They're at it again! Ethereum killers are everywhere! Ethereum doesn't stand a chance! Ethereum is going to zero!

The Collapse of ETH is Inevitable!

OMG the sheer ignorance of these arguments is starting to get under my skin.

Here are some examples of the foolproof logic for why the #2 coin in existence is "worthless":

If all the applications and their transactions can run without ETH, there’s no reason for ETH to be valuable unless the miners enforce some sort of racket to require users to pay in ETH.

Yes, and ETH can run without ERC-20 tokens. See what I did there? Turned it around on you. Every application on the Ethereum network could be reprogrammed to use ETH instead of the ERC-20 token.

Not only is this argument irrelevant, it's also false. I use the MakerDAO to lock up Ethereum as collateral for a loan. Making the claim that ETH has no purpose is asinine. You can easily flip the argument to make the much more convincing claim that it's the ERC-20 tokens that are worthless.

Even then, this is a hard sell. This space is cooperative. ETH benefits from ERC-20 tokens and ERC-20 tokens benefit from ETH. What is it about this dog-eat-dog corporate-rat-race permanently-worn-torn planet that makes us blind to anything but cutthroat-capitalism? Oh... right.

The main argument that Ethereum is worthless (in the linked article) revolves around the concept of economic abstraction. The claim here is that ETH gas prices are what give it value. ERC-20 tokens must use gas to pay miners to confirm the blockchain and process smart contracts. Once you can pay the gas fee with ERC-20 tokens the claim is that ETH tokens will be worthless.

Let's digest that for a moment.... ... ... ...

Okay, so what gives Bitcoin value? Is it the transaction fees? LOL. Are we also going to make the argument that Bitcoin is going to zero? Should we also make the argument that all ERC-20 tokens are going to zero because a lot of their funds are tied up in ETH? This is the slippery slope you have to navigate when you make such wild accusations.

What is gas for? Processing smart contracts. So, people are out there making the argument that Ethereum is going to zero because of the fee structure of an incredible technology that the number one coin doesn't even have. Seriously, do you skeptics even listen to the words coming out of your own mouths? Isn't it obvious at this point that Ethereum is superior to Bitcoin in almost every way? The only thing that makes Bitcoin better is that it's harder to exploit because it's so basic and unchangeable. This is Bitcoin's number one strength: It's lack of functionality and inability to evolve. Yet everyone is uber bullish on Bitcoin right now because "OMG ETF MOON MOON MOON". Unreal.

Why does everyone call Bitcoin a "store of value"? Because it literally has nothing else going for it. Spoiler alert: Ethereum is also a store of value, plus it can do a million other things on top of that.

To make the claim that mandatory ETH gas fees are what give ETH its value is just such a basic bitch argument. There are so many variables that go into determining a coin's value:

| Application | Decentralization | Inflation | Speed | Community |

|---|

This is the scale I use. Where do gas fees fall into this chart? Inflation/Distribution. This is one of the lesser categories of importance in my opinion. Community, Application, and Decentralization are all more important. When viewed from this perspective, making the claim that ETH value is derived from gas fees is ridiculous. Gas fees are a small part of the inflation category, and Inflation is a small part of overall value.

What about coins that have no transaction fees? Are we making the claim that they are going to zero as well? Seriously the logic of these arguments is bewildering. Nothing is going to zero, shut your yap already. The only reason anyone is listening to you is due to the recent Ethereum crash and a scarcity mindset rooted in fear. We need to fight against these snakes capitalizing on our emotions.

Jumping The Gun

Skeptics are always trying to compare Steem to MySpace. As we all know, MySpace was pretty much torpedoed by Facebook. Often times the first application for a technology is doomed to fail because it's so primitive and unknown. Only after another application refines itself do we see real mainstream adoption.

This very may well happen with Steem, but it's foolish to be talking about it now. First of all, it might not happen at all. Steem and cryptocurrency in general are cooperative movements. Can you imagine a world where Facebook and MySpace were open source? I can't; just like many people don't understand how crypto projects are cooperative and open source.

