I've done it!

For the first time ever I have successfully completed a full 13 week powerdown. I've never done such a thing, except for that one time when I powered down all my Steem and swapped it for Hive. Peace out, J-Sun.

The only reason I was able to complete it this time around was that I was only cashing out 1000 Hive a week (13k total). Coincidentally, this just so happened to be very very close to my exact monthly income from blogging & curation. Not too shabby. It's actually kind of weird earning so much across multiple platforms. Web3 I tell ya.

During this time I was also doing 100% powerups on my posts. Now that HBD is trading significantly over $1 I can no longer do that profitably, so I've since switched back to 50/50 payouts to support the network and dump my much-needed HBD onto the market. I look forward to my HBD payouts coming in after a few days time.

I miss $1 LEO

Remember when my 70k LEO stack was worth $70,000? I do! Those were the days! Even though LEO is up from a 20 cent rock-bottom to just under 30 cents, it's still massively undervalued. Remember back in the day when I was trading a tiny bit of LEO into Hive at a 3:1 and 4:1 ratio and everyone said I was nuts? Hm, looks like the ratio is back down to 0.5. The tides are changing once again. Or maybe they aren't.

LEO is on sale.

But so is Hive and potentially CUB as well, so it's hard to move money around in one direction or another. What I do know is this: if one of these bags moons I use them to balance the rest. Sink or swim together: that is the motto of my crypto bags. If only it were the motto of the entire industry. Tribalism strong.

Right now the hope is that the IDO launchpad moons CUB, and I can buy LEO with CUB. Then ideally LEO would moon which I would then use to buy Hive. Dream big, amirite? Such waterfall timings are usually impossible, but if I happen to catch one I could be set for life at this point. Let's hear it for this Triple-Crown bet.

There's also the issue of the CAKEPOP IDO.

I think any profits from that volatile rat-race I'll put directly into Hive. Although I also have the option to start stacking CAKE in the CUB kingdom because the large dividend on CAKEPOP happens to dump BUSD for CAKE. It seems as though all these things are connected and bolster each other. I've never bought or held any CAKE before, but now I'm thinking about it because of some oddball meme-coin launch on CUB. So random.

Judging to the tokenomics of this thing, it's possible that if you just hold the CAKEPOP in your wallet from day one (after IDO)... you might end up paying off the principal just by doing nothing and holding onto the CAKE that gets generated as dividend. It's tokenomics like this that allow risk to be mitigated in an automated fashion that requires zero user interaction. This is powerful, even if/when it turns out to be a short-term speculative meme coin and nothing else.

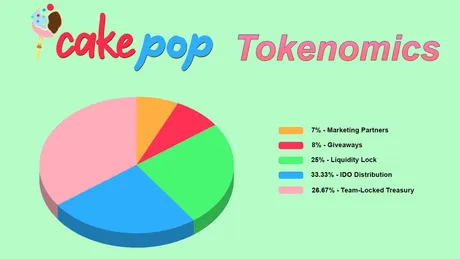

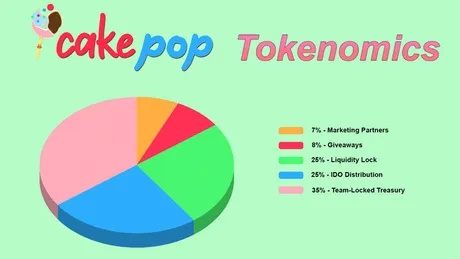

Speaking of the tokenomics:

Apparently they have been modified. The original post has been edited shortly after I talked shit about the huge premine, which has apparently been reduced from 35% to 26.67%, and the excess added to the IDO distribution. Although the math is still confusing and we need more info.

Under these numbers, if you put in $2500 into the IDO (own 1% of it), you'd get 1% of 333,333,333 CAKEPOP (3,333,333) that gets minted. At an opening price of $0.0005 per CAKEPOP, that's $1666.67.

Under the old numbers, if you put in $2500 (owned 1% of the liquidity lock) that would give you 2.5M CAKEPOP which is worth $1250. I assume my math is wrong because the BUSD side of the equation is getting in the way, but again... need more info.

It's quite unclear and the examples given in the original post directly contradict what I've just said.

Because if this is how it works it would be better to just wait for the IDO to complete and buy at the discounted price. Although every indication given on the original post implies the opposite so I'll wait for a more official announcement. I'm not even sure how long the IDO is going to last. August 30th will be interesting.

For example if a user deposits $10,000 in the IDO raise of $250,000 but the total raise amount overflows to $500,000 then the user will receive 50% (since it was 2x overfilled) of their share in the total 250,000,000 $CAKEPOP up for grabs (10,000,000 $CAKEPOP tokens for this user) at the fixed IDO valuation of $0.0005 per $CAKEPOP. This means that this user has received $5,000 worth of CAKEPOP and their other $5,000 deposited in the IDO that wasn’t used will be automatically returned to their wallet as the original CUB-BUSD tokens.

This is what was originally posted.

The problem here is that $5000 ($2500 CUB/$2500 BUSD) is 2% of the $250000 IDO total, while the number of coins issued to that user (10M CAKEPOP) is 4% of the total distribution, therefore this sounds pretty incorrect, as twice as many tokens are being issued in this scenario. Probably just a typo, because what it says now is even more incorrect:

For example if a user deposits $10,000 in the IDO raise of $250,000 but the total raise amount overflows to $500,000 then the user will receive 50% (since it was 2x overfilled) of their share in the total 333,333,333 $CAKEPOP up for grabs (10,000,000 $CAKEPOP tokens for this user) at the fixed IDO valuation of $0.0005 per $CAKEPOP. This means that this user has received $5,000 worth of CAKEPOP and their other $5,000 deposited in the IDO that wasn’t used will be automatically returned to their wallet as the original CUB-BUSD tokens.

All that's been changed is the 250,000,000 number to 333,333,333. Nothing else was modified, which is mathematically impossible, so I'm still taking a wait and see attitude. There are obviously errors here.

It's hard to see how these numbers are going to add up to 1B total tokens minted without the IDO being a bad deal on opening day. For every CAKEPOP in the LP (currently displayed as 250,000,000) twice as many tokens (500M) must be issued via the IDO to make up for the BUSD side of the equation. However, only 333M are currently allocated there, and originally it was 250M, which is obviously even less.

Conclusion

I doubt I've stumbled onto anything weird here; just a miscommunication. However, I have no reason to participate in CAKEPOP whatsoever if the opening USD value of the CAKEPOP I receive is lower than what I put into it, especially considering the 8% tax that comes from selling those tokens. Needless to say I expect some kind of explanation before I jump on in. The numbers don't match the examples given.

Posted Using LeoFinance Beta

Return from Full Powerdown Completed to edicted's Web3 Blog