Nouriel Roubini's boundless hypocrisy.

It's come to light that Dr. Doom himself, the black-pilled anti-crypto warlord, is heavily involved in the process of creating a digital token called ATLAS.

A Resilient Investment Strategy enabled by AI, ML, Climate Technology and Blockchain

Enabled by buzzword, buzzword, buzzword, and buzzword.

Looks like I'm not the only one who caught this.

The strategy that Atlas suggests it’s using seems to include all the buzzwords to woo venture capitalists and angel investors. Specifically, it says its product is “enabled by AI, ML, climate technology, and blockchain.”

These aren't particularly even current events, as some of these articles about Atlas are over a year old. But still it's the first I'm hearing of such things, and it's kind of hilarious. Roubini attaching his brand to something like this is just the worst kind of red flag imaginable. It's shocking he could even stoop so low after everything he's said about digital currency, but I suppose we can't be surprised.

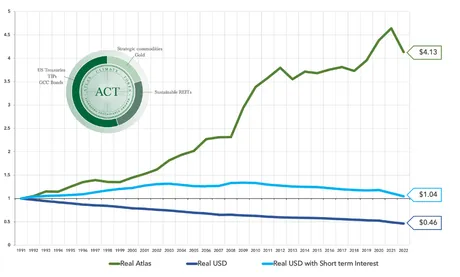

What is surprising is this chart showing that the Atlas Climate Token (ACT) has actually been around for over 30 years and is supposedly performing somewhat decently over that time. I'm hesitant to waste my time looking into this more but I guess I'll give it a whirl.

Protos Link

Atlas calls its products “digital currency for resiliency.” While none of what it’s offering has been tested in the real world, it has apparently

backtested dataand feels that it’s developed a solution to the pain of holding cash.

Uh huh...

If only I could backtest my crypto trading and be a billionaire right now.

The website itself explaining what it is: looks like any other typical shitcoin marketing ploy for an asset that doesn't exist yet. How does this product actually work? Well we certainly won't find out from this website will we? No, rather blanket statements like,

Atlas has developed an Index (the Atlas Roubini Macro Navigator Index) and is in discussions with leading ETF issuers and distributors planning to launch an ETF during Q1 2024. Atlas invests by allocating reserve assets across carefully selected asset classes to preserve wealth and help finance climate adaptation and sustainability.

We just peg it to things that have value, bruv!

Cool story bro, but how? Nah don't worry about it!

The portfolio consists of three types of assets:

- Climate-resilient real estate and infrastructure

- Green commodities

- Short-term and inflation-indexed sovereign bonds and gold

Uh okay?

If there's one that I know about all of these assets it's that they aren't very profitable. I mean how else would we have gotten into this mess in the first place? If sustainable infrastructure and ESG protocol was actually scalable and profitable then we wouldn't have to be constantly subsidizing it and forcing people into it; it would just happen organically.

Bloomberg Link

Atlas says it’s working with Fireblocks Inc., the crypto startup backed by one of Alphabet Inc.’s funds, for the tokenized version, in addition to Mysten Labs, the web3 developer founded by former Meta Platforms Inc. engineers and backed by Andreessen Horowitz. The product is dubbed the “United Sovereign Governance Gold Optimized Dollar.” A spokeswoman for Fireblocks confirmed the collaboration.

So...

It is admittedly a venture capital enterprise blockchain project funded by Google, Facebook, and A16Z. What a combination! No wonder why it has a price that essentially only goes up! Not very hard to make a market with razor thin liquidity and access to VC money. Of course I can't even find a market cap for this asset that's apparently been around for 33 years so who knows what's up with that. Oh wait just kidding that was all fake nonsense data. Reminds me of the OneCoin documentary I just watched yesterday.

Analysis

Would I like some magical asset to come along that somehow gives people access to a stable currency that basically only goes up slowly over time? Yes of course I would, I literally talk about the need for such an asset all the time. Do I think that Dr. Doom will be the one to wave his magic wand and make it appear? Not really but I won't reject this project completely just because I think he's a joke.

