Another full-moon, another crashing market.

I'm shocked. Shocked I tell you.

I made a really good play on July 2nd when CUB crashed to 2.1 cents. Basically sold a bunch of assets I was holding in reserve (including Bitcoin/Hive) into the CUB/BUSD farm. I was getting very nervous when Hive and Bitcoin where climbing during this bearish 2-week cycle. But now that's all ancient history. Hive and Bitcoin are back to scraping the bottom and CUB still higher than 2.1 cents.

Not that it matters.

The real benefit to the CUB/BUSD LP is the BUSD side of the equation. Now I have enough money in there to basically pay bills for a year or two without having to scramble to sell Hive. Very much looking forward to grinding my HP back into the 200k+ area with my blurg post rewards and curation.

It's always going to sting a bit knowing I should have ran for the hills when my Polycub stack was over $140k. I think my CUB stack was over $100k at the time as well. To think that I could have just cashed out a quarter million dollars and had that to buy the dip? UG! But it's also important that at the time we were all shooting the moon and expecting to be multi-millionaires. Being greedy gets constantly punished in crypto. Easy come easy go. Better to grind out the money and secure it over a long time period. Live and learn.

Migration back into CUB

The next halving event for Polycub is going to push yields significantly under CUB yields. Mathematically I would assume that this with spark a minor reverse-migration from Polycub back into CUB. Not a difficult feat considering the market cap of CUB is only 35% as big as Polycub, and even Polycub is a dinky little $1M cap. At these levels even $1000 has a noteworthy impact on the price of CUB, and it is known that various whales (including subsidies from Khal) are keeping CUB alive. I guess I'm one of those whales too considering I own something like 5% of all tokens in circulation. Pretty wild.

I think it's funny that the "CEO" of a "Company" (Khal) would dump his own money into his own projects. Classic critical difference between penny stocks and penny crypto. A penny stock is created for the sole purpose of getting funding for the company. The creators of that company literally can't afford to "buy the dip" and put their own money back into the stock. As much as we like to look at crypto's like stocks, these critical differences add up to a completely different outcome. Things like CUB/Polycub/LEO can't die because the community (and even the founder) won't let them die. The same is true for Hive and Bitcoin, but even moreso due to the increased decentralization of it all. Dozens of books will be written about this strange history ten years down the line.

Objects in motion tend to stay in motion.

I've noticed something a little weird with DEFI. Yields go down but a lot of the whales in those LPs don't move their money out of the position. Very true with the LEO/BNB and LEO/MATIC LPs. The same people that were in for 100% APRs are still there at 20%. This gives me pause as to whether or not there will actually be a migration back to CUB. A lot of money in DEFI seems to stay put right where it is.

It's actually a pretty interesting scenario and makes me wonder if there is some kind of secret sauce that will lead to users providing the maximum amount of liquidity for the least payoff. That should be the goal of everyone DEFI platform. The platform is like an employer or a business and the LPs are like employees or clients. Both sides want the best deal, but the platform chooses the price.

Things get even more muddled when we look at incoming governance votes on something like Polycub. The platform chooses the price, but the platform is controlled by the clients. When we actually look at how crypto works... it's so backwards and nonsensical when compared to anything we've ever seen, but yet we keep on making comparisons to the stock market and corporations to our own detriment.

Have I not talked about the 9.1% CPI yet?

Everyone is talking about the Consumer Price Index today. The number came in at 9.1%. This is unsurprising to most in crypto, but it also has some dire ramifications attached to it (which is why the market dipped today; goddess moon is displeased!).

While everyone is crying about inflation, the CPI does not measure inflation, which is an expansion of the money supply. Rather, as implied by the name of the thing, the CPI measures aggregate price over time of a basket of assets. It's a very flawed metric, but then again most economic metrics are very flawed. They all have to be taken with a grain of salt.

For example, when prices go up, everyone calls that inflation. When prices go down, everyone calls it a "good deal" or "what I deserve". The self-entitlement and absurdity of such a mindset is a thing of legend. Everyone knows prices going down doesn't mean deflation, and yet they all refuse to admit that prices going up is not inflation. Inflation and deflation are tiny subsets of price action based on the money supply. They have nothing to do with what is going on right now. But I'm done sounding like a broken record on this one.

FED to increase rates?

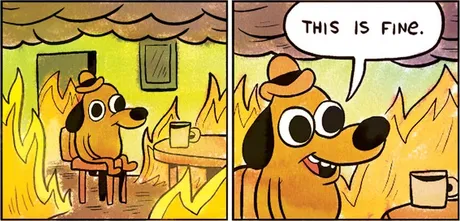

The FED said they would wait for the data to come out before they decided to increase rates or not. This data tells us that they will almost certainly increase rates, even though doing so will likely collapse the economy. I suggest balance positions going forward. The bottom isn't in until the FED reverses course, and the FED may not reverse course until everything is on fire.

That being said, Bitcoin is still comically oversold and we are consolidating in a range that we have never consolidated in before. If I had to guess, I'd say that the next Bitcoin crash (if we even get one) will be much less harsh than the previous ones we've seen. That's just the name of the game when we dig dig dig and finally hit rockbed. Bulls with income are gobbling up crypto at these low prices with hungry eyes. I'd be surprised if BTC went lower than $15k (unless it's a crazy flash crash to $10k with immediate recovery to $15k). Make no mistake, if we get $10k I'll definitely go long again; no questions asked. That's simply too good of a deal considering how far we've come. Gamble Gamble.

Conclusion

We made it past the bearish 2-week cycle. The supermoon is upon us. Another 2-weeks of up after we get this bad CPI taste out of the mouth of the market. Looks like the next FED meeting is... July 27th? Probably have to sell some crypto on July 25th for bill-paying and whatnot. Every time I sell crypto at these levels is a bit cringe, but whatever. I'm low maintenance.

In any case, we are very near the bottom. When FED increases rates again (as it looks like they will) the entire economy is going to collapse in short order. Should be fun. Luckily I don't have a job I can get laid-off from.

Posted Using LeoFinance Beta

Return from Full SuperMoon Dump into 9.1% CPI to edicted's Web3 Blog