Nobody knows how the economy works.

Not even professional economists.

Just like ten doctors can diagnose ten different illnesses from the same set of symptoms, so can ten economists argue about which variables are causing problems in the economy. The economy is a living entity, an emergent macro entity that is just as complex as the human body itself.

Do you go on WebMD and try and diagnose an illness better than a doctor would? Many try, and many fail. Of course some people will succeed due to the fact that they put a lot more effort into the research and the problem they are diagnosing is a chronic issue. Still, if someone tells you they got a self-diagnoses from WebMD, everyone takes that with a grain of salt. The same should also be true about economic ailments. We would not normally trust what Average Joe has to say about "printer go brrrr".

And yet that is what all these Bitcoin maximalists are doing.

- 21M supply

- 21M supply

- 21M supply

- Few.

- Have you heard that Bitcoin only has 21M supply?

BTC is not a store of value.

Or rather you can't say that BTC being a store of value is the defining characteristic of the granddaddy cryptocurrency. Hive is also a store of value. In fact, if you believe that the way Hive allocates its inflation is better than Bitcoin (I do) then Hive is an even better store of value than Bitcoin, by definition.

Worrying about USD going into hyperinflation is kind of like worrying about your best friend dying from a bacterial infection. Before antibiotics existed, dying of a bacterial infection was not only brutal but commonplace. Now we live in a different world.

Just like someone in America probably isn't going to die of a bacterial infection, America isn't going to die from hyperinflation. Could someone from the Congo die of a bacterial infection? I'd venture a guess to say that yes, the chance of that happening is much higher than in the states, just like the chance of their currency hyperinflating is also much higher. These are things people need to understand before they just decide they know what they are talking about. The environment and economy has changed a lot in the last hundred years.

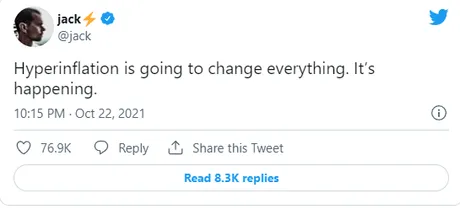

Really, is it now, Jack?

Do you trust JACK with your economic advice? Seems silly. This is the guy who keeps harping on the need for a decentralized social media while simultaneously blacklisting Hive from CryptoTwitter. Don't get me wrong, as far as rich people go I find the guy quite interesting, but his personal experience and outlook on the world as a top 0.0001% percenter is not really useful in these contexts. STFU and go all in on Bitcoin, Jack. Then I'll at least take you as seriously as Michael Saylor.

https://bitcoinmagazine.com/markets/bitcoin-is-safe-from-growing-hyperinflation

So what really prompted this post is the above link to a random article on my crypto news feed. Clearly, I have been triggered. Of course first, we must look at the source: Bitcoin Magazine. So obviously right off the bat we already know their transparent agenda: buy more Bitcoin. I tend to agree, but the way they get there in this particular article is highly problematic.

Now, more than ever, is a good time to clarify what inflation is, why it is never a good thing and what you can do to protect yourself.

- Inflation is never a good thing.

Well, I mean that's obviously wrong right out of the gate... What else ya got?

History Lesson: History doesn’t repeat itself, but it does rhyme. Just over 100 years ago, in 1913, Germany’s economy was thriving. With a booming export business, Germany was one of the world’s wealthiest nations. Ten years later, in an attempt to pay back enormous wartime debts, the government began to print German marks. Hyperinflation soon followed and prices ran out of control. By November of 1923, the price of a loaf of bread was 200 billion marks. Paper bills became so useless that they were burned as a cheaper alternative to firewood. With hyperinflation ravaging the economy, crime exploded, poverty became the norm and rebellion began.

- What happened to Germany after WW1 could happen to USA.

Um, how? Are we going to lose a world war and then get forced to pay the debt of that war? Like, where is the logic here? Also, it's important to note that the economic devastation caused in the wake of WW1 obviously set the stage for WW2 and gave Hitler a platform to blame it all on "The Jews". We literally created the environment necessary for an authoritarian like Hitler to thrive. How's that for a mindfuck? Nothing happens in a vacuum.