That being said there's no evidence to suggest that enterprise blockchain will ever be able to work or sustain itself. There's only a handful of VC chains (non-enterprise) that even have any value anymore (like Maker and Solana). Most everything else got flushed during a bear cycle. I guess I'm curious to see how this turns out and I'll keep tabs on it, but I won't be holding my breath.

How are the actual decentralized networks doing?

Ah well Bigcorn has lost a little dominance as it trades sideways and various alts pick up some momentum. Typical altmarket stuff. Hell, even Hive is going up! I'll take it! This is pretty much what happens every time Bitcoin flags up and then crabwalks for a while. Traders get bored and use their BTC bags to pump the rest of the market.

Bitcoin itself still has horrendously low volume, which again is usually a bad sign and followed by a dump, but at the same time BTC on exchanges continues to dwindle and many signals point to the idea that we are simply in an awkward supply shock transition where not a lot of people want to buy or sell at this juncture. It's all a bit up in the air at the moment.

Thus far it's been a very boring November for BTC with a total volatility ranging over 3.5% the last week. It doesn't get much lower than that, as we all know that 5%+ volatility per day is the standard within both bear and bull markets. Rather we find ourselves in that awkward middle ground as we close out the year of the maximalist within the 4-year cycle and head into the year of new narratives and fresh blood into the ecosystem.

Of course November is far from over and I'm very much expecting to see some fireworks that put "Uptober" to shame, as is often the case. At this point even a crash to $31k is still a bullish scenario as long as such a dip results in the exponentially increased volume we are looking for followed by a V-shaped recovery.

We can see that the bullish flag we got in October has broken out into a slightly less bullish ascending wedge that seems to constantly head-fake the market and pretend to breakout without actually doing so. The final golden cross between the 100-day moving average and the 200-day also just happened recently, albeit at an extremely slow parallel grind. Looks like we'll only be trapped within this ascending wedge for another week at the maximum. In fact my 40th birthday on November 14th, a day in which the market always seems to do something crazy (up and down), seems to be in exact alignment with this analysis. I guess we'll see what happens.

It's also nice to see the 25-day moving average climbing the chart quickly at almost a 45-degree angle. This is a line that will almost certainly act as at least temporary support should we breakdown out of this pattern and start dipping.

There are support lines everywhere.

- $34k (very light support)

- $33k (currently reinforced by the MA(25))

- $31k (Heavy support that would provide confirmation of previous resistance line)

- $28k (Massive support where all moving averages converged)

- $25k (Uncrackable support that won't fail unless something terrible happens).

Point being is that there is still very little downside in the market (-30%) with potentially 'infinite' upside over the next 2 years. The long position that I opened at $27k is still going strong and ridiculously in the green. I'd very much like to unwind that position but I'm still holding out hope that the other shoe will drop and I'll get the opportunity to deleverage given another 20% god-candle on the daily.

Conclusion

I guess it's all just a sign of the times. The biggest black-pillers and naysayers will step out of the woodwork to create their own shitcoin it seems. Good story bruv, please tell it walking. Even if their projections are 100% accurate (which they obviously are not) do we really want to x4 our money over the next 30 years? Funny story: on their own website they claim that USD inflation could increase to 5% a year. Wanna guess how much devaluation that is over a 30 year timespan? x4.3... so even their best guess is a net wash over a 30 year time period (maybe x2 if we look at the actual chart of backlogged data). I'm not impressed, and the fact that they are relying on treasury yield is a huge red flag in my opinion.

What I am impressed with is crypto, even in all its volatile glory. I have every reason to believe that one day crypto will figure out how to create stability without piggybacking off of fiat architecture. Again: this is all just an awkward transition phase. A 30-year timeline is completely untenable in an environment of actual artificial intelligence, machine learning, and otherwise exponentially flowing technologies.

Even Hive is looking pretty great from this position. Don't forget that last cycle we had to contend with the hostile takeover and a massive exodus of capital during the Q4 2020 spike. By all accounts something like that can't happen again simply because we are in a completely different environment this time around the block. Things are looking pretty up, just don't get sucked into the shiny new novelty toys that pop up next year and call it good. WAGMI

Return from Dr. Doom Coin to edicted's Web3 Blog