Spoiler alert: @edicted never wins.

Everyone & their mothers are bullish on Bitcoin right now. Technical analysis looks good. On-chain metrics look good. Institutions are buying in record numbers. We've gone x10 in 9 months: most impressive.

But @edicted is not pleased with what he sees...

No, no I am not. I see a hostile administration moving in. Massive rounds of FUD hitting the news circuit including terrorist funding and undermining the Green initiative. I also hear whispers of scary strains of COVID popping up: more virulent, contagious, and deadlier than ever. Lockdowns are all but assured. Again, we've also gone x10 in 9 months. When does this party end?

My claim that Q1 is going to be a very bad quarter for Bitcoin is being met with a lot of resistance. After all, we are in the mega-bubble year and trying to trade during the mega-bubble is a damn fool's errand, to be sure. @jrcornel and I have started up quite the on-chain rivalry in bears vs bulls. The patterns of the 2017 run are popping up.

Moral of the story?

30% retracements happen all the time in a bull run.

Do not trade during the mega bubble year, just buy the dips and enjoy the wild ride. The chance that you're able to capture value from the 30% swings during the thick of it is pretty small; just an unnecessary risk during all that upside. Fair enough.

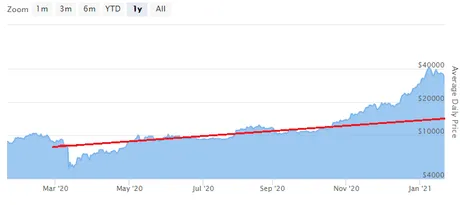

However, I'd like to point out the only good predictions I've made in the past are based on the doubling curve: this idea that Bitcoin is doubling in value ever year, seeded at $100 in 2013.

Bitcoin Doubling Curve

| 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 |

| 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| $3200 | $6400 | $12800 | $25600 | $51200 |

By my count, the current value of Bitcoin is already trading past what it should be by the end of the year ($25.6k). Of course the mega-bubble takes Bitcoin x10 higher than the curve for a short time, so there is that. $250k-$300k Bitcoin is definitely on the table by Q4.

The main problem I have with the current analysis, as I've already stated a few times, is the doubling curve. I believe the curve shows us when the market is trying to price in an event early and about to fall flat on its face. I believe we're being signaled right now with the current run, but I've never actually visualized that on the graph.

That being said, if anyone actually knows how to chart this line onto TradingView let me know. There are so many things you can do with TradingView scripts but plotting a simple Y = X^2 line doesn't seem to be one of them. I assume there's an "easy" way to do it I just don't know what it is.

I realize it's pretty lame and unprofessional to freehand it like this, but the blue line I've added here is the doubling curve. Because this is on a logarithmic scale it reduces the curve to a straight line. You'll notice that the first three 30%-38% retracements bounce pretty much exactly off the curve, and we don't break away from the curve until summer time. This is literally the only reason why I'm bearish right now.

Because where is the doubling curve right now?

2021 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $13867 | $14933 | $16000 | $17067 | $18133 | $19200 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $20267 | $21333 | $22400 | $23467 | $24533 | $25600 |

Not even $14k yet.

This is what makes me so so nervous about Q1 2021, because Bitcoin was 0% bubbled during Q1 2017... and it is very bubbled right now according to the curve, making the current comparison between 2017 and 2021 invalid.

So in my opinion we are about to get the mega-bubble 6 months early in summer time, or the market was foolish and tried to price it in 12 months in advance. Considering the timelines and the price action of the last 9 months (x10) I'm going to go with priced in early. This market got hardcore greedy, and a lot of that has to do with the COVID crash.

Way back in March COVID rocked Bitcoin and sent us absolutely reeling 50% lower than the doubling curve... remember that? Remember the predictions of Bitcoin to $1000? Hilarious. We recovered back to the curve within 5 weeks. The doubling curve is strong.

This is the doubling curve now on the same logarithmic scale, and we are trading massively above it. If one was to assume this is simply the first retracement in a long series of upward motions over the course of the year, this run is going to be way way way bigger than it was in 2017. Certainly, that's possible.

Chaos Theory

Here's the problem: I already said this was going to happen. Even way back in March when we plummeted to $4k... I was like, "Wow this is going to create a springboard that sends us to the moon at the end of the year." I even made bets to that effect claiming $20k was all but assured. Have my readers forgotten how skeptical they were of that prediction back when Bitcoin was trading at $4k-$8k just 10 months ago? $20k Bitcoin sounded like a fleeting dream, but I saw it coming a mile away... in fact I was predicting $30k and getting laughed at pretty good.