What Inflation Is: Economists will tell you that inflation is a sustained rise in prices. However, this definition hides a much more sinister truth. By lowering the purchasing power of your hard-earned dollars, inflation means that you must continuously spend more time working to purchase the same amount of goods. Since money is the way that we value human time, inflation of the money supply is government-sponsored theft. It is the theft of your most precious asset… time.

- Any economist will tell you...

That inflation is a HEALTHY increase in the money supply. How does this increase in the money supply come about? Because the collateral that the money is based on goes UP in value. Collateral going up in value sounds like a good thing, does it not? Well, I mean... not if you were the sucker holding the dollars, but whatever. Again this article misrepresents the facts. However, I obviously do agree with the concept of time vampirism.

Over the last two years, the number of circulating dollars has increased by 40%.

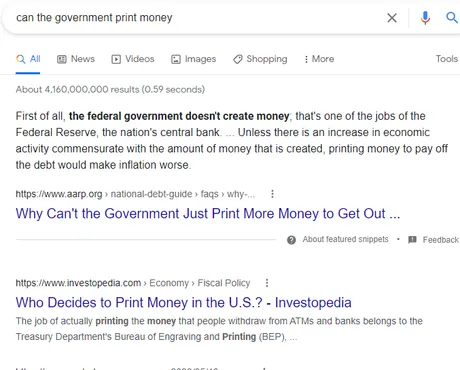

- No, it hasn't.

Big difference between dollars circulating in the economy and the FED buying liabilities and turning them into assets via QE within the banking sector only. Do I know how this works? Not really, but @taskmaster4450 seems to.

The Cause Of Inflation: Although the Federal Reserve will often use words like “transitory” or “quantitative easing” to confuse the public, the record high inflation rates are a direct result of the expansion of the money supply. To put it simply… the more the money printer goes brrr, the higher the inflation.

- Ah, shit! He said it!

Money go brrr!

Can you imagine the logic of this statement? Look at the FED go! Using silly words like transitory and QE. But I know better. Economy can best be explained by money go brrr! Just like the human body can best be explained by "heart pump blood". Wow, they should give me my doctorate now! Again, we see the gross oversimplification of this issue (and even the glorification of ignorance) is a huge problem.

Why The Government Won’t Stop Printing: By having the sole right to print money, the government is able to create something out of nothing and play god in the economy. With these newly-created dollars, the government is able to prop up politically-favored sectors and make fiscally-irresponsible promises to win votes. We have become so indebted and addicted to these government handouts that any slowdown of the infamous printer could lead to a collapse of the entire economy. The government won’t stop printing because it can’t.

- The government is printing money out of thin air and giving it to politicians.

- The government owns and controls the FED.

- If we stop being corrupt then the entire system collapses.

Yeah, I mean again, obviously none of that is true. Money only enters the economy via loans. Those loans aren't "printed out of thin air". They are based on collateral. Whether that collateral be a business loan, a house loan, a car loan, or a credit card, underlying collateral for loans exists in every situation (even if that collateral is usury, aka credit score).

Further, the implication that we simply print money out of thin air and just allocate it to corrupt practices, while simultaneously claiming that cutting out that corruption will kill the entire economy... is obviously ridiculous. This is like a child opening up a lemonade stand and then telling people they're the CEO of their own company. Like, okay kid, whatever you say.

Why Inflation Is Bad For The Economy: Inflating the money supply allows the government to spend money that it has not earned and exert an ever-growing influence on the public markets.

Again, the FED is a private institution so... try again?

Why Inflation Increases Inequality: Although the government often promises to distribute printed money to the poor, inflation is extremely regressive. By causing dramatic rises in the prices of assets such as stocks and real estate, inflation actually benefits the rich. Meanwhile, the rise in the price of staples such as food and gas disproportionately affect the poor, as spending on these goods constitute a much larger percentage of their income.

- Bitcoin fixes this because poor people can afford Bitcoin!

- Also, this heavily implies that wages are not increasing, ever.

Again, the article writes completely contradictory narratives. On the one hand, the price of everything is going up and poor people are screwed, but on the other hand Bitcoin fixes this via delusion. Again, it's not a problem if prices go up if people are getting paid more. Unfortunately, again, the economy is complicated and you could write and entire book just on the topic about why people aren't getting paid more.

