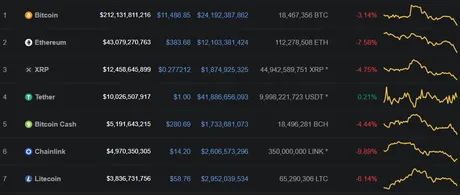

Crypto getting slightly hammered.

Okay so the market is down a bit today; not by much but enough to raise an eyebrow and wonder if there's any weird speculation going on. So I check my crypto news feed and see what's up:

Capital flight from China?

So yeah from a lot of investor's perspectives, this report from Chainalysis could look not-great at best. And this didn't just appear on the crypto-news circuit. Check that out: CNBC is reporting it.

If there is indeed a light dump going on right now because of this news, that's actually pretty bullish. This is totally empty fluff FUD, and many of the traders dumping would be doing so because they are meta speculating. They are speculating that weak hands will speculate poorly and dump, therefore they dump first and try to capitalize on that.

The fear here is that money exiting China via crypto will only stay there temporarily, and the assets will be turned into cash or whatever else locally, putting selling pressure on the market.

The problem?

Well, for starters, Tether was a big vessel in this supposed exodus. Meaning that dumping Tether isn't really going to affect the crypto market at large, which is exactly why someone with deep pockets would want to use it for this purpose of capital flight in the first place.

The market cap of Tether is currently $10 billion.

It's done nothing but go up since November 2018.

In addition, this analysis covers a year's worth of activity, and traders might be foolishly trying to price in an event that has already happened. If capital flight did indeed occur, the crypto assets being moved ($50 billion) have already been sold, and the irrational fear that this report could somehow cause more Bitcoin to be dumped than it has already... is just downright ridiculous, especially on a short-term time-period like a couple days or weeks.

This data is creating irrational FUD and being reported by the mainstream news circuit.

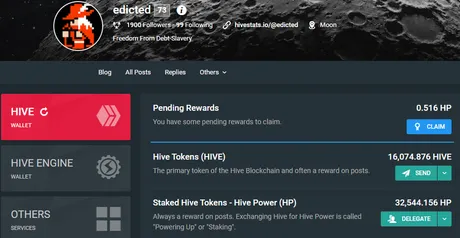

Urge to power up... RISING!

I had to suppress a HUGE urge today to power up all those 16k coins and restart my powerdown. A little voice was telling me:

Cmon, just do it... no big deal!

Need I remind you all that my gut feelings in these situations are wrong like 99% of the time.

Many analysts are saying labor day (2 weeks out) is going to be a good time for Bitcoin for various reasons. I even agree with that sentiment for a separate set of reasons (doubling curve vs resistance lines). There are a lot of people that all say the same thing: Bitcoin looks like it's going up in the short-term.

This mini-dump could turn into quite a fun bear trap, especially if bears start opening up shorts and bet that BTC will fall below the doubling curve. All that money would get liquidated immediately to the upside. #dreambig

2020 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $6933 | $7467 | $8000 | $8533 | $9067 | $9600 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $10133 | $10667 | $11200 | $11733 | $12267 | $12800 |

We see that the price of Bitcoin right now is essentially only a month away from the doubling curve support at $11400. Everything about this situation screams "buy". Even if BTC did drop to $10500 in the short term you'd only have to wait a month to get your money back assuming the curve holds (it will).

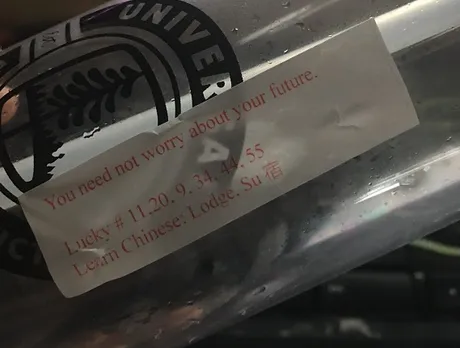

Fortune Cookie?

This is the real reason why Bitcoin will moon soon™. Today I pulled out my water bottle from the bug-out bag I packed to evacuate the fires. A little bit of water leaked out and got on the outside of the bottle. Stuck to the bottle was this fortune cookie saying not to worry about my future. BTC to the moon, fam!

Where did this thing come from? How often does a fortune cookie actually tell your fortune?

Not fortunes!

The road to knowledge begins with the turn of a page...

When one door closes, another opens.

In any case

I don't play the lottery, but those numbers are magic. Feel free to use them:

11 20 9 34 44 55

Conclusion

I actually hope this pushes Bitcoin down to the doubling curve at $10,500. Creating that kind of false downward pressure would send the market skyrocketing up once it hits that "rock" bottom. More of a trampoline than a rock... Volatility breeds volatility.

Return from Fortune Favors the Fool to edicted's Web3 Blog