The market decided to derisk right before the FOMC meeting yesterday just in case Powell decided to go hawkish again. We can see within minutes of confirmation that this was not the case: risk-on was back and everyone who derisked aped right back into the market. The DXY crumpled 1% instantly.

1%? Who cares?

1% might not sound like a lot to us crypto degens, as that's a price moment that happens multiple times a day, but for the world reserve currency... it's a little different. DXY dipping 1% within minutes of a FED meeting is just kind of absurd on multiple levels. To be fair today it's gone back up to where it was before, but still. Many many people are trading around the FED's actions right now. It will be nice when they finally stop trying to manipulate demand in response to supply-chain-disruption.

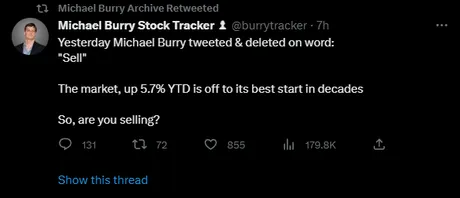

Short Story: Michael Burry ragequit

https://twitter.com/michaeljburry

KEK!

To be fair this is not the first time this has happened. In fact, Michael Burry has promised multiple times that he would stop disabling and then later reenabling his account like a petulant child. And yet here we are.

I used to give this guy a lot of credit for being able to accurately predict the 2008 housing crisis and profit from it in one of the most daring financial plays the world has ever seen. I've been tracking his moves accordingly.

First, he started investing in random property in the mountains that still had water rights intact: meaning that if water falls on the property you're legally allowed to collect and own it. He predicted massive water shortages and skyrocketing water values. That has yet to happen and it's been ten years+. To be fair he did lose a lot of money on the housing market short from pulling the trigger a bit early. He pissed off a lot of investors, which is portrayed well in the movie about it called the Big Short.

More recently he's been he's been buying farmland (seems smart) and only has one stock left: GEO GROUP. I looked up Geo and was a bit horrified. It's basically an investment in privatized prisons. Well that's dark as shit and totally not cool...

Professional doomers like Burry have become wholly insufferable. I mean think about it. Even if they win: they lose. If you short the world and the world ends, you're not a winner. If you put money into private prisons and help them expand: you're an asshole.

I have to assume at this point that I held entirely too much respect for this man and that he's simply a one-hit-wonder that got lucky: so people started glorifying him as some genius. He's not a genius: he's an immature asshole. Pretty sure.

Focusing on something more positive.

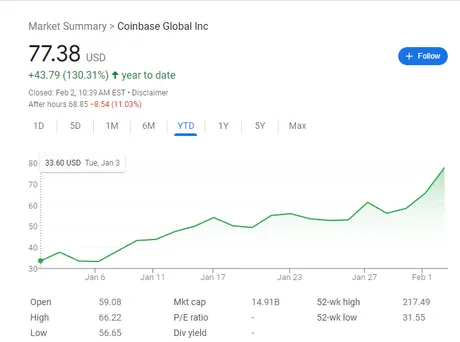

In the last month Coinbase's stock is up 130%. How wild is that? Cathie Wood of Ark Investments had her best month ever over the last 30 days as well. Facebook/Meta is up 20% after declaring massive losses on the metaverse branch. Clearly, we are still fully encased within the bad news is good news financial paradigm.

I think we have to assume that billions of dollars who want to be investing in risk-on assets simply aren't because of the age-old adage "don't fight the FED". These record-breaking hikes that have been occurring for 11 months in a row now have created a completely artificial lack of demand for financial risk. The moment this artificial sentiment melts away we are in for one helluva pump and dump. Considering what happens I may have to start taking some gains in as soon as three months, as that's often how long it takes for these things to materialize.

This is such crazy timing that seems to be constantly revolving around the same theme. All of the times that I would normally say are bullish end up being bearish, and vice versa. We've been in opposite-land for an entire year or two. Normally I would say late April is a great time to get in and there's not a lot of volatility. Now it looks like again it might turn out exactly the opposite just like we saw in 2021.