Here we are, x10 later, and still everyone is like, "Well why wouldn't it just x10 again!?" Because it just went x10 and we aren't in the pocket of the mega-bubble... that's why. The market got greedy and tried to price this thing early, and now it's going to fall flat on its face just like it always does.

Perhaps I haven't emphasized enough just how much stock I put in the doubling curve. The price of Bitcoin can not float above the curve for a full two years. One year max, that's all we get. According to what I've seen we absolutely can not continue this run for an entire year and then spend another year deflating back to the curve. That's one year too long.

Timelines

Everyone seems to think that we are for sure going to peak in Q4 2021, but what if that wasn't the case? What if we knew for a fact that the peak would come in Q2 2022? That's an entire 6-month difference. Wouldn't that flip a lot of these predictions on their ear? Wouldn't that give us plenty of time to deflate back to the curve in order to ramp up again later? My opinion on the matter is clear. I think there is a good chance.

Stock market

With Bitcoin this bubbled, the only way to expect more gains is if the stock market performs well concurrently. Blood in the streets on Wall Street will not be bullish for Bitcoin. So what do we have to be bullish about?

Is it the crippling pandemic? The administration change that's intent on mandating lockdowns and vaccinations? The infinite quantitative easing and money printing? The crippling deflation resulting from everyone being scared to spend their money? The crippling unemployment? Negative interest rates? So many people can't pay rent that they made evictions illegal? The unrelenting assault against the middle class and business owners?

Speaking of vaccinations, many think this is going to save the economy and it will just be business as usual by summertime. I have bad news... the damage has already been done, and even if vaccinations did have that effect of allowing the economy to resume as normal, it wouldn't matter.

Watching this economy is like watching a train crash in slow motion or getting a sunburn. It's a delayed reaction. If you're in the sun too long and you start to realize it because your skin is burning, then it's already too late. In a couple hours the burn will get worse even after removing the sun from the equation. Everything that's been going on has been stacked again and again and "solved" with unsustainable debt practices. The chickens are coming home to roost eventually.

This entire market is floating on nothing but fluff.

I can't think of a single good thing about this economy. Yet Bitcoin gonna continue mooning because 2021? Hm... yikes. It's not even late 2021. It's not even summer. Q1 has been bullish one time and that's when it was bouncing directly off the curve before and after the pump. Nothing about that scenario is like what we are witnessing now.

So what are the risks?

One must weigh the risks vs the reward. What is the risk of exiting the market during Q1? How high can Bitcoin really go? Looking at 2017 the price actually doubled after the 38% retracement in Q1. That would be $58k Bitcoin at these levels. That's a potentially devastating loss, although we'd assume the 30% retracement to $40k so it's not THAT terrible.

On the other hand, if the market does indeed deflate back down to $20k that's another 38% retracement. Sure would be nice to have fiat around to buy the dip in that scenario.

Also Ethereum...

These ETH predictions are insane as well. The network is so clogged. Gas fees are out of control. How can the price double from here when users can't even pay the current fees? There's a definite scaling barrier in play. Don't you guys remember buying ETH at $230 just 6 months ago? Guess not...

So what's the problem?

The ultimate problem here is that I need to focus less on freaking out over possible speculation and more on balanced positioning and hedging bets. It's easy to make a prediction of Bitcoin going up or down. It's much harder to make a recommendation as to what actions to take in the current situation. "Not financial advice" and all that jazz.

It becomes clear that the winning strategy here is to hedge our bets in both directions and reduce volatility to maintain sanity and not cave in to the crazy emotions surrounding these ridiculous price movements. Either that or just HODL. That seems to be a winning strategy as well when investing in volatile unicorn assets. Is it really going to be the end of the world if Bitcoin dips to $20k? A laughable question just a month ago.

Conclusion

Gonna write another post on my 20-point system and try to rein in this gross speculation. It is somewhat of a hybrid of dollar cost averaging but gives more wiggle room to gamble than doing so on a set schedule. The only way to safely trade this market is to set limits for ourselves and never move in or out of the market too quickly. More on this later.

Posted Using LeoFinance Beta

Return from @edicted vs @jrcornel: Who will win!? to edicted's Web3 Blog