GoT

How does one navigate the Impossible Trinity?

Nothing in this world is perfect, nor is it supposed to be. This is the nature of the simulation we call reality. Every path has a different subset of challenges. Some lead to victory; other's to defeat. Some paths still: exist just for the prospect of existing. Not everything is meant to have a deeper meaning or purpose. Everything is as it should be.

https://www.investopedia.com/terms/t/trilemma.asp

Trilemma is a term in economic decision-making theory. Unlike a dilemma, which has two solutions, a trilemma offers three equal solutions to a complex problem. A trilemma suggests that countries have three options from which to choose when making fundamental decisions about managing their international monetary policy agreements. However, the options of the trilemma are conflictual because of mutual exclusivity, which makes only one option of the trilemma achievable at a given time.

Within the context of international economics:

- A fixed foreign exchange rate

- Free capital movement (absence of capital controls)

- An independent monetary policy

This is the original trilemma. Choose 2.

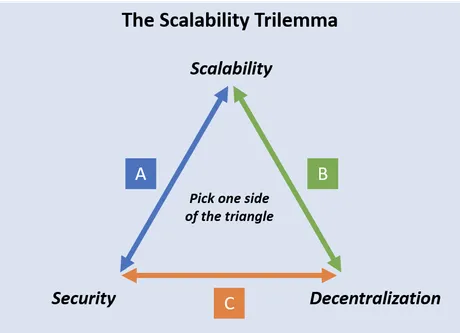

Within the context of crypto:

This is what we get.

- Decentralization

- Scalability

- Security

Vitalik Buterin is famously known as the blockchain developer who adapted the old Trilemma into this one. Vitalik Buterin is a bit of a genius and a prodigy, but there's something you should know about Vitalik Buterin: he's basically autistic. Super high-functioning autistic and extremely gifted, but definitively on the spectrum nonetheless. We can't take everything he says as gospel, and certainly not something as flawed as the Unholy Trinity.

For starters: it doesn't even make sense.

The Blockchain Trilemma is not a Trilemma at all: it's a dilemma. There are only two variables in play here: Scalability vs Security. Decentralization is simply a subset of security and can not be distinguished from it. A chain with high centralization can't have high security, just like a chain with high decentralization can't have low security.

The exceptions prove the rule.

There may be some niche situations where the above insinuation isn't true, but that doesn't matter. These situations do not come up enough to justify the existence of a trilemma. For example, one might make the argument that if it was easier to mint a Bitcoin block (lower difficultly level) then this would theoretically increase decentralization while also increasing scale. More Bitcoin blocks means more transactions getting processed at a lower cost. It also implies that more mining pools would exist and more solo miners would be able to mint their own block.

But that's just an impossible theory.

Because decentralization can't be measured like that. You can't say that "Bitcoin is more decentralized" because slightly more people have access in creating a block. The second the price moves up that bar moves up with it and we're right back where we started. In fact we can make exactly the opposite argument: Bitcoin is less decentralized given an easier difficulty because an easier difficulty introduces an attack vector that allows for double-spends. This brings the issue full circle with the idea that it's very difficult to distinguish between decentralization and security.

Of course that might be a bad take.

I could easily be begging the question here by assuming what I said is true based on the original assumption. Perhaps that was just the perfect example of how one could increase decentralization while lowering security and increasing scale. So allow me to take it one step further.

Increasing scale and lowering difficulty in this case means a bigger blockchain. More data needs to be stored. This increases the cost of running a node, which means that less people will run a node. Thus the end result is that more decentralization in one area (distribution, rewards, and governance) leads to less decentralization in another area (data redundancy). It should become quite clear at this point that there are multiple types of decentralization along with multiple types of security and scale. Lumping them all together as if they are the same is a comically reductive oversimplification.

Types of Security:

- Hash algorithm

- Cryptography

- Node connections/communication

- Level of centralized control of bottlenecks

- Mining centralization (for POW governance)

- Coin distribution (for stake based governance)

- etc

Types of Scale

- More transactions per second (quantity)

- Higher value transactions (quality)

- The required operation fees

- Total size of the database

- Amount of RAM required

- Amount of internet bandwidth required to seed a new node

- Bandwidth required for nodes to talk to each other in real time

- etc

Types of Decentralization

- Token distribution

- Governance power distribution

- Ability to fork/upgrade core code

- Number of full-nodes and otherwise non-full-nodes

- Amount of data those nodes can process

- Users per node

- Financial incentive to obey the rules of the network

- Reputation

- Level of consensus between frontends

- etc

Looking at this list it's quite easy to see that the Trilemma is a complete farce. Different variables within the same category can easily compete with each other in addition to the same variable existing in multiple categories. Take Monero (XMR) for example; a privacy token. The fact that it is private and very difficult to trace means it has good security right? This quality also makes it more decentralized as code like the Dandelion protocol ensure that even IP addresses are difficult to track. Anyone can participate with a reasonable expectation that it will certainly be more private than a non-private platform.

