It was only two days ago that I asked Hive to crash back down to the obvious support line so I could yolo all in like a degen. We are very close to that level now. Am I ready to yolo all in? LoL, nah... what if it goes lower! Boy Howdy!

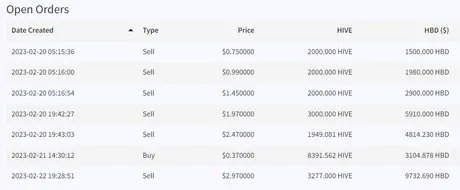

This is a classic example of why all of our buy and sell orders should be chosen in advance and not messed with. Provide liquidity on the books and the network will reward you. Use a step-ladder and DCA accordingly. Try not to run out of liquidity one way or the other unless you're willing to be locked out of the market on further declines/pumps after going all in.

For example if we look at my orders on the books right now they are extremely deep and looking to capitalize on pumps or dumps in either direction. I've got all my HBD sitting at 0.37 and Hive would need to pump to $3 in order for me to have no liquidity left in the upward direction. Obviously there won't be any tears in that scenario. Basically not even possible at this point. Give it a 0.00001% chance.

You know what's really funny is that I would totally yolo all in here if the market hadn't started crashing immediately after the new moon ended on the 20th. Perhaps Godden Moon is still trading these markets and I should wait two weeks for a full moon before going full greed. Or maybe I should just chill out and stop gambling with my rent money. One of those.

NAH! Degen fo life.

Hive is rocking three pretty solid support lines right now.

The one at 35 cents is massive.

- Basically if Bitcoin crashes to $20k like I've been talking about for a month that's where Hive will end up. 35 cents.

- Confirmation at 44 cents would be the best outcome on the TA side of the equation.

- 40 cents is the level we dumped to before, so there is already support there from previous action, and has even more now that the MA(50) has risen up to that level.

The Hive/BTC chart is also interesting.

This is one I don't typically look at but in this case I'm willing to go the extra mile due to personal circumstances. It's pretty obvious that Hive is essentially beholden to whatever BTC decides to do. We are trapped in a pocket of moving averages and gliding with the rest of the market. The MA(25) and MA(100) seem to be offering quite a bit of support as we oscillate within the center of this band.

Spikes above the MA(200) should probably be DCA sold into Bitcoin. I may log into Mandala today and set up some sell orders around 2600 sats just in case I can catch another one of them pamps. I actually have a little Hive on exchanges, so it will be nice to use that Hive as leverage to capitalize on any potential volatility that may come our way.

I have some BTC on the exchange as well and will use that to catch any dumps. Looking to buy any dumps around the 1600 sats range. Anything below 1500 and I'll just shove all in. Hive is muh main squeeze after all.

But what of Bitcoin?

If the fate of Hive seems a bit tied to the fate of the rest of the market... what does Bitcoin look like? Uh... pretty hilariously bullish actually. Which is kinda funny because I wasn't that bullish before pulling up this chart. Crypto Twitter is losing their minds. Par for the course I guess.

We can see that we already had the 25/200 golden cross... and nothing really happened. This is to be expected as my experience with the 25/200 cross is more of a trend reversal than an actual day-trading opportunity. Talk to me again in 3 months for confirmation.

The big day trading opportunity are always crosses between the 25/100 lines, because those are the lines that everyone is looking at by default. In this case I marked the 25/100 with a yellow star and show how the price spiked 12% to $23k literally the day after even though we had already just pumped quite a bit already out of the FTX contagion zone from $17k to $21k a week prior.

It's pretty obvious that all of the current alarmists on Crypto Twitter are totally full of shit. They think we are in deep trouble given the recent declining price action. This is not what I see. I see a solid support line at $23k that we haven't even tested since February 8th. And again we get another support at $22k as a zone to retreat to combined with MA(50) rising to that level.

What's up with the light-blue star?

Once again we see another example of Golden Crosses involving the MA(50) turning into a counter signal. I've seen this with Hive like a dozen times already. MA(50) does a Golden Cross and then the market dumps and then pumps out of the dump. Death crosses seem to do the opposite when the MA(50) is involved. They pump then they dump immediately after. It's pretty weird I'm going to keep an eye out for more examples of this pattern in the future.

Notice the MA(100) and the MA(200)?

Yeah... they are about to Golden Cross in say... a week? Last time that happened was October 17, 2021, and Bitcoin was peaking at all time highs around $65k. Obviously I don't expect a rip that crazy this time around but crosses between the slow moving averages tend to be pretty damn significant. All I see is bullish bullish bullish.

$20k? Really?

We can also see that when the 100/200 do cross it's going to very close to the $20k support line. To me this reiterates the idea that $20k is likely an uncrackable support at this point and I'll even think about going long if we happen to retest that level. These bears that are still convinced we are going to $12k crack me up... like... how? Delusional. All of the signs point to a massive trend reversal. Even if we x2 long $20k that position wouldn't even get liquidated till $10k. Hard to imagine losing in that scenario. Not that leveraged trading is a good idea (unless used as a hedge).

To give an example of how accurate these slower crosses can be, let's look at the 2022 bear market MA(100)/MA(200) death cross. This happened on February 8th 2022 and we could have easily taken that as a signal to get the fuck out and sell at $45k... lol... pretty good eh? Of course if we had just sold at the 25/50 death cross we could have exited at $60k... but the faster MAs can trick you much easier than the slower ones. I simply did not want to believe that the market would go lower and we'd somehow spike to $250k. Silly.

Looking back at that 25/50 death cross... what do we see? Yet another pump and dump. Pump from $53k to $59k with a dump to $42k. Seriously these MA(50) counter-signal crosses are weird. They seem to zig-zag every single time. Mind games.

Conclusion

All of the trend reversal signals are flashing "bull-market-rally" into summer 2023 just like we saw in summer 2019, but these signals are going largely ignored by bear-market PTSD investors who want nothing more than to short an asset that makes exponential gains over time. Given this lack of faith in the Bitcoin community I have all the more reason to believe it will end up happening. Markets have a dark sense of humor like that. Don't let the psychic vampire get into your head.

I'm providing more liquidity to Hive's internal market than I ever have in the history of my Hive journey. This is going to be a time to get lucky and capitalize on volatility. Powering up 100% is not an option. We need to help stabilize this market. If we end up getting paid for our troubles, so be it.

That being said I'm going to end with how grateful I am that the internal market is actually a viable solution for trading this day in age. Used to be that providing liquidity here was a fool's errand, but now the market actually works due to the stabilizer and community faith that comes along with it. HBD has x10 more liquidity than it did a year ago, and that's really impressive.

Good times.

Stay bullish.

We're in for some chop.

Posted Using LeoFinance Beta

Return from Getting Greedy! to edicted's Web3 Blog