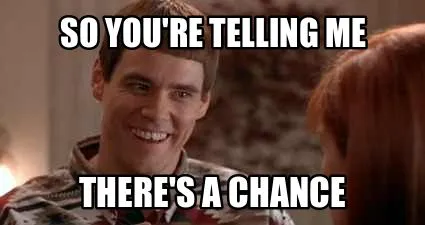

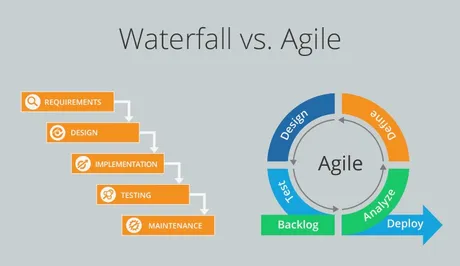

I believe people aren't getting paid more because wages increasing is at the bottom of the stack on the waterfall of inflation. Also technology is creating deflation and that deflation hits wages the hardest as the most expensive parts of society get automated for a cheaper price.

Why Inflation Is Bad For The Future: Inflation leads to higher time preference. Since dollars are going to be worth less in the future, we are incentivized to quickly spend them before they lose any further value. This has disastrous consequences as inflation discourages long-term investment and encourages us to sacrifice the future to benefit the present.

- Inflation causes us to spend our money faster (velocity).

- Inflation discourages long-term investment.

WHAT?!@

Again he contradicts himself within the same breath. If I need to get rid of my USD to avoid inflation that means I'm putting more value into investments (aka storing the value). I think it was this paragraph that triggered me last night and caused me to get up out of bed and jot a note down that Hive needed to hear about this nonsense. In fact, I'm sure of it.

Can we see how bad this is? Look at the confidence level of this guy. He says these obviously contradictory statements like they are 100% facts, and people read it thinking they better understand the economy and the gravity of the situation. This is gross misinformation, and people are going to suffer for it.

What Can You Do About It: The answer is simple, you must buy hard assets that are resistant to and even benefit from the money printer.

Really?

The poor people can just buy Bitcoin?

That's the solution?

Dumbass.

Okay then, what assets benefit from inflation?

For decades, the mega-rich have been doing this by buying hundreds-of-millions-of-dollars-worth of paintings, beach front properties, gold and equities. Although this strategy has been successful, each of these asset classes suffers from one or many of the following problems: illiquidity, high barriers to entry or dilution risk.

Hey hey hey! Now we are talking.

Bitcoin is better than all these assets.

24/7 markets and near infinite liquidity.

We finally agree on something!

But then the article trails off and ends... so...

Oh shit are you saying the stop being poor shirt was photoshopped that entire time? Don't believe everything you see with your own eyes, I guess.

So after reading this travesty.

I thought it would be best to at least learn a little bit more about hyperinflation. Might as well since everyone and their mothers seem to be sounding the alarm lately.

https://www.thebalance.com/what-is-hyperinflation-definition-causes-and-examples-3306097

So let's click that very first link about hyperinflation and see what Google has to say about it.

Google does know everything, after all.

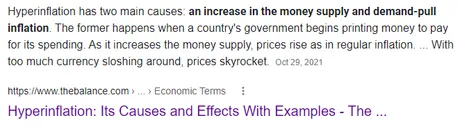

Everyone understands that if the money supply goes up, inflation can happen. That's just basic supply and demand. What I don't remember is what "demand-pull inflation" is. Let's find out.

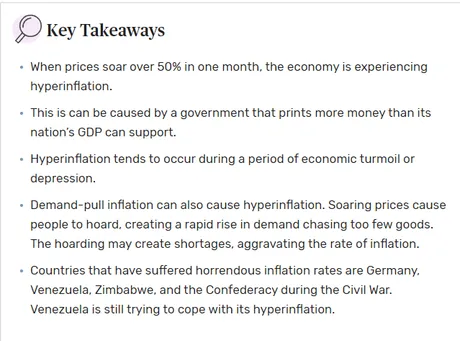

Hyperinflation is when the prices of goods and services rise more than 50% per month. At that rate, a loaf of bread could cost one amount in the morning and a higher one in the afternoon. The severity of cost increases distinguishes it from the other types of inflation. The next worst, galloping inflation, sends prices up 10% or more a year.

