You know how everyone says "Not financial advice" to avoid getting sued for illegally giving financial advice? Have you ever wondered how many of the people who parrot this phrase blindly have actually looked into it? Probably not very many right?

So the other day I was sitting in the waiting room at the doctor's office and I was like: you know what, I live in the future. I have a super computer in my hand, and this super computer has direct access to the internet. What a crazy time to be alive, amirite?

So I looked it up.

And this is what I found.

https://purposefulsp.com/is-financial-coaching-breaking-the-law

As I was reading this document I was absolutely shocked on multiple occasions. It became so painfully obvious that the vast majority of people who are saying "not financial advice" have absolutely no idea why they are saying it and never even thought to look it up. They just say it instinctively because "What's the harm in saying it?" I must admit there is no harm (aside from unearned overconfidence assuming you won't get in trouble), but once you look at the actual law you may never say it again and be just fine with it.

So let's get into it, shall we?

This document is a primer on the potential liability associated with giving advice through financial coaching. Throughout this document terms like “potentially”, “can”, “may”, and other qualifiers will be used. Do not construe this use as a suggestion that it is safe to do something as you are only potentially in danger. These qualifiers are used solely to highlight that only a court can ultimately determine whether a specific action you take is illegal.

Are they fucking serious?

Even the Not-Financial-Advice article begins with a "Not Financial Advice" disclaimer. Unbelievable. So meta. No matter, as there is still good info here.

Investment Advisers Act

Violating the IAA carries with it some hefty penalties, including fines, civil liability, or jail time.

Violating the IAA (offering investment advice illegally) carries with it a fine up to $10,000 and up to 5 years in federal prison, as outlined in § 217. Notice this is ‘and’ not ‘or’, meaning you could face both the financial fine and the prison time.

Starting strong with punishments

It's always good to know what you're up against, and after reading this it's easy to see why so many would choose to deflect with a "not financial advice" statement. Those who are actually drawn and quartered by the SEC find themselves torn to pieces by the regulators. These are serious punishments that are not to be taken lightly.

However, we can see that the language of this law is "up to" meaning "cannot exceed". Within this legal context we can begin to understand what this actually means: It means that every case is basically up to the discretion of the judge or jury involved, and that most punishments should be less far less than the maximum sentence.

If this wasn’t bad enough, advice given to each of your clients could theoretically be seen as separate counts of violating the act, meaning the full prison sentence could be more than 5 years. So giving the same advice to 10 clients could, in theory, result in a 50 year prison sentence. While this is theoretically possible, only an attorney could tell you if it is likely or realistic.

AKA it is not realistic to expect that kind of punishment.

But legally they aren't allowed to tell you that explicitly.

I can because I'm not a person.

I'm @edicted.

Try to sue me.

See what happens.

As explained in § 209, the damages start relatively small at $5,000 for natural persons or $50,000 for other persons. The issue, of course, is that if you operate your business as an LLC, S-Corporation, or other legal entity; you would fall into the natural persons category and your business would fall into the other persons category.

I pasted this because corporate personhood is an interesting topic that I do not fully understand. To be fair only niche lawyers fully understand it, and I'm not a lawyer, so there is that. It looks like if you use both your personal and corporate brand to further the agenda of illegal financial advice then your LLC is far more liable than you are. Interesting. I actually would have assumed that only the LLC would be in trouble... as that's usually the entire point of creating the LLC (literally short for "limited liability").

A person could sue you for damages if you offered advice illegally and then:

- the portfolio halved in a market crash

- the portfolio was lost to a lawsuit because your advice left the investments more open to creditors

- the assets were transferred to someone other than who was in the will due to your advice

- or one of many other scenarios which are possible (and often given as advice on radio shows or podcasts)

Think about this:

So if you tell someone to move money out of their retirement account and into an investment that succeeds greatly and goes 10x... they can still sue you if they go bankrupt (through no fault of your own) because the value that was in the retirement account was immune to bankruptcy law, but the 10x investment was not and creditors garnished it all to pay back the bad debt. Aint that but about a bitch? No good deed goes unpunished, amirite?

This is what caught my eye.

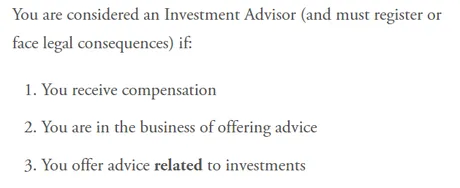

This is why I decided to write this post. Does this sound like you? Do you get paid for the advice you give? Are you in the business of offering advice? The answer for 99.9% of us that say "not financial advice" is unequivocally "no". Given this fact, the chance that we could actually be sued for giving financial advice is very small because one of the key elements to getting sued for financial advice is making money off said advice, which we are not.

Of course if the SEC really wanted to be a dick about it they could say the money I made on the blog post counts as being paid, which would be pretty ridiculous considering I'm not being paid because of the advice I gave.

