Just in case some haven't noticed...

The current bull run we are in is pure insanity, and it's only just started. Bitcoiners are already screaming from the rooftops that "this time is different". Why? Ah, basic stuff like the fact that BTC has never even come close to all time highs right before the halving event. They take this as a signal to mean that we are in a super cycle, price will never come down, and 2026 is not a bear market year. They are sorely mistaken, but that's a topic for another post.

Instead we focus on all the reasons they are correct, of which there are numerous examples.

[link](https://twitter.com/edict3d/status/1763582111032713534)

ETF inflows have exceeded the wildest of expectations

Not only that, but they will continue to do so for a handful of reasons. This is a flywheel of epic proportions. First off, everyone that bought into the ETF right when it launched is up 50% in less than two months. This new class of investor is feeling like a genius right about now and telling all their friends about it. Testimonials are flooding in from every direction that prove availability is extending out into a completely untapped market, just like all the speculators said it might. However, no one could have predicted it would be this insane, or if they did they'd be the ones looking like a crazy person.

Point being is that a lot of these accounts coming in are tax-free retirement funds like Roth IRA whathaveyou. And what better place to HODL over multiple 4-year cycles than a literal retirement account that you're not supposed to touch until you're 60 years old? Many of the naysayers in crypto are constantly doing mental gymnastics to convince others that "Bitcoin is too volatile for a retirement fund". That's the most absurd and provably wrong logic I've ever heard. We've all understood that it's not about timing the market but time-in-the-market.

Yesterday some more cray-cray news broke that both Bank of America and Wells Fargo are now apparently offering their own flavor of Bitcoin ETF. Of course the reporting on this development is god awful because nobody cares about anything but number go up, but I do believe that this is ironically a decentralization-level event.

Up until this point Coinbase has been the custodian for something like 90% of all the ETF providers, including Blackrock and Fidelity, which is way too centralized and potentially dangerous. That's too much money in one place, and I'm actually glad that these assholes over in the big banking sector have finally pulled their head out and want to wet their beaks on this action. Everyone can see that the money is going to be absolutely flying in every direction over the next couple years.

Including...

Oh crap, did we do that?

The CEO of Vanguard has declared his resignation by the end of the year, and all the Bitcoiners are declaring victory. Obviously nobody knows for sure why he's stepping down but that doesn't stop us from speculating on the decision to refuse customers the ability to buy into Bitcoin. The timing is rather suspect considering it's been two months, a ton of money from Vanguard exited to buy into the ETF elsewhere, and Bitcoin is up 50% in such a short time. Is Bitcoin the reason he's gone? I don't know, but let's just assume this is the case because it's a fun story to tell. Either way it's obvious that investors at Vanguard that wanted in on the ETF but didn't leave are absolutely furious.

Regardless of the truth in this particular instance... the thing that we all said was going to happen is clearly happening. Remember a few years ago when everyone was saying there would be a transition with Bitcoin from risk-on to risk-off? Well, this is a very good indicator of that exact happenstance.

Back in the day if you told your clients to allocate to Bitcoin it was extremely risky and you could lose your job as a broker. Now we see exactly the opposite. If you refuse to allow your clients a Bitcoin allocation you could lose your job. The script has flipped just like we said it would. It's just crazy to be watching this happen in real time. It's so surreal and fake-feeling.

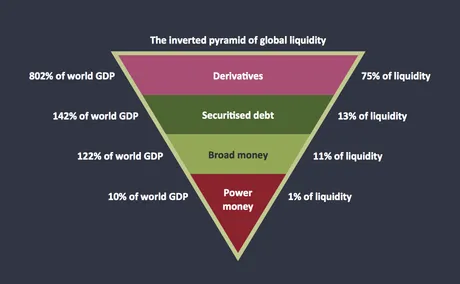

ETF Derivatives

Word on the grapevine is that Blackrock and other ETF providers are going to create some very useful derivatives for their clients. The most obvious ones to create are call and put options, which I still don't really understand because I've never participated in the futures market in this way, but I'll do a post on it soon if only for my own benefit.

It's also important to understand that the Bitcoin ETF itself is a derivative, even though it's a spot ETF and on a technical level that derivative should be pegged 1:1 with BTC. In fact, all Bitcoin on all exchanges are also derivatives. The only exchange that reflects this is HiveEngine. HE calls things "SWAP.HIVE" and "SWAP.BTC" which is what those assets really are, wrapped versions of the underlying asset.

However, the ultimate utility is the ability to leverage the ETF position in order to extract loans from it. This is the derivative position that will likely fuel the next bull market and potentially even push Bitcoin up to something insane in 2025 like $5M per coin. Derivatives are leverage, and when institutions come in to leverage Bitcoin, an asset with a current market cap of $1T, we can rest assured knowing that the impending bubble is going to be bigger than anything we have ever seen or even imagined. But I can speculate some other time.

Looking at the financial incentives

At the end of the day Blackrock doesn't care if they destabilize the market. In fact they probably want to because their algorithms and AI trading bots have a huge advantage over us plebs. The more volatility they create the better. The more Bitcoin gets pumped the higher the fee they take on the ETFs. Every signal we are getting points to moon.

Institutions can't lose, they are going to make money no matter what because their clients are paying them a yearly percentage fee and their professional job is hedging and playing it safe in a volatile environment. There's no reason to assume they won't try to play god during this cycle when they are the player with the biggest bankroll and have already honed the most cutthroat PvP tactics over the decades.

The banks are saved!

It's time to disavow this delusion that Bitcoin was ever going to replace the banks. The banks are adopting it. Not only does Bitcoin help them but it will likely save them from themselves at least for another decade or two. Debt flourishes under the guidance of pristine collateral, and that's exactly what Bitcoin is, the market just wasn't big enough for these players to ape in. Now it will be.

Conclusion

Bitcoin is back near all time highs and this bull market hasn't even started yet. We have two more years of insanity to go, and the vast majority are going to tap out early and take gains long before the top is in. All I can say is don't sell to Blackrock in 2024 under any circumstances. They haven't even implemented the inverted pyramid yet on this asset class, and ETF adoption is exponentially larger than any other ETF that has ever existed... including gold which pretty much went 10x from ETF adoption.

Return from ETF Extra Tertiary Features to edicted's Web3 Blog