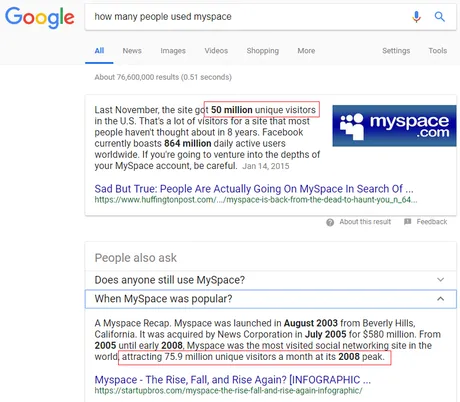

Secondly, take a look at this:

People still use MySpace. MILLIONS AND MILLIONS of people. How many users do we have at Steem? 60k? Imagine investing in MySpace when it had 60k users. Wouldn't it be foolish to make the Facebook argument at this point? Yes, yes it would.

Also, it wasn't hard to see Facebook coming. If you're that worried about it just be on the lookout for the next best thing. A superior platform coming on the scene will be blatantly obvious. Regardless, this entire "Facebook FUD" argument is irrelevant. We can easily see when we crunch the numbers that MySpace never got killed by Facebook. It simply stopped growing.

Another thing to consider on this front is Bitcoin. Bitcoin is the mother of all blockchains. Why does no one make the argument that Bitcoin is the MySpace of the blockchain world? Why is everyone focused on attacking tech like Ethereum and Steem when they are clearly superior products? Because it's the number one coin; gotta get that ETF and secure dominance amirite? So, because Bitcoin is the number one coin that makes people blind to the fact that it can't evolve nearly as fast as the other technologies? What is this echo chamber we are witnessing? Wasn't MySpace number one at some point? The logic here is baffling.

"Two Years Is An Eternity In the Cryptoshpere"

I saw @dan say this on a YouTube video about Ethereum scaling. The argument is that in the two years it takes Ethereum to scale all the Ethereum killers will have already moved in and gobbled up all the business. Really? Two years is an eternity? IN SOFTWARE DEVELOPMENT? @dan, you must be joking.

In two years none of these "Ethereum Killers" will even be close to caught up to Ethereum's level of development. Even if they do catch up, none of the "Ethereum Killers" will be as decentralized as ETH which means ETH will still be the most trustworthy. Seriously though, the Ethereum network has a quarter million developers working on it. No one can catch up to it. The smartest thing to do will be to pivot and provide different services.

Where is this lightning-speed development at?

Where is EOS? Where is project Atlas? Where are the killer apps? Where are SMTs? Where is the "competition" for Steem? Where is the Lightning Network? Where is Casper and Sharding and Plasma? I'll tell you where it's at: getting developed at a snail's pace because that's how software development works. "Two-year eternity," LOL. Two years is going to come around like nothing and everyone is going to realize exactly how wrong they were about all of this.

Why are we all expecting this impossible outcome? It seems to be a common theme in the world of software development. Everyone predicts a product will be released in half the time it actually takes. You'd think we'd of learned to just double the estimate by now. NOPE!

We are all expecting these impossible outcomes because we are living in scarcity and fear. We all want to believe that we've found the next Bitcoin and we'll strike it filthy rich. We all want to believe that by investing in an "Ethereum Killer" we can leech all the market cap of Ethereum into the coin we just invested in. We are so smart for making this investment.

Spoiler alert: This isn't how it's going to play out. The road ahead isn't that simple or easy.

I'm not even that bullish on Ethereum. I just know that all this perceived competition is a farce. Fiat is the true enemy. There is room here for everyone. Ethereum is going to stick to what they do best: decentralized trust. The disadvantage here is efficiency, speed, and friction, so Ethereum applications will gravitate toward apps that require trust but can sacrifice the rest. Other smart contract applications like EOS will focus on the speed based apps at the cost of trust. Everyone will find their niche. Steem will focus on its strengths as well: built in community, social media, and proof-of-brain tipping. THERE IS NO COMPETITION.

This is the Wild-West. Competition is counter productive. There is "literally" gold littering the ground. Instead of fighting someone for their gold just walk three more steps and pick up your own. The space is massively underdeveloped and if we do eventually experience competition it will be long after crypto has gone mainstream and we're all filthy rich anyway.

Don't worry about the Facebooks of crypto when no one even knows about the MySpaces yet.

Return from Ethereum Still Under Attack to edicted's Web3 Blog