As far as Bitcoin is concerned, I believe we are currently consolidating in the area we are guaranteed to return to once this mega-bull has finally run its course.

| 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| $12.8k | $25.6k | $51.2k | $102.4k | $204.8k |

BTC is only worth $15k at baseline support, but the mega-bubble doesn't care. Corporations and institutions don't care. Big Tech doesn't care. Even Banks and governments are talking about jumping on board. This was always in the cards.

That being said, when this is all over and the impending doom of a year-long bear market hits, where does that leave us? Well, my prediction has always been $250k Q4 2021 down to near $50k Q1 2023. Another brutal 80% loss... too bad so sad. Bitcoin has died once again.

The market seems to be putting quite a lot of weight on this $50k unit-bias level, and even I think it is pretty significant for this reason: this is exactly where we'll be 2 years down the road as the fundamentals of Bitcoin race to catch up to the speculators.

Again, it is ridiculous to think that somehow within the last few months Bitcoin is somehow more than doubling in value every year even though this has been the trend for almost a decade now. That is just greedy impatient thinking.

My strategy at this point is to simply hold till the end of the year and refactor my position after all the information I've been predicting over the last three years finally gets set in stone and I see how close I got.

Again, we need to remember that Bitcoin is only getting easier to short as time goes on and the network expands into the legacy economy. When someone shorts an asset, they borrow it with the intention of paying it back later with interest. This essentially allows Bitcoin to be dumped onto the market that doesn't even exist, and is how precious metals have been suppressed over the last however many decades.

How does the Bitcoin not exist?

Well, two parties are taking a risk. Someone is lending real Bitcoin (in theory not a naked short) to someone else to dump onto the market. However, there's always the chance that the market spikes up after it gets shorted: the dreaded "short squeeze".

So what happens in the case of a short squeeze? Well, the person who loaned out the Bitcoin isn't interested in doing so on usurious debt. It will take more than reputation to get one of these loans: collateral must be provided. This is called securitized debt. The collateral secures the debt incurred.

Therefore, when Bitcoin spikes the collateral that was provided to take out the loan starts getting liquidated. So we can see how Bitcoin was dumped on the market that didn't exist: The value was transferred to the collateral. It was really the collateral itself that was used to dump "fake Bitcoin" onto the market with the intent of turning a profit.

It's easy to see how this could backfire. For example: if a lot of people were shorting BTC all at the same time and the price spiked up massively and with little liquidity: what would happen? All of the collateral would get liquidated but it still wouldn't be enough to pay back the loan.

There is a chance, however small, that instead of paying back the loan in full the entities that shorted the market would simply refuse to do so by declaring bankruptcy or whatever else. So we see that not only is the short-seller taking a big risk, but also the entity that loaned the Bitcoin is taking a small risk that could fail spectacularly.

This is especially true on non-kyc exchanges. If these exchanges provide shorting services to too many users and it blows up in their faces, they have zero recourse but to eat the loss and lose all the Bitcoin they loaned out that wasn't paid back. What are they going to do? Ask a random email address for the money back? Please.

This "Coding Jesus" guy makes some good points. One of my friends asked me to parse this video. This is basically a lot of reasons why Bitcoin has fallen to the wayside and no longer serves the ideals that it used to.

The problem with these ideals is just that: they are too idealist. This is the real world, and you can't get mad when Wall Street jumps in on the fun or when Bitcoin users cheer when they get regulatory clarity. These are permissionless systems. Concessions were always going to be made when Bitcoin entered the legacy economy.

How high can we fly, Icarus?

Even though I believe we've reached the point of guaranteed return, I still have no idea how high this market can really go. By all accounts, this bull run seems like the strongest one we've ever had, and it is just getting started. If we maintain this pace we could far exceed the $250k BTC expectation, and could go as high as $400k. Even something like $1M is not out of the question. Still, volatility breeds volatility, and I think no matter how high we go we are still doomed to return to this $50k level eventually depending on the timelines ($100k if the bear market pushes back 1 year longer than expected).

