leech the curation into their own pockets.

It's a bit of a lame start to such a good hardfork, but thankfully we'll all be able to put this behind us come July 7th when this bug will finally correct itself and we can go back to the new normal.

Incentives

In the short-term, this bug created some pretty bad incentives that we don't have to worry about because it will self correct itself quite soon. However, what about DPOS's long-term incentives? Vitalik has pointed out that DPOS rewards "politicians" (block producers / witnesses) with an extreme incentive to bribe their support-base. This is true, but is it really a problem? Or is that just how politics works?

It's funny because Vitalik acts like Bitcoin or Ethereum have a better system, which they clearly do not. Rather, platforms like Bitcoin and Ethereum opted for zero governance structures, and look what filled that vacuum: totally centralized development and miners who will only vote for things that put more money into their own pockets. It's all going to revolve around the money no matter what. Welcome to capitalism.

DPOS is superior to republic voting.

Many crypto peeps look at DPOS like a complete joke. A system that allows you to vote with your money? Yeah! That's going to end well! Sure, there are problems with this, but everyone ignores all the good things about it and simply bashes it like it's completely worthless, which is silly.

At the end of the day DPOS is the crypto version of a republic. We vote with our money, and that has a lot of power. It gives everyone incentive to stack tokens and gain reputation within the system. How is this different from a normal republic? It's a lot better because "democracy" has already been demonstrably hacked.

When a politician wants your vote in the real world, they have all manner of ways to get it. They pretend to be in line with their constituents when in fact they serve the money that serves them. Mainstream media constantly pumps out messages and propaganda to this effect. Votes are bought and paid for in the legacy economy even worse than they are with DPOS.

In a DPOS system, votes are public. Every vote comes from an account with a certain level of reputation. If you start voting for garbage, people are going to notice, and reputation will be lost. If random accounts start powering huge swaths of stake and start voting unfavorably, this is the beginning of a Sybil attack and actions should be taken against it.

Stake

The magic of DPOS is that you have to risk your own money in order to attack the system. The centralized Steemit Inc ninja mine hit us pretty hard, but we emerged more resilient than ever afterwards. If anyone wants to attack this network they are going to have to spend a lot of money, and the chance that the attack actually turns a profit is very slim.

If you wanted to attack the Bitcoin network, you'd need mining equipment. Once you have that equipment, there is no way for Bitcoin to remove that threat, and the same equipment used to attack Bitcoin could be used to attack any other networks that uses SHA-256 hashing algo.

With DPOS, stake can be neutralized should it be deemed extremely malicious. Many point to the idea that now that Steemit Inc's stake was neutralized no big investors will want to participate because their stake could be "stolen" as well. Looking at how difficult it was to fork Steemit Inc's stake away it's pretty clear that this is ridiculous sentiment not based in reality. Such an action can only be considered when the network is under extreme threat, meaning tens of millions of coins have gone rogue and are actively attacking what we have going here.

At the end of the day no one is actually going to do that. It's an easy come, easy go scenario. Justin Sun acquired those 80 million coins extremely easily, so he wasn't too worried about messing around with them. If someone actually bought that much off the exchanges and x100 the price of Hive, you can be damn sure they aren't going to mess around and attack their own investment. That's how investments work. There is very little incentive to risk so much and then try to strong arm a community to bending the knee. Not gonna happen, and we have the history to prove it. Hive is alive.

Having a soul.

Another thing Vitalik says is that these networks need a "soul". Basically they need diehard community members willing to stick around even when things get really bad. We have that. Hive has a soul. It's not going anywhere. It can't be bought out by a billionaire. It is known.

Incentives are very important. What are we incentivizing users to do here? Many things... and a lot of them are money related. The stakes are high and greed is a constant. The goal is always to incentivize long-term sustainability over short-term sellouts. So far (barring this curation bug) I'd say we are doing a pretty good job.

This is a fluid evolutionary process. These networks are largely reactionary, and we will react to threats and correct them as they appear. When looking at the decentralization of the network (especially token distribution) it's pretty clear, even on an objective mathematical level, that we are on the right track.

All the tokens built on Hive act as experimentation and prototyping for the main chain. Whatever works the best on the tokens can and has already been implemented on the main chain. Curation has been changed to reflect this. The convergent curve has been eliminated. The dev fund still needs a lot of work but most networks don't even have one yet. Hive is way ahead of the game on a dozen different metrics because we've been constantly under attack for years. This community is grizzled and ready to fight every single day.

Conclusion

Yeah, I'm not feeling too great about using all my voting power to exploit a random curation bug, but the network has greatly incentivized me to to just that. I can assure everyone that I'll simply power up whatever HP I get until the end of time and try to build x100 more value than I ever leach for this network. That's always been the goal and it always will be. Synergy trumps competition every time.

Moving forward we have to be forever vigilant about our mechanics and what we are incentivizing users to do. Tokens built on Hive provide a fabulous buffer and testnet to allow every possible road to be explored and potentially utilized on the main chain. Development continues at a phenomenal pace across the entire cryptosphere. Don't blink or you might miss it.

Posted Using LeoFinance Beta

Return from DPOS Incentives: Curation Bug Escapades to edicted's Web3 Blog