Shit is going down, yall.

It wasn't long ago that I posited the idea that Bitcoin's intense (even record-breaking) correlation to the stock market was nothing to be worried about. In fact, in my opinion, the stronger the correlation, the higher chance we have of snapping out of it and fishtailing in the opposite direction.

The market is afraid terrified

And terrified markets make hugely rash decisions. The first rash decisions happened before we were even terrified. They happened while we were greedy, and thus made the terror to come later even more amplified.

I'm talking of course about the speculation regarding the halving event. Everyone was leveraged up to their ears expecting a pump and dump like last time, and what we got instead was a global economic lockdown that pushed the price in the opposite direction, liquidating everyone's greedy long positions.

Well, all that greed is gone

In this context, the only one's left are strong hands, yet the fear in the market remains constant. The vast majority of analysts I see constantly predict lower prices rather than higher ones.

Chaos Theory via Bitcoin

Do not listen to the bearish analysts at a time like this; the pendulum is swinging upward, and with incredible force. In hindsight when the fear is gone everyone will say that this upcoming pump was so obvious. The situation we are in is the exact reason Bitcoin exists, yet all seem to be blinded by fear.

I must not fear. Fear is the mind-killer. Fear is the little-death that brings total obliteration. I will face my fear. I will permit it to pass over me and through me. And when it has gone past I will turn the inner eye to see its path. Where the fear has gone there will be nothing. Only I will remain.

The Titanic is Sinking

This is what we should actually be afraid of. While the rest of this niche community is afraid of taking losses on Bitcoin, what they really need to be afraid of is the impending unprecedented economic collapse that's going to be blamed on this virus. Trust me, the virus is a scapegoat, just like Trump.

COVID Scapegoat

Trump Scapegoat

Escape Fiat!

USD is not a real currency!

Putting your money in the bank is a crime you are putting on yourself.

None of these technical analysts out there are factoring in the obvious fact that Bitcoin is doubling in value every year on average. If you are afraid of the market and don't want to believe in me this time around, I understand. I've been wrong a lot, but I can feel the energy of this one, and it's a monster.

If you want to turn bearish on the market...

Set stop-losses BELOW the doubling curve ($8400). If we dip under $8200 this time around I'll be worried. That shouldn't happen.

Already seeing more evidence that I'm correct:

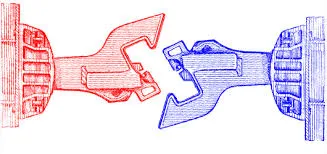

The Decoupling

The blue line here is XBTUSD, an asset tracking Bitcoin that users on BITMEX can trade for up to x100 leverage. The lower line is the S&P 500. A decoupling from the stock market correlation is happening right before our very eyes.

Once this decoupling happens for a long enough period of time there will be massive FOMO and a gigantic bull run. Billions will flow from stocks into Bitcoin, and when you think about it, billions from the stock market is really very little in the grand scheme of things.

Bitcoin liquidity is so shallow right now due to the incoming halving event and the fact that all our longs were liquidated and we sit flat on the doubling curve with only strong hands holding. Bitcoin will decouple for a few weeks (I'm guessing three), gain massive value, and then re-couple and continue crashing with the rest of the market.

We've all seen how short these windows of opportunity are.

Just look at Hive!

We practically went x10 in 4 days.

That's absolute insanity, and this insanity will continue.

Hive

Speaking of Hive, my prediction there is turning out to be accurate as well. I have a really good knack for dumping my coins preemptively where the price is going to go. I dumped at 2400 sats, so I'm targeting buy zones in the 2000-3000 sat region.

Wouldn't you know it, there's a 500k Hive buy order on Bittrex right now, and 200k liquidity down to that level on Binance. Will the 3000 sat level hold? I don't know, but that's where I'm going to start cost-average buying back in to get back to orca.

This implies arbitrage.

Hive on Binance is continuing to dump, pushing the price of hive down. However, Hive on other exchanges is trading for a higher price, so users on those exchanges are purchasing Hive on Binance and then transferring them to other exchanges and selling for a profit.

We can expect this to continue for a bit.

The Steem vs Hive war continues. I continue to hold 'massive' amounts of Bitcoin waiting to enter.

I've never held this much Bitcoin before,

it's a weird feeling considering all the shit I used to talk.

This market is completely broken and unsustainable.

Bitcoin is not.

Bitcoin stands back up even after being knocked down.

The rest of the economy has to be coddled by the Fed in order to avoid implosion.

The graphs might look the same; the correlation may appear strong

But when you take a step back and realize that no, the Fed is not pumping trillions into Bitcoin. They are pumping trillions into failed zombie corporations that are "too big to fail".

It becomes clear that the projected correlation between Bitcoin and the stock market is completely meaningless. For example, if the stock market goes +5% and Bitcoin goes +100%, and then the stock market goes -10% and Bitcoin goes -20%, we can see that the market is extremely correlated. However, Bitcoin netted an extreme gain while the rest of the market suffered a loss.

Conclusion

Bitcoin is still doubling in value every year. No other asset in human history has ever done this. Stop listening to the noise and caving to the fear. Even as an atheist, I can say now is a good time to have a little faith.

Return from Financial Advice™ to edicted's Web3 Blog