And we also need to remember just how badly this bear market has hammered us. Coinbase might be up 130% in 30 days, but they are still down 77% from the peak of the last bull market. How long will it take to recover? Well, nobody expects it will be this year because of how every indicator points otherwise. At the same time we know how irrational markets get and that the ideal environment for any outcome is that no one expects it. Tough call. Always is.

But what of the actual FED meeting?

signaling that potentially only a “couple more hikes” were likely to achieve an “approximately restrictive stance.”

Powell has explicitly stated that the hope is that there will be a couple more hikes. There are other expectations that there will be only one 25 point hike left to go before a complete pause. Whenever that pause comes (or is explicitly stated) we get another round of pamps. It won't be long now.

He maintained the view [that] the risk of doing too much is less than the risk of doing too little.

This is a funny statement for Powell to make considering that they've already done way too much. The deflationary snapback was coming either way, and the 5% fund rate is going to accelerate this snapback to a very alarming rate. Their trailing metrics are already out of date. Then again perhaps this was the plan all along. I still maintain the cronies are insider trading all of these moves.

As I write this Bitcoin has broken through the $24k barrier once again. The aggressive shorts have been annihilated. It's pretty obvious from price action that there was a massive liquidation yesterday that squeezed the bears, and we have no reason to believe this market will change anytime soon (even though it would make sense if it did). By all accounts this market is up 50% and showing almost no signs of pullback. Pretty crazy honestly, but that's crypto for ya.

There have also been some interesting regulation developments while we wait for the outcome of Ripple lawsuit (hope they win). I read a report today that details how it is now common practice for SEC lawyers to try and use Tweets as evidence and gain a literal legal advantage from them. Talk about what-you-say-can-and-will-be-used-against-you. Christ Almighty!

In this case SEC lawyers showed the judge a LBRY tweet that recommends that other developers should not be transparent with the SEC, because Library was fully transparent and that actually put them at the top of the list to be attacked. Let's see if I can find it...

When SEC lawyers shared this with the judge, the judge literally laughed in their faces (along with the rest of the court) and said that they need to stop taking this stuff so seriously and should instead focus that energy on creating actual regulatory clarity within the cryptosphere. Wow!

SEC owned a SECond time...

So apparently the LBRY team has gotten a huge win in their own case against the SEC which I'm learning about right now as I write this post.

SEC settles on security claim in LBRY case; community calls it a big win for crypto

This fully confirms what I said in my last post about regulations: that someone can create a token and sell it and be ruled securities fraud, but once that token is out in the ecosystem it is no longer a security. Wild. This is huge for crypto and not a lot of people are talking about it.

And also I had no idea that this John Deaton guy was acting as amicus curiae for Library in addition to Ripple. Wow, this guy is everywhere backstabbing the SEC at every turn. Hilarious. He must really have a vendetta against this blatant regulatory overreach. Nice.

It's pretty clear that Coinbase should indeed resume XRP trading given this regulatory clarity. Somehow I doubt that will happen because Brian Armstrong is kind of a coward imo. This is the perfect time to kick the SEC when they are down and relist a token that still has an active ongoing court case with the SEC. It's pretty clear that the only thing these government agencies actually respect is force. Par for the course.

Conclusion

A bull trap pump and dump is seeming more and more likely as we travel through this historic time period. This is funny because famously bearish Twitter accounts like CryptoCapo saying things like "biggest bull trap I've ever seen" are being ruthlessly mocked as the market goes up. However, just like Michael Burry shorted the housing market way too early, so are the bears shorting this market way too early as well. +50% is nothing. Get back to me at +200% in a couple months and we'll talk. 2019 appears to be playing out all over again. Very strange. History rhymes.

- The value of the dollar is going down.

- The FED is on the verge of pivoting and pausing rate hikes.

- Library has struck a crucial blow to SEC regulatory overreach.

- Ripple has a very good chance of winning their lawsuit.

- Coinbase stock is up 130% in 30 days.

I don't know mang, if you ask me this market is starting to get very crazy, and all the metrics point to it getting even crazier. Hold onto your hats!

Posted Using LeoFinance Beta

Return from FOMC Was Unsurprisingly Favorable to edicted's Web3 Blog