WOW!

So first of all, the thing that everyone is calling hyperinflation is very clearly galloping inflation. Doesn't have the same ring to it, does it? Printer go brrr, amirite? Obviously no one is worried about USD losing 50% of its value in a month. Let's be honest, crypto would probably takeover instantly if that happened. I know I wouldn't be selling any crypto into a hyperinflating asset unless I planned on spending that asset immediately. That's the nature of hyperinflation.

Hyperinflation has two main causes: an increase in the money supply and demand-pull inflation. The former happens when a country's government begins printing money to pay for its spending.

AKA: hyperinflation can't happen in the USA.

Why?

Because USA can't print money to pay off its debt.

Okay, but what is demand-pull inflation?

The other cause, demand-pull inflation, occurs when a surge in demand outstrips supply, sending prices higher. This can happen due to increased consumer spending due to a growing economy, a sudden rise in exports, or more government spending.

So you might be asking...

If hyperinflation can't happen in the USA, then why can it happen in other countries? First, it sounds like other countries might actually print money out of thin air just like the FED is constantly accused of doing (but isn't). Second, read that line more closely: a sudden rise in exports.

Interesting.

So if something my country produces something that is now worth a lot more in another country, that same product becomes more expensive in my own country. This is because capitalism pulls the demand and supply from one country to another. If I'm being honest, this sounds a lot like arbitrage, a concept I'm already intimately familiar with.

Another thing we must take into consideration is imperialism and political embargos. The United States empire attacks many countries economically in this way, and will choke key resources to force other economies to do what we want them to do (usually sell us cheap oil using the Petrodollar).

The Petrodollar

This is another huge variable to consider. All countries are forced to buy/sell Oil with USD. This means every country is forced by the military industrial complex itself to have USD on the balance sheet so it can buy this critical resource. USD is the world-reserve currency for this reason. Again, it would be foolish considering the liquidity pools and economic policy to assume that USD could possibly hyperinflate. Not gonna happen.

Moving on.

The two often go hand-in-hand. Instead of tightening the money supply to stop inflation, the government or central bank might continue to print more money. With too much currency sloshing around, prices skyrocket. Once consumers realize what is happening, they expect continued inflation. They buy more now to avoid paying a higher price later. That excessive demand aggravates inflation. It's even worse if consumers stockpile goods and create shortages.

Hyperinflation begets hyperinflation.

Look at the countries that have experienced hyperinflation. One of them lost a world war, and in turn, control of their own bank. One of them has oil that the United States lays claim to and we constantly impose sanctions (actually this has happened way more than once). There's a story behind all these tales of hyperinflation, and USD does not fit any of those narratives. Again: Not gonna happen.

When hyperinflation is in effect, consumer behavior adjusts. To keep from paying more for goods tomorrow, people begin hoarding today. That stockpiling creates shortages. Hoarding can start with durable goods, such as automobiles and washing machines. If hyperinflation continues, people hoard perishable goods, like bread and milk. These daily supplies become scarce, and more expensive, and the economy falls apart.

Interesting... what happens when you have Bitcoin and other crypto's to stockpile and the physical goods remain cheap? I'll tell you what happens: we have no idea what happens, because that's never happened before. Again, it looks like Bitcoin fixes this.

People lose their savings as cash loses its value. For that reason, the elderly are often the most vulnerable to hyperinflation. Soon, banks and lenders go bankrupt because their loans lose value. They run out of cash as people stop making deposits.

Kinda sounds like Bitcoin fixes this.

There are two winners in hyperinflation.

UUUUhhhhhh, say what now?

There's a silver lining to all this?!?

The first beneficiaries are those who took out loans and find that the collapsing value of the currency makes their debt worthless by comparison until it is virtually wiped out. Exporters are also winners because the falling value of the local currency makes exports cheaper compared to foreign competitors. Additionally, exporters receive hard foreign currency, which increases in value as the local currency falls.

WOW!

So taking out a loan is like shorting the currency itself! We take out a loan, buy collateral with it (car/house/business/crypto) and then when the currency collapses we owe back practically nothing but we get to keep the collateral (NFT). Good deal. No wonder why Michael Saylor has borrowed BILLIONS to buy BTC. Smart dude.