I'm being payed because of the reputation I've farmed and the networking connections I've made over the last six years. Of course the situation gets more and more iffy if Hive moons and suddenly a post pays out thousands of dollars in my name. Good thing @edicted is anyone in the world with the posting key to @edicted, amirite? Could be anybody really. Who's to say?

The IAA defines an investment advisor as “a person who, for compensation, engages in the business of advising others, either directly or through publications, as to the value of securities or as to the advisability of investing in, purchasing, or selling securities or . . . who promulgates analysis or reports concerning securities . . . .” (1)

BUT THIS REALLY CAUGHT MY EYE

When we look at the actual legalese for truly defining these things, we see some VERY interesting statements.

- For compensation (you got paid)

- Engages in the

businessof advising others - as to the value of

securities - or as to the advisability of investing in, purchasing, or selling

securities - who promulgates analysis or reports concerning

securities

SECURITIES SECURITIES SECURITIES!

Notice how "securities" gets repeated over and over and over again. If the product you are shilling is not a security, the chance of you being sued over that advice drops dramatically. This means that anyone who shills gold or Bitcoin (or even Hive) will probably never get sued. Even if you did: your lawyer could make a very compelling argument that the prosecution has not even done their due diligence in proving that the underlying crypto asset is a security in the first place.

No wonder why the SEC wants to declare everything under the sun a security.

If it's not a security, they have absolutely no power over it. This is what I have learned every time I've delved into the law regarding these matters.

- If it's not a security: it doesn't pass the Howey Test.

- If it's not a security: the SEC has no power.

- If it's not a security: it's not insider trading.

- If it's not a security: it's not financial advice.

Seriously though...

How deep does securities law go?

No wonder why the SEC has denied every single Bitcoin ETF proposal.

It makes perfect sense now.

The crux of the SEC's position is that bitcoin's price is subject to manipulation on unregulated platforms, and approval of a bitcoin spot ETF would only invite further manipulation.

We've heard them make this claim 8 ways till Sunday, and we've called bullshit on them every time. How is a Futures EFT any less prone to manipulation? We know that it isn't so we assume the SEC are just dirty lying bastards. Typical government.

The real difference is that a BTC Futures EFT is obviously a security; issued by an incorporated entity with an address. If anyone fucks around they're going to find out. Because Bitcoin itself isn't a security at all: if they allowed a raw EFT to materialize it would be impossible for them to regulate it after they approve it. If people were insider trading that market they'd just get away with it... legally. Wow...

This really makes you wonder why the SEC even has the authority to deny a BTC EFT in the first place. Bitcoin isn't a security so why is it the SEC that gets to make this decision? Clearly this should obviously be the decision of the CFTC (Commodity Futures Trading Commission). I can only assume it's through delusion and red-tape power structures of government regulatory agencies. It gets especially weird when we consider that crypto is still legally "property" because the legal system has no way to classify it and they want to consolidate as much power as they absolutely can.

Conclusion

Getting sued for investment advice is actually much more involved than most people who blindly repeat the disclaimer assume. In fact many of you have probably heard that the "not financial advice" disclaimer doesn't mean anything and won't keep you out of trouble. I hope after reading this assessment everyone can see why this is true.

There is no way to loophole out of giving illegal investment advice with a disclaimer. Nowhere in the law is it stated that you can simply say some words and everything is all good. That's not how it works.

Hm, nice try.

If you got paid and you shilled a security, you're guilty of giving illegal financial advice unless you have a permit to do just that. This is the plain and simple truth of the matter. The disclaimer may score you some points in court (or even deter a lawyer from taking on the case in the first place), but it is by no means a get out of jail free card.

No immunity for you, sir.

The most important thing we learned out of all of this is that it's actually much easier to stay out of the "business of giving advice" than we originally thought. Anyone can shill a product to the moon as long as they aren't getting paid to shill. Look at all these famous people who shilled crypto projects that failed or were rugpulls. They didn't do it for free. They were paid huge sums of cash to shill a security and then didn't even bother to declare what they were paid to the public. That's a huge Gary Gensler no-no.

Regulation Daddy doesn't like that!

Long story short, if it's not a security, then it probably isn't illegal financial advice (or insider trading for that matter). This means we can shill Bitcoin and Hive to our hearts desire, and even get paid for it, and it would still be legal.

But think about it: how would you get paid to shill Bitcoin, Hive, or gold? The only possible way to go about it is on Hive with the proposal system. The magic Bitcoin fairy isn't going to shower you with gems for telling people to buy Bitcoin. Same story for gold, silver, or literally any other commodity.

These are the core differences between securities and commodities. Commodities don't have a centralized owner with intellectual property rights or investment contracts, and securities absolutely do. Not only that, securities have a financial incentive to pay you to shill their product. Don't do it... that's illegal... dummy.

Not financial advice.

Not legal advice.

Return from Getting Sued for Financial Advice to edicted's Web3 Blog