Can you feel it?

The market has been a very sad panda due to September price suppression. Mark my words, we probably get a 5 to 10% bump tomorrow just because it's not September anymore.

wLEO don't got time for that!

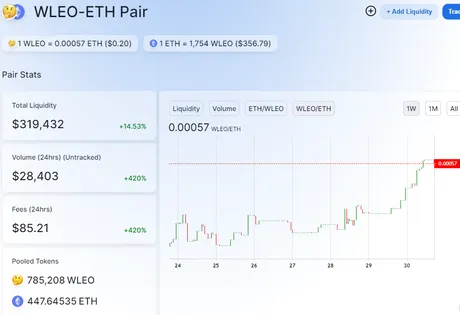

We've essentially been trading at all time highs for the last 24 hours. 18 minutes ago someone cashed out 5000 wLEO for 2.8 ETH ($1000) and that dropped our price around 1%. This is a pretty big deal considering 5000 coins is one thousandth of all coins in circulation. In comparison to Bitcoin 0.1% of all Bitcoin would be 18k coins (almost $200M). Imagine $200M worth of Bitcoin being dumped and the price moving less than 1%...

For example, if $50M in Bitcoin was dumped on Coinbase Pro right now the price would flash-crash to $7000.

Of course no one would actually do this because of all the arbitrage opportunities across all the other exchanges, but still this is a great example of how valuable it is that LEO has 15% of all coins in circulation in a single liquidity pool that doesn't contain an order book.

The Uniswap algorithm is essentially giving us the same stability and slippage rates that Bitcoin has in terms of percentages. That is crazy. It almost feels like it shouldn't even be possible, but here we are.

U mad, bro?

So am I mad that someone just dumped 5k coins in the face of trying to get the coin to moon? Not at all, in fact, considering the circumstances, it just makes me more bullish. If a whale's worth of stake can just be sloshed around like that with very little change in price it's a win for everyone. If Bitcoin has taught us anything, it's that liquidity can be the killer dapp.

Having this option to exit to Ethereum is a huge boon.

Eth is a great network, and now we have a direct mainline to them without having to go through a centralized exchange. MetaMask will likely be the most popular wallet in the world for a while. Smart-contracts are simply just too valuable.

Hive stands alone.

A lot of people have been down on Hive because of the price action. Not me! LEO is 100% fully reliant on Hive at the moment. That isn't going to change anytime soon (if ever). The benefits of the symbiotic relationship are too great to break away.

Whereas Bitcoin must pay miners to secure the network, LEO derives all security directly from the Hive blockchain. This allows LEO to pay $0 a year on security and allow the community to control 100% of all inflation via stake. Meanwhile, even Hive has to spend 10% of their inflation paying the witnesses to secure it.

Inflation bad?

Because Bitcoin has a logarithmic hard-cap on how many Bitcoin can be minted ever, people get the idea that inflation is bad. Inflation must be bad because it dilutes the value of the underlying asset.

False.

Inflation is amazing. Inflation increases liquidity and velocity and funds growth and development on its own in this self-regulating system we call capitalism. Crypto is ushering in a new form of capitalism that I like to call cooperative & open-source. It's something the world has never seen before and still doesn't understand. Those who learn quickly will have the first-move advantage.

Curbing inflation

I believe that we can create dapps using proof-of-burn tokenomics that completely flip the concept of inflation on its ear. Say I create a dapp that ends up being super popular for LEO that ends up burning 5% of all LEO tokens per year every year.

Now LEO is experiencing both sides of the coin, inflationary economics and deflationary at the same time. We all know that LEO has pretty high inflation at the moment (~10%). What if dapps on LEO applied an equal amount of proof-of-burn pressure of 10% a year. Now LEO has effectively 0% net inflation.

At this point we'd have to ask ourselves:

Should we INCREASE inflation greater than 10%?

Because like I said, inflation is good.

The only reason why people think inflation is bad is because for our entire lives inflation has been controlled by the central banking cartel. When stake-holders control inflation the ENTIRE GAME changes.

So again, we want inflation because it creates growth and increases velocity and improves network effect. Combined with powerful proof-of-burn apps the network may decide to increase inflation rather than decrease it.

In fact, allowing inflation to diminish as planned could have extremely negative effects in the face of strong proof-of-burn mechanics. Without inflation, currency becomes volatile, and the more volatile a currency is the less "unit of account" rating it receives.

- Store of value.

- Medium of exchange.

- Unit of account.

Economists will tell us that we only get to choose two of these. Having all three is impossible. That is no longer the case now that we have crypto, I guarantee it.

Cryptocurrency potential is x1000 times more powerful than anything the central banks can offer. In fact, central banks work to prevent innovation at every turn. We see this time and time again as startup innovators get bought out and watered down in an extremely corporate manner.

To be fair, there is definitely a balance between SOV, MOE, and UOA. You can sacrifice one side to benefit another. However, when crypto is doubling in market cap every year, that gives us a lot of wiggle room. Is it so ridiculous to assume that a network could sacrifice ROI gains to gain stability, while still having both? I don't believe that's a fantasy any longer.

MOE

In fact, when we look at the odd-man-out in this picture, what do we find? MOE (medium of exchange) is simply a given for every cryptocurrency in existence. Any network that pairs their currency to a BTC trading pair becomes more powerful than gold and silver in this regard. Spoiler alert: we were using precious metals as money less than 100 years ago.

This implies something quite grand: that every crypto from now until the end of time will AUTOMATICALLY have better medium of exchange than gold and silver. In fact, when crypto goes mainstream and everyone is accepting it for everything, all coins will gain greater MOE than fiat itself because you can use any crypto in any country.

Crypto is borderless.

As we can see with Uniswap and the evolution of the DEX, the only fees that need to be paid are to the network that secures the exchanges. The middle men are being cut out of the equation and governance is being automated into idealistic code. The future of crypto is bright.

Conclusion

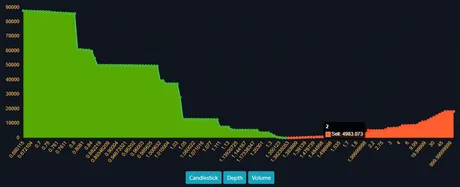

There's no LEO left on the market, and the buy-wall that I bought out is not going to be replaced. Doing so just puts the money at risk of being arbitraged by the real market (Uniswap). There are only 5k coins left up to the 30 cent mark. I expect to reach that number fairly soon given the situation.

Again, the Uniswap market feels like an ICO for ETH. We've pumped over 15% of all coins in circulation into a single pool. There is 'only' 450 ETH in the pool. What would happen if someone doubled it? For $160,000 anyone from ETH could buy 400k LEO tokens, making them the biggest whale on the network. This would x4 the price of LEO by doubling the ETH side and halving the wLEO side of the ratio, as the algorithm would let them cost-average into the market at 50% slippage.

So, I ask again, if LEO goes x4 how many users are going to sell into that demand? As a community of zealous holders, I can all but guarantee that the answer will be: not much. This is especially true if the 300k bounty isn't ending anytime soon. LEO loves to yield farm.

On the Hive side of things: never fear. Hive is doing just fine I assure you. This community refuses to die even though the world seems to keep demanding we do just that. Not gonna happen. You can't be bullish on LEO without being bullish on Hive. Hive secures and supports every token connected to the protocol.

September is ending.

Prepare for moon in Nov/Dec.

Return from Goodbye September! (Increasing inflation theory) to edicted's Web3 Blog