However, the fact that XMR is private means that no one can audit the platform. Nobody knows for sure if there's an exploit was discovered that allows a hacker to mint tokens out of thin air. Nobody knows for sure how many coins even exist total. So again we're left in a situation where the thing that makes the platform more secure is also the thing that makes it less secure. The oversimplified theory of a trilemma model experiences systemic failure in face of a complex reality.

There's also the problem of the same variable existing in multiple categories. For example, token distribution is both a form of decentralization and security within a stake-based system. The type of encryption being used could be linked with scale due to the resources required to employ it. It is often argued that Bitcoin's inability to upgrade and change core code is actually a feature and not a bug. On and on the rabbit hole of paradox continues when we attempt to oversimplify complex systems in such a basic-bitch manner.

There is such a thing as superior solutions.

Sometimes a way of doing things presents itself that can't help but be adopted by anyone and everyone. Why else would a human share 60% of its DNA with a banana? This is due to the fact that this backbone core code was the best solution for all living tissue, not just our specific genetic lineage. To assume that we could never hope to find a solution that doesn't have many pitfalls is a bit naïve. After all, it was assumed that the Byzantine General's problem itself was an impossible solve until Satoshi Nakamoto solved it. These things do happen, even if few and far between.

Personally I'd like to take this all one step further and point out a variable that nobody seems to notice but is just hanging there in plain sight: centralization. But first, I would be remiss if I didn't remind everyone of an even more prominent trilemma than the ones already discussed.

- UoA (Unit of Account)

- MoE (Medium of Exchange)

- SoV (Store of Value)

Choose two.

The foundation of money and value within society itself supposedly plays by the same rules. A currency is not allowed to be all three. The idea here is that fiat currency chooses to be a unit-of-account and a medium-of-exchange while slowly sacrificing store-of-value over long periods of time because it "has to". While something like gold is supposedly a good SoV but not such a great MoE due to its weight/bulk and lack of divisibility (which is where silver coins start coming into play to compliment gold).

Here's the thing though: it's all bullshit.

The reason why fiat currency can't be a good store of value has absolutely nothing to do with the fact that it's a good unit of account and medium of exchange. The reason why it loses value over time is because it's a centralized product controlled by bankers, and the bankers that control it all want to extract as much value as humanly possible from their product. In fact, this philosophical line of thinking doesn't just apply to bankers: it applies to everyone in the entire world. Everyone would like to extract as much value as they can for as little effort as possible. That's just basic capitalism.

Once we remove the centralization variable from currency it can easily be all three. When the centralized leech of a vampire gets removed from the currency there's no reason why it can't be a store of value on top of an MoE & UoA. In fact anyone who believes in HBD already inherently agrees with this ideology. With high yields in play HBD is already in a position that totally cracks the trilemma theory in twain.

For me the most interesting thing about all of this is that no one in crypto is actually attempting to create an asset that has all three. Everyone assumes that Unit-of-Account and stability of cryptocurrency is impossible (unless it's a stable-coin pegged to USD, which doesn't count) to achieve. Why?

Why would it be IMPOSSIBLE to create a stable asset based on the economic policy of the network itself? It seriously boggles the mind that crypto enthusiasts are resigned to the idea that USD will forever be the measuring stick of value in which all products are weighed... except of course for the delusional maximalists who wrongfully think that Bitcoin will magically become stable and defeat the market cycle simply by getting mainstream adoption. Again: it's all just mindboggling.

If we're being honest, creating stability in crypto isn't something that anyone seems to truly want. Everyone wants number to go up and nobody wants number to come down. It's a delusional mindset rooted in greed and we should shed ourselves of such toxicity. All in good time I suppose, as there is zero indication that such a thing could possibly happen within any kind of predictable window.

Conclusion

The Impossible Trinity is a great example and tool that can give us insight into how the world actually works behind the scenes. Tradeoffs do exist: this is undeniable. We can't have it all, and we must pick and choose which variables in the equation are important to us; acting accordingly in the process and sacrificing potential benefits that just aren't important enough to incorporate. It's a priorities game. Some variables are mutually exclusive and cancel each other out; we can't have both. Similar to life and evolution itself: there are no perfect solutions, only combinations that are good enough to survive and propagate.

It should come as no surprise that a decades-old economic policy that likely wasn't 100% accurate to begin with was never going to correctly translate to crypto, and yet the vast majority of crypto users out there seem to accept this adaptation of the Crypto Trinity as extremely profound and insightful. It's not. It muddies the waters and confuses an already confusing issue with ironic oversimplicity.

At the end of the day it is not possible to take a legacy economic theory and adapt it to crypto. Every previously forged economic theory operates under the assumption that production, money, and governance are centralized. This is the variable that matters. We haven't the slightest clue about what will happen when this variable is eliminated at scale during a wave of mass adoption. Better to just admit we know nothing and come at it with a blank slate than try to project old theories (that were already heinously flawed to begin with) onto a completely foreign paradigm.

Thinking you know is much worse than not knowing.

Beware the unknown unknowns.

Return from Game of Tradeoffs: Choose Three to edicted's Web3 Blog