For anyone who took my advice last night and sold a little Bitcoin (probably no one), we are now left in an awkward position. While the price has gone down, has it really gone down enough to justify "buying the dip"? Not really.

Take an exchange like Coinbase Pro who jacked up their fees to 0.5% last year. If we sold one Bitcoin at $40k, that ends up being a trading fee of $200 and we are left with $39,800. Buying back in at $39k is another trading fee of $199, leaving us with 1.0154 BTC, a $601 profit instead of the $1000 we would have gotten without the fees in place.

On Coinbase Pro, anyone who sells at $40k and buys back in at $39k is only going to get 60% of the money they might have been expecting. For many day-traders, this tax is wholly unacceptable, making it impossible to actually make money on average in the long run given such small movements.

A 40% tax on profits is not sustainable in the long run because we can't always expect to guess right in the first place. For example, if we had sold at $40k and then capitulated and bought back in at $41k, that would have been a net loss of $1400. When combined with our previous winnings of $600, we still lost $800 when we combine the two trades that should have canceled each other out. All $800 goes directly to Coinbase as corporate profit and we, as average traders, lose quite a bit even though we took very measured risks.

Even the most professional and talented day-traders are going to make a huge percentage of bad bets. Professional gamblers can be wrong 40% of the time and still turn over massive profits in the long run. As far as gambling is concerned, anyone that can achieve a 10% edge like this is essentially a master in their given field.

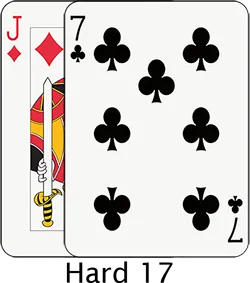

Taking blackjack as an example, how much of an edge would you guess that card counters can get in order to beat the casino? The goal there is to get a 1% edge, meaning you win 51% of the time. A 2% edge in blackjack is literally impossible to achieve given the math of the game.

Meaning that much like crypto, gambling is also filled with wild variance and completely unpredictable short-term outcomes. It is the long-term outcomes that begin to lower volatility and reveal hourly rate. Poker players have to play 10k-100k hands before they can calculate their hourly average. Meaning it could potentially take 2000 hours of work before even realizing what kind of gains one is making in a certain environment (However the first 100-200 hours is usually a good enough estimate).

In poker, the act of winning more money then the casino is taking from you in fees is called "racing the rake". The rake being the cut they take for themselves and the race being the comparison of how much you've made compared to what they've taken. In many situations, if you make as much money as a centralized casino makes off of you, you're doing pretty well.

It should go without saying that if this is the case (which it is) then eliminating the rake entirely would not only double the wages of seasoned professionals, but it would also boost up those who break even into the extreme green (professional wages) while allowing fully average players to break even instead of lose big over time. This is why I think there's going to be a huge resurgence of poker within the cryptosphere when we can figure out a decentralized solution that eliminates these offensive taxes.

After all, do you pay thousands of dollars to play chess or checkers online? Do you pay thousands to play Facebook games or interact on social media? No, the only reason why gambling is taxed so heavily is because they can get away with taxing it that heavily without killing the market... because lets be honest: people love to gamble, and gambling involves lots of money, whereas things like online chess and checkers do not.

Here we see that once again ascending triangles are bearish while descending triangles are bullish. Contrary to what you'd think when considering higher and higher lows.

Low volume warning still in affect

Volume for Bitcoin is still at dangerzone levels and I do think we'll be testing $37500 soon. Finding support at $39k would once again be unexpected and can only happen given a hyper bullish scenario combined with recent supply shocks.

The incentives of legacy order books are backwards.

This is what I would truly like to point out here. With legacy order books, the only way for market makers and traders to earn a living is to capitalize on volatility in the market. Buy low; sell high. 100% of the gains made by order book market makers are accomplished via price volatility and instability.

However, this runs contrary to what is best for the market. The best thing for Bitcoin and crypto is that if there's very little volatility and number just keeps going up very slowly over time. That might be boring to some of us, but that's the best thing for Bitcoin and the cryptosphere at large, as it will promote the highest amount of sustained network growth over time.

So we have to ask ourselves: how can we possibly stabilize crypto and have it act as a unit-of-account when the incentives for liquidity providers depend on volatility?

The answer is: we can't.

If the liquidity providers require volatility to make money, that's exactly what they are going to get. After all, they are the ones who provide liquidity, and thus, determine how much volatility there will be.

Luckily, there are exchanges like Binance out there that only charge a 0.1% trading fee or less (BNB discount). This is FIVE times less of a fee than Coinbase Pro. Quite impressive indeed. In the above example that $200 trading fee gets reduced to $40 on Binance, and traders would make over $900 on the $40k-sell/$39k-buy day trade instead of $600.

Lower fees help lower volatility and increase liquidity, so Binance provides a valuable service to the cryptosphere, even if it is a centralized one.

BUT AMM IS THE FUTURE!

Whereas legacy order book market makers incentivize volatility and pure gambling, AMM technology lowers the bar and creates a new system that is better for everyone. In AMM, the liquidity providers want the opposite of what the legacy systems crave. The best way to make money with AMM liquidity provision is through stable markets.

Massive amounts of yield are allocated to these pools, therefore, it doesn't matter if the price goes up or down. In fact, every time the price goes up or down in AMM the liquidity providers lose money from "impermanent loss" slippage. It is in the best interest of all liquidity providers within these AMM systems to create stable markets that move more predictably, which is exactly the opposite of what we see with order books (buy low sell high).

This is a very understated difference in core incentives that no one seems to be talking about. It is a BIG DEAL that the users who are providing all the liquidity and control these systems have completely different and exponentially more healthy incentives given the crypto solution.

The reason people might not be talking about this yet is because AMM is new and largely unproven to the dinosaurs in the legacy economy that are judging it. Books won't be written about AMM superiority until we get another mega bubble and all these liquidity traps scoop up a lion's share of the next run up. That's just how the world operates: we live in a REACTIVE society that doesn't act until after the thing happens. After all, predicting the future in such a volatile atmosphere of exponential technological gains is quite difficult (if not impossible given the timelines and topics involved).

Conclusion

The world is changing. Business solutions within crypto are creating superior outcomes that can not be copied by legacy systems. Quite suddenly, we find ourselves being able to monetize the correct incentives that create healthy economies, rather than exploitative ones.

Looking ahead to the quite distant future, societal shifts like this are going to hit the health and medical industries the hardest. Whereas there is little financial incentive to do scientific research on plants and wholistic medicine (as these things can't be patented) within a cryptocurrency that forges its own custom rulesets, previously impossible incentives to monetize suddenly become possible. This context will extend to dozens of industries over the next few decades.

The days of centralized agents raking profits from the top of the pyramid are coming to an end. All such systems will be replaced by superior stake-based systems that allow entire communities to own the means of production and research (IP) provably on-chain.

Many (if not all) of these solutions will be rooted in DPOS consensus out of necessity, unless we can somehow think of a better way to give users communal ownership based on other forms of reputation. Again, predicting the future is not easy given exponential technological gains. Chaos Theory is in full effect.

Posted Using LeoFinance Beta

Return from Exchange Fees: A day trader's worst enemy. to edicted's Web3 Blog