https://steemit.com/ethereum/@edicted/blockchain-backed-loans https://steemit.com/ethereum/@edicted/binance-coin-and-dai

I've mentioned the Maker governance coin twice now, but now it deserves its own post. As I am writing this I am currently in the process of using the system to lock up my Ether coins in a Collateralized Debt Position (CDP) and create DAI coins out of thin air. Here are the steps I've taken so far:

-

Go to https://dai.makerdao.com/

-

Unlock MetaMask account.

-

Turn Ether (ETH) into WETH.

Apparently, Ether is not yet compliant with ERC-20 functions so you have to "wrap" it in an ERC-20 complainant container. -

Turn WETH into PETH Pooled Ether (PETH) has even more increased functionality that let's you create Dai.

-

Unlock all token allowances. Each of these takes costs a transaction on the Ethereum network. Was about 7 cents each.

-

Open a Collateralized Debt Position (CDP)

-

"Lock" my PETH into the CDP

-

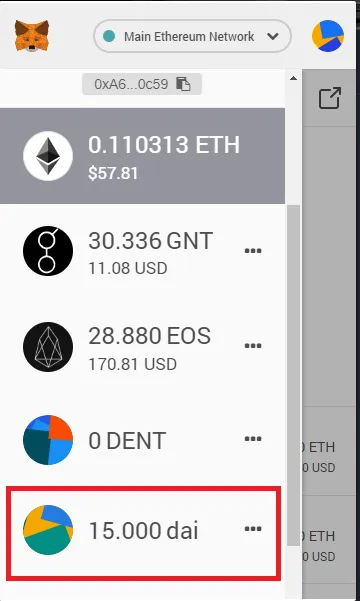

"Draw" Dai from my CDP into my wallet.

SUCCESS I did it!

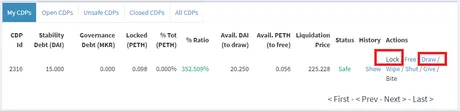

I created $15 worth of Dai with 0.1 Ether as collateral. As you can see my loan is over-collateralized at 352.5%. That number would have to drop to 150% for a margin call to liquidate my collateral and I would be charged at 13% fee if I allowed that to happen. As you can see in the screen shot, Ether would have to drop from $529 to $225 for that to happen if I allowed my CDP to remain in the same state during the crash.

What's the point?

Check out Dai on coinmarketcap.

This is the last week of Dai price action. As you can see the Dai hovers around $1.02 and $0.98. In any given day the Dai is practically guaranteed to hit the $1 mark multiple times. Every day, the Dai goes above and below one dollar. This is basically free money in the form of arbitrage.

This is the last week of Dai price action. As you can see the Dai hovers around $1.02 and $0.98. In any given day the Dai is practically guaranteed to hit the $1 mark multiple times. Every day, the Dai goes above and below one dollar. This is basically free money in the form of arbitrage.

Decentralized

Dai is the best option out there right now as a stable coin because, unlike Tether and TrueUSD, it doesn't require that actual dollars are held in a bank. It's the only stable coin I've been able to find that is actually decentralized (which is something I recently thought was impossible). It can't be regulated or shut down. It is self regulating on a worldwide scale.

How does the Dai stay pegged to $1?

The Dai's volatility is transferred to the underlying asset used for collateral. Right now that asset is Ether coins, but they will be adding more in the future. Put simply, when you lock your Ether into a CDP you can't unlock it until you've paid back the loan that you took out.

Therefore, if the market is crashing and people start retreating to Dai as a source of stability, the demand and value of Dia goes up. However, let's say the value of Dai is $1.05. Anyone holding Ether could lock up their coins in a CDP, create Dai, and sell it instantly for a 5% profit. If Ether continues to crash you are now the one bearing the brunt of Dai's volatility because you can't sell your Ether until you buy back the Dai to pay off your loan.

Basically, this end's up being a win for anyone who was going to hold their coins anyway. When Dai is worth less than a dollar you can buy it and pay off your loans for a reduced cost, and when Dai is worth more than a dollar you can create more and sell it for an instant profit. You can mitigate some of your losses by being part of the Maker platform during a crash, and you can also make some extra money during a bull run.

WTF is Maker?

Maker is the governance coin of the entire system. The MakerDAO is the Decentralized Autonomous Organization that controls all this madness. If you hold Maker coins you get to vote on things like the definition of a risky CDP and when risky loans need to be liquidated. You get to vote on how much debt can be created in the first place and a myriad of other issues.

The push and pull dynamic of Maker coins.

If the MakerDAO makes a stupid decision, they are the ones who have to pay the price. Conversely, if Maker holders never make a mistake, they will be heavily rewarded.

Push

If the value of Ethereum crashes so fast that the debt is no longer full collateralized the Maker platform will create new Maker tokens out of thin air to cover the debt. This would be an extremely bad situation for Maker holders to be in because they would all lose money. More Maker coins in circulation means that all the coins that they are holding are now worth less.

Pull

Here's where it get's interesting. The Maker platform charges 0.5% interest per year on the loans that people take out using the platform. This interest can only be paid in Maker coins and, when they are used in this way, are permanently destroyed. This means that the number of coins in circulation will always decrease as long as the system doesn't fail and is forced to create new coins.

Balancing act.

These two dynamics create a balancing act for the MakerDAO. Do you vote to allow people to make riskier CDPs and take more loans off of the platform? This would mean more Maker was destroyed from interest payments, making your stake worth more. At the same time such an action could result in an epic backfire. These are the dynamics that keep the MakerDAO in check.

Conclusion

The Maker platform is pretty amazing. It is the ultimate decentralized solution for creating a stable coin and helping crypto to become mainstream. On top of that, it also allows anyone to take out a loan on collateral with incentives to stabilize the system.

Not only do CDPs stabilize the value of the Dai, but they also stabilize the value of Ether. The higher the Dai rises in value because of a crash the more incentive the MakerDAO gives the Ethereum community to hold their coins. During the Feb and April crashes where everything bottomed out, most coins crashed to the same value. However, both Ether and Maker crashed to a higher value in April than they did in February. I think this is very significant.

The worst part about all this was that Ethereum is having scaling issues. It took too long and theoretically costed too much to complete all the steps. It was also overly complicated. I fully expect this model to be copied on all the other smart contract platforms. EOS, NEO, Stellar, DragonChain, Cardano, Tron, Etc etc etc. They will all eventually have stable coins pegged by a system of loaning. I very much hope that SMTs and Oracles can provide the tools necessary to build this technology here as well.

Return from Figuring Out MakerDAO to edicted's Web3 Blog