And then the article goes onto explain the stories of specific countries and their tale of hyperinflation. And wouldn't you know it, Germany after WW1 is the first example! What luck! So how does this article differ from the previous one that I debunked?

From the outbreak of the war until November 1923, the German Reichsbank issued 92.8 quintillion paper marks. In that period, the value of the mark fell from about four to the dollar to one trillion to the dollar.

At first, this fiscal stimulus lowered the cost of exports and increased economic growth.

When the war ended,

the Allies saddled Germany with another 132 billion marks in war reparations.Production collapsed, leading to a shortage of goods, especially food. Because there was excess cash in circulation, and few goods, the price of everyday items doubled every 3.7 days. The inflation rate was 20.9% per day.5 Farmers and others who produced goods did well, but most people either lived in poverty or left the country.

Just like I remembered from high school history class, Germany went into hyperinflation because???? You guessed it! American imperialism. This seems to be a theme. America cripples the economy of another nation with their economic policy. Gee, do you think America is going to cripple its own economy with foreign policy? I guess then it wouldn't even be called foreign policy at all by then, eh? Spoiler alert: we aren't going to make laws that cripple our own economy to cause hyperinflation. USD is still the world reserve currency.

Hyperinflation in Zimbabwe

Zimbabwe experienced hyperinflation between 2004 and 2009. The government printed money to pay for the war in the Congo. Also, droughts and farm confiscation restricted the supply of food and other locally produced goods. As a result, hyperinflation was worse than in Germany. The inflation rate was 98% a day, and prices doubled every 24 hours.13 It finally ended when the country retired its currency and replaced it with a system that used multiple foreign currencies, predominantly the U.S. dollar.

Zimbabwe and El Salvador scrapped their own garbage currency in exchange for USD, but sure, keep believing that USD can hyperinflate.

Hyperinflation in the United States

What?! Say it aint so!

The only time the U.S. suffered hyperinflation was during the Civil War when the Confederate government printed money to pay for the war.

Oh... lol... it was confederate currency. lawls. Get out!

If hyperinflation were to reoccur in the U.S., the Consumer Price Index would measure it. The current inflation rate shows that the U.S. is nowhere near hyperinflation (it isn't even in the double digits). In fact, inflation may be too low, as mild inflation can be good for economic growth.

Facts.

The Federal Reserve prevents hyperinflation in America with monetary policy. The Fed's primary job is to control inflation while avoiding recession. It does this by tightening or relaxing the money supply, which is the amount of money allowed into the market.

Tightening the money supply reduces the risk of inflation while loosening it increases the risk of inflation.

More facts

Most of the funds the Federal Reserve has injected into the banking system in the years since the Great Recession sits in bank reserves. It has not gone into circulation. If the banks start to lend too much, the Fed can quickly raise its reserve requirement and lower the money supply.

Too many facts!

Despite the rarity of hyperinflation, many people are still worried about it. So, if it were to happen, what should you do? There are a couple of ways you can protect yourself from any kind of inflation. Sound financial habits would help you get through a period of hyperinflation, too.

First, be prepared by having your assets well-diversified. You should balance your assets among U.S. stock and bonds, international stocks and bonds, gold and other hard assets, and real estate.

So you're saying there's a chance!

Someone like me is already 100% guarded against the threat of hyperinflation. As someone who is currently sitting on over a quarter million dollars worth of Hive alone, I value this asset x10 higher than any stock, bond, or hard asset like gold and real estate. Why? Because crypto is money. Crypto is an economy.

The only way people can get truly screwed over from hyperinflation is if their wages don't go up as fast as products and services. Yeah, that does happen, but again, as someone who doesn't even get paid in USD (Hive blogger/curator) again this is something that I don't even have to worry about. In fact I may be able to not only save myself during a situation like that but also several others as well. That's the magic of crypto for ya.

The real point to be made here is that the threat of hyperinflation is constantly being grossly overexaggerated by people who have done ZERO research on the topic. Look at how much information I found on the most CURSORY GLANCE of trying to verify the given alarmism. It's mindblowing how few people are willing to do the work and how even more are just willing to straight up make shit up and peddle it as undisputable fact.

Printer go brrr.

