The market finds itself in an extremely critical position right now. All the bullish news and supply crunches should easily lead us to believe that the pressure of Bitcoin will blast to new all time highs soon™.

If we get rejected here and test $35k support again I won't be too worried, but if we test $30k again I'd say that's pretty bearish. We've already quadruple bottomed on $30k and I'd say the ice has cracked pretty hard in that direction.

The way this is playing out though, we really don't need to worry about the market until March or April. Even if this was a blow-off top volcano erupting it should still take until then to deflate.

Overwhelmingly bullish news

Again, it seems like every day we get some piece of good news that indicates extreme supply crunches. This alt-market has made huge runs in some areas.

Maker is up from $500 to $2500, Link up to $25 from $5 in the summer, Rune up to $4 and when I was told to buy it was 60 cents. Binance Mafia coin selling for all time highs $65 from $20. Leo holders continue to dump very little inflation onto the market in anticipation of airdrops.

Even in the bearish scenario, it takes more than a month from now for Bitcoin to deflate. That gives alts the entire month of February to go up. I expect the alt-market spikes to continue. Retail is just waking up.

One Point Out!

But I'm not trading alts. So I'm going to start keeping track of my own fantasy Bitcoin trades by hand until I have something in my database for it. For now I am "officially" one point out at $40k.

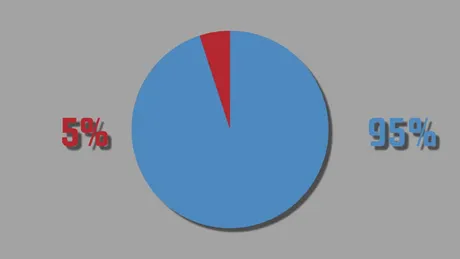

Selling 5% right now as a hedge can't be a bad play. 2 or 3 points would be much more aggressive but still valid plays according to my Venti Trading System I'm trying to do.

We are at the critical point trying to figure out if we are still stuck in a wedge trapped by resistance, or about to blow right past it will all the speculation going on. Could easily go either way, especially in the short term. Plenty of bullish scenarios continue with a bounce off $35k.

Rules of Fantasy Bitcoin.

For this fake run, let's assume everyone got in at $35k received 20 BTC, one for each 5% block. I just sold 1 BTC at $40k, so the total value of my account is still $40k x 20 ($800k), but I would out-perform those who were all in should the price fall from here.

Another question becomes do we charge a fake exchange fee so that trading has friction... which may be silly in a game of trading, as it rewards stagnation and idle action, but at the same time mirrors the cost of real trading. Best to keep it an option to be modified. A range from 0% to 1% sounds reasonable. Even Coinbase is only 0.5% and Binance & other Eastern exchanges are as low as 0.1% fee, sometimes with an additional discount for holding the exchange token.

Conclusion

Again, only 1 point out, so pretty bullish in the short term.

Smallest possible hedge in case of being trapped in a wedge.

The bearish scenario doesn't play out for another month or two.

$35k has become critical support for the bulls.

Breaking above and holding $42k is the big target at the moment.

Posted Using LeoFinance Beta

Return from Fantasy Bitcoin: One Point Out to edicted's Web3 Blog