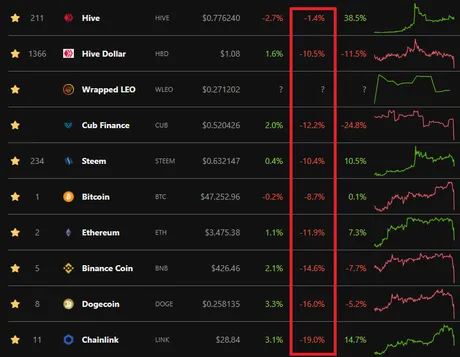

Last night Bitcoin had quite the tumble, then again a few hours ago. Coinbase has "degraded service" so not quite sure what's up with the potential volume. Volume on Binance is a staggering 113k BTC/24h, so lots of people are popping on to "buy the dip".

This flash-crash is honestly pretty great.

It's a great way to test supply shock and see how strong this market is at the lower levels.

This dump pierced through support at $50k, $47k, and $44k before I even saw it coming. For the most part, it seems like $44k was confirmed as a rock bottom, even for a flash crash.

The real test is how long it takes to get out of this potential fear induced dump.

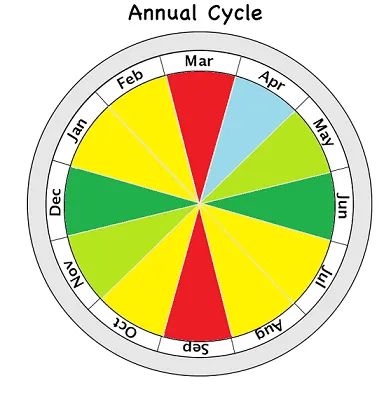

We find ourselves in a perfectly predictable situation right now. Yesterday was the new moon, and we would normally expect 2 more weeks of sideways/retrace action from this point. Also the volume was so low this very much baited a crash. All the signals were there for this one to occur. There are no surprises here, except for the speed and timing of it.

Hive handled the dump flawlessly, even after being bubbled up at the 83 cent level. At this point Hive feels like it's in mega-bullish mode and I will treat it as such. My next selling target is right under $2. Until then, no more selling for me. I've rebooted my 1000 hive powerdown per week so I can unlock a little more and provide liquidity once we're in all time Hive territory.

Again, Hive is so oversold it's not even funny. Not even in the top 200 by market cap? Silly. In 2018 I would have sworn to you that the fair market price of Steem was 80 cents. Look how far we've come since then. We don't even have the same brand name or centralization issues. I see dozens of builders throwing down here, and in the long term, we have a superior business model.

Yield farming bandwidth

When you allow other projects to transact for "free" this is a big deal. Any platform that charges a fee to put data on the blockchain can never participate in the micro-charge economy. Micro-charges and income-streams are the future. Hive is in a good spot as we head into overload. It costs $100 to use Uniswap one time. I wish you well on your scaling adventure, Ethereum Foundation.

Hive, why are you so sexy right now?

Seriously though to not crash after getting so inflated? Hive might just stay bullish until the end of the year or until it goes x10 back to Steem's all time highs. That being said I've always given warnings for September.

September has never been a fun month for Bitcoin. Judging by what just happened on the first day after the New Moon, we'll be lucky to trade in the $45k-$50k range for the next two weeks. This would still be bullish for the alt-market, as described in my post yesterday. Consolidating at such a high level (x2.5 higher than 2017 highs) can only be good for the alts.

These next two weeks are likely going to be the ultimate bear trap. No idea how low it will go, but supply shock at $46k seems to be holding quite well for the time being. I'd be pretty surprised to start trading in the $40k-$45k range considering how overwhelmingly bullish the supply shocks have been.

Conclusion

As I said before: the sharks are taking Q3 gains. That was the perfect time to do it. Well played, sharks. First day after the new moon combined with El Salvador making Bitcoin a legal currency. So well played. Somebody just made bank.

Hive is outperforming like crazy. All the on-chain technicals point to constant supply shock, perhaps even all the way to the end of the year (unless we 10x before that).

CUB and LEO are also bottoming out. CUB at the 50 cent level and LEO around 25 cents. It's nice to see that CUB bulls are no longer speculating on future IDOs, and the next couple that come down the pipe should shake up volatility when they arrive.

At the end of the day we just need to get through September. It's the worst month out of the year consistently over the last decade. After that it blue skies till the end of the year. October might be a little slow but Novembers and Decembers are legendary.

Posted Using LeoFinance Beta

Return from Emergency Flash Crash! to edicted's Web3 Blog