The truly interesting thing here is that these people who are concerned about hyperinflation are conspiracy theorists and don't even realize it. They don't understand how the economy works. They think that the FED prints money and that money appears in the economy. They think the politicians can print money and siphon that money into their own pockets. That's not how it works. If you think that's how it works you're are a conspiracy theorist!

And there's nothing wrong with that.

But one must at least admit that's what they are doing. You at least have to know how the system is supposed to work to then make the claim that it's working in a different way. All these unknowing conspiracy theorists are embarrassing themselves and they don't even realize it.

I'm all for a good conspiracy theory. Could the FED be printing money and laundering it through the 1970's SWIFT system and nobody has any clue as to what's happening? Of course they could, but no one is actually making this claim. There's also no reason to break the law when you make the law, so there is that as well.

waterfall stack of inflation

No one actually gives a shit if more USD is being printed or not. That's a fact. All people care about is the purchasing power of their dollar and how much money they can get for their labor. If the money supply goes down and wages go down and price of products goes up/down, they call it inflation. That is clearly deflation, but nobody cares. On a certain level this is just a matter of semantics.

More importantly though, I believe we should look at inflation through the lens of healthy economic growth. The purchasing power of a dollar going down isn't bad unless you are holding dollars. The secret? Don't hold dollars; that's the whole point. Increase velocity. Make good investments. Bitcoin is the best investment in the world from a risk/reward standpoint. Yeah, it's not gonna go x1000, but it's also not gonna crash to zero either. Sorry Peter Schiff; dream on.

Again, healthy inflation doesn't even mean that the dollar has lost any value whatsoever. It means that the value of the collateral (NFTs) has gone up. If the price of a house goes up because property is an investment and that investment is now worth more, this is perfectly healthy inflation that everyone should want and accept. If the price of the house only went up because fiat flooded the economy in an unsustainable way, that's obviously a different conversation.

The reason why wages are at the bottom of the waterfall is simple. People are the worst form of collateral in an economy dominated by technology and automation. If the value of your business goes up, you aren't going to pay your workers more "just because". You only pay workers more when workers refuse to work for the lower price. The key to this economy is increasing the collateral value of the workforce. Easier said then done, eh? But I think crypto has a real shot of accomplishing this. "Get paid to _____".

Plain and simple, if you believe that inflation is bad under all circumstances, then you believe that the value of investments going up is bad.

I have never heard anyone directly make this argument. But every single person that QQs about inflation implies it. Think about that for a moment.

The key to avoiding inflation is simple.

Don't hold dollars in a bank unless you are shorting economic collateral. Now that cryptocurrency exists, there are really no excuses. Gone are the days of buying a washing machine to store your value like Andreas Antonopoulos' parents in Greece. Just buy Bitcoin. It really is that simple.

Bitcoin is the best form of collateral, and our debt-based system depends on high-quality collateral to function. While everyone thinks that Bitcoin is in competition with the legacy economy, it is likely the very thing that will prevent the legacy economy from going under. This is how badly maximalist misinterpret the position they are in. They get it exactly wrong on so many occasions because they don't actually understand how any of this works.

Conclusion

Not so simple as "printer go brrr", is it?

Money is the lifeblood of the economy.

If you believe printing money is bad, then you also believe that blood is unhealthy and we should use leeches to cure the illness, just like an old-time doctor would. At the same time, when we see a morbidly obese person eating fast food everyday, it's obvious to see that this is unhealthy, but actually fixing the problem is not so easy.

You can't just fix that problem by telling the fat person they should stop eating trash and exercise more. If you thought that was actually going to fix the problem, that makes you the idiot. That person is probably depressed and has a myriad of problems that need fixing before the problem goes away. The problem itself is much bigger than the visible symptoms of the problem. In addition, even if the cause of the problem gets solved, it takes time for the person to heal. These things don't happen overnight.

The same is true for the economy. We can't just be like: turn the printers off, that's going to fix the problem! That's like telling a fat person to stop eating: forever. Guess what? They'd be dead within a month; you killed them; just like you'll kill the economy if you turn the printers off for a month.

Few.

Posted Using LeoFinance Beta

Return from Economy Doctor: What is Hyperinflation? to edicted's Web3 Blog