So...

The future might not be certain but the signal is getting stronger.

- Huge regulatory attack against stablecoins.

- Binance crushed by $4B fine and CZ pleads guilty (Feb 23 sentencing)

- High profile ETF meetings with the SEC are now commonplace.

- Elizabeth Warren introducing a bill to tame self-hosted accounts.

- And now this.

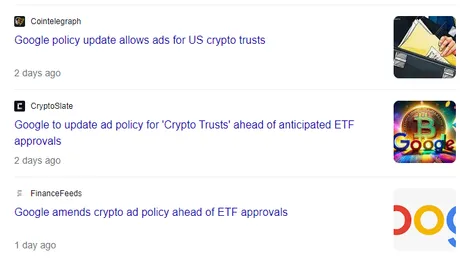

In a Dec. 6 policy change log, Google said its crypto and related products ad policy will be updated on Jan. 29, 2024, to allow ads from “advertisers offering Cryptocurrency Coin Trust targeting the United States.”

Google has never allowed Trusts to advertise on their platform.

And now less than a month before the first final deadline they just magically change their mind? Wow, okay then. Totally random happenstance I'm sure.

So imagine, if you will, every institution that lists a spot ETF shilling their service to the moon as if it's God's gift to humanity. They're already spouting the rhetoric quietly with Larry Fink himself calling it a, "flight to quality" like gold or bonds. I expect that noise to get ten times louder once they actually have a product for sale. Not just Blackrock, but also Fidelity and everyone else.

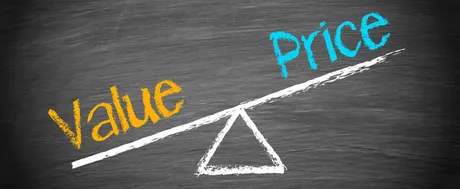

Again it's important to repeat that the business model of ETFs like this is completely different than a typical exchange. These people do not take a trading fee of any kind. Trading is free. Also, a lot of the money being used to buy and see comes from retirement accounts, which is also tax-free money in most situations.

So basically these people only make money if more and more users buy and HODL Bitcoin within the ETF for long periods of time because it's a ~1%-2% fee per year in total. The only way they make money is to convince people to buy and hold for as long as possible, which is obviously exactly what crypto itself has been wanting for over a decade now. Strange how the incentives align so well.

Deadlines

Many have wrongfully assumed that January 10th is the ultimate deadline for approving ETFs, but all that speculation hinges on the idea that the SEC isn't corrupt and playing favorites. Why would anyone assume this? It's nonsensical.

I myself have sported the January 10th deadline half a dozen times already, but it really means nothing. Who cares about ARK investments? Would it really be that surprising for ARK to get declined but Blackrock and Fidelity to get approved however many weeks later? Be serious: it wouldn't be surprising at all.

A lot of this data becomes an insult when taken in globally. Institutions all around the globe want a piece of the action, but suddenly politicians are like, "Oh no this is terrible we don't control everything!" And of course they continue to spin the narrative in a way that makes it seem like we're being done a favor as they take more power for themselves.

We've officially reached the "fight" stage of crypto.

And it's not going to be pretty either. Because when banks and other big institutions go to bat down a competitor, the first thing they'll try to do is buy them out. Will they be able to buy out Bitcoin? Will they be able to control the mining pools and institute blacklists and various surveillance on the network? Will they have a say in policy changes to the code itself? I don't know about all that, but I do know that they're going to try. The days of being able to kill Bitcoin are long gone but the days of being able to control or exile it have only begun.

7000 account tokens

Another tidbit I've really been meaning to mention is that I've reached the milestone of 7000+ account tokens on Hive. Every 7 months or so I get another 1000+ accounts and I'm always sure to mention how important these tokens are for growth and perhaps even as a speculative asset.

Unlike most blockchains, Hive utilizes explicit accounting, which means every account must declare itself before doing anything on the network. The advantages of this are numerous in that accounts are a higher level container that store much more than just a public key. In fact we have 4 different pubkeys (that can be changed) and a readable account name with potential account recovery. You can't get that with a normal implicit system.

In any case I'm always harping on the value of accounts saying that maybe these tokens will be worth something one day, but that's not really what they're for. The idea behind them is that we can scale up and offer free service to compete with WEB2 and even WEB3 protocols that force a charge to the user (like EVM).

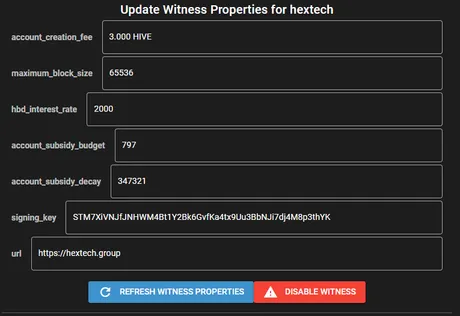

https://hive.ausbit.dev/witness

In fact in tinkering with my own @hextech witness node I found out that we witnesses (well the top 20 anyway) actually get to decide how many account tokens get created and how much bandwidth we allocate to accounts with little to no HP. These allocations are reflected by the account_subsidy_budget & account_subsidy_decay variables.

Therefore if we wanted or needed to it's quite clear that we could just turn these subsidies off during network overload. For example if someone was exploiting the subsidy by using a bot army to spam data to the chain we might have to rethink the strategy here.

I haven't run the numbers on such a thing but common sense tells me that something like that happening is extremely unlikely. What we actually have to worry about is legitimate adoption across millions of accounts at once. I was told by a high-ranking witness that we're actually making some good upgrades to the account indexer so giving away millions of free accounts shouldn't be too much of a shock to the system. What really matters is the bandwidth we allocate to those accounts and what they are actually using the chain for.

It stands to reason that one day Hive may not be able to afford to give away free bandwidth directly and we may have to rely on RC delegations or users getting ahold of HP directly. In theory something like that moons the price of Hive which makes it much easier for our node-runners to scale up and accommodate more throughput. Again, if Hive goes 10x, all of a sudden it becomes 10x easier to pay for a server. POW chains like Bitcoin, on the other hand, offer zero incentives to the infrastructure providers, and that will almost certainly become a big problem over the next decade.

Conclusion

The Bitcoin spot ETF seems to be coming whether we like it or not. The final deadline for both Blackrock and Fidelity are essentially the Ides of March (how poetic). The whole January narrative could be a complete farce and red herring, but at the same time all the signals we are getting seem to confirm that these timelines are moving at lightspeed. Since when does government ever move this fast on something? It's almost impressive.

Unfortunately our little network continues to flounder about like it always does during this part of the cycle, but I'm not too worried about it. Hive has proven time and time again to have a certain staying power that most other networks simply do not have. The antifragile game of attrition continues. Who will win out the day?

Return from ETF Decision Imminent & 7000 Account Tokens to edicted's Web3 Blog