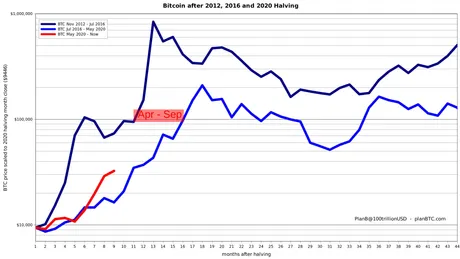

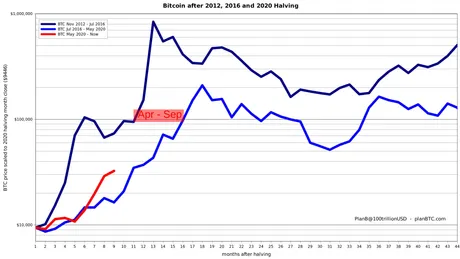

This is a halving chart that many analysts use to predict the long-term market cycles (4 year blocks). Each line starts at the halving event and is charted on a logarithmic scale. Personally I believe this is very flawed analysis.

The reason it's flawed is because this logic assumes that the date of the halving is an anchor point: it isn't. For me, the real anchor point is the doubling curve.

Essentially the first line drawn is grossly incorrect. The 2012-2013 bull run had two spikes: a double-bubble if you will. However, it was that first spike that brought us to the doubling curve baseline to begin with: BTC worth $100 in 2013 baseline. Since that moment, Bitcoin has been doubling in value every year extremely consistently. Like, scary consistent. Unreal consistent. The doubling curve has been in play for almost a decade now and hasn't failed to disappoint.

So because of all this the above flawed chart shows the 2013 bull run as much stronger than than 2017 bull run. Remember this is a logarithmic chart and one line being twice as high as another implies a 10x difference.

However, because the first half of the 2013 was simply price discovery it doesn't count as part of the bubble. Bitcoin was simply massively undervalued for the first 4 years of its existence because no one realized what a goldmine it was.

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|

| $3.13 | $6.25 | $12.5 | $25 | $50 | $100 |

Working backwards, we actually see that if the doubling curve is to be believed, Bitcoin was actually worth over $3 when it launched, and doubled in value every year thereafter. The speculation did not catch up to these fundamentals until Bitcoin hit $100 in 2013.

With this in mind, that first dark-blue line shouldn't be charted the way it is. The foundational support of the 2013 bull run was $100, and it bubbled all the way up to around $1100, so it was x11 higher than the curve. The foundational support of the 2017 bull run was $1600, and it spiked all the way up to $19,500. This was x12 higher than the curve.

So what I'm getting at here is that I believe that the 2017 bull run was actually even more bubbled than the 2013 bull run even though it doesn't look that way because of these flawed halving analysis graphs.

By all accounts, it looks like the 2021 bull run is going to be stronger than 2017. This could push us as high as x15 the doubling curve. At the end of the year the curve will be $25,600 so x15 that is $384,000. That's a realistic target for Q4 should Q4 be the peak of this run.

Let's not forget how this goes down: during a mega bull run most of Bitcoin's gains happen within a very short period of extreme FOMO and overleveraged speculation. We are already at $50k and the big spike isn't even close to hitting yet. We still have to see what happens during the summer (usually June), as we could easily get to $100k+ at that time.

A standard 85% loss from $384,000 takes us back down to $57.6k, which is pretty much exactly Bitcoin's current all time high that we hit a week ago. Don't be surprised if it happens, as the mega-bubbles have a way of deflating spectacularly over the course of a year. Hopefully we can make some money on the dead-cat bounces during that time.

Conclusion

Volatility is in the cards. It's easier to make plans than to carry them out. At the peak of the next mega-bubble many will be in such a euphoric daze that everyone will just assume Bitcoin is going to take over and can only continue upward; just like always. The winner's-tilt is real.

However, it's almost guaranteed that regulations and short speculation will bring it crashing back to reality. These boom and bust cycles will continue, and only the strongest of diamond hands will be able to handle the emotional stress of such massive movements in either direction.

This has always and will always be a scaling issue. Even with the fundamental value of Bitcoin doubling every year, the network is not able to expand quickly enough to accommodate the new inflow of users. Speculators will push the price up too fast and new users will buy the peak and get wrecked: as is often the case. All we can do is try to mitigate those damages when the time comes.

Posted Using LeoFinance Beta

Return from Eat my shorts: Point of Guaranteed Return to edicted's Web3 Blog