And that's what these bears are.

Never before in the history of Bitcoin have the bears been so comically powerless.

24h/6h/1h Candlesticks

Candlesticks tell a story, and that story changes depending how the data is organized. I NEVER look at one hour candlesticks unless we are in extremely volatile territory. Things happen quickly in the time before and after the peak.

I almost wish I had been screen capturing some of these dumps and volume sloshes in real-time on Coinbase. The information gathered there is invaluable as well.

What does it all mean?

It means the bulls are in full control, and this run ends when they say so, not before. In the past, bears had a lot of power over the market through shear force of fear. The goal is to start a snowball of fear at the top of the peak and then ride it all the way down so bears can then flip bullish and start pushing the price back up, making a pretty-penny in the process.

Bears have tried to crash this market via fear 5 times in the last 5 days. And each time the attempt has become weaker and weaker.

They are trying to intimidate buyers who have infinite funds and can't be scared off so easy. Oh, you want to dump Bitcoin? Here, let me buy that, YOINK! Yep yep, keep dumping into my greedy little goblin hands. I dare you.

At this point: it is the bears who are afraid.

FOMO is a powerful drug.

These corporate Vipers do not FUD on a day to day basis like us plebs. No, they have much stronger hands than that, and they FOMO/FUD on a quarter to quarter basis (or not at all). Gotta please those shareholders with those quarterly reports, amirite?

I've said it before and I'll say it again, the end of Q1 is usually garbage. Unless of course you plan on buying during that time... then it's a great discount a lot of the time. However, the gloves are off and this is an unprecedented situation, so who knows. We can really only guess.

When to sell?

So when should we turn bearish and take gains? It's pretty simple and I have already implied it in this post: when the bulls say so (not the bears this time). That means all we have to do is wait.

What are we waiting for?

For volume to plummet massively after a blow off top. Looking at the charts, such a blow-off top could be days away. The 24h candles tell a story: and that story is that this parabola could moon within the week.

A rising tide raises all ships

And the tide, it is a rising. However, have you ever surfed or body-boarded before? The ocean (liquidity) is a beast, and that beast is powerful when disturbed.

Even though this rising tide is lifting up all our boats, in the end that change in elevation will eventually create massive volatility to the downside. Sure, that downside will be a lot higher than when we started, but those who panic and make hasty decisions are going to wipe out hard. This water is about to get extremely choppy.

Looking at the monthly candles on Binance, we see yet another story. This is a story of the strongest bull run in history, happening right now, active, today. This is not even close to the strongest bull-run in terms of percentages (especially above the doubling curve currently x3.2) but rather that of longevity.

Never before has the 4th month in the bull run been so powerful. We've gone up up up for 4 months straight and the top still hasn't even blown off the volcano yet. When it does the market will trade angrily sideways for at least a month. February gonna be absolutely insane for day traders.

Why is this happening? Because these institutions buying Bitcoin are doing it slowly by the Michael Saylor playbook. They are using bots to buy up liquidity rather than FOMOing in all at once like retail loves to do. They are better than us at this, guaranteed.

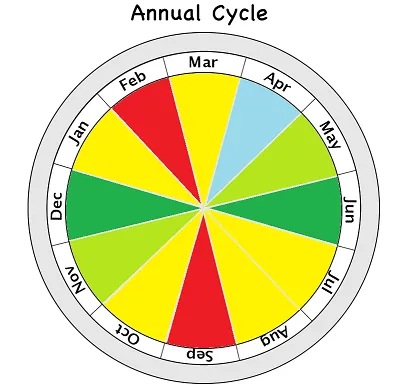

Checking out my rehashed market-cycles chart, I'd like to point everyone to April. April is the best month to buy of all time; usually right at the beginning of the month.

April Fools Day is no joke.

Go back and see for yourself: every April all the way back to 2011 was a good buy. There really is no argument. This is a time when the market has always cooled down. We don't get this kind of stability in any other month of the year. We probably won't get in at the bottom, but there is very little risk of the market crashing further.

The doubling curve is at $17k in April.

Will we crash that far? I highly doubt that unless we get a Black Swan event. It will be interesting to see when we get there, but I'm thinking more like $20k-$25k. At this point I'd def be willing to buy at $25k... which is just crazy considering Bitcoin was $10k a few months ago. How time flies.

Analysis

These bears have no teeth. This market is in complete control of the bulls, and these bulls don't flip bearish like retail. Sellers beware.

The Bitcoin being bought today might never be sold, ever. It's quite possible that these corporations padding their reserves with BTC will realize it is a unicorn asset doubling in value every year, and simply hold it forever. Rather than play the market and sell, they can simply leverage their stack to take out loans, supply collateral, and buy whatever they want.

Even if they wanted to short the market they could leverage their own Bitcoin to do so without selling it. How wild of a hedge is that? Bitcoin is crashing, the underlying collateral is dwindling, but the bet you made is gaining value. Bonkers.

These people literally can't lose; they've been at this a long time. Corporations know how to play the game and not lose... on razor thin margins I might add. When given a Unicorn asset that's doubling in value every year, they will be absolutely unstoppable.

So when do we sell? Quite simply when they stop buying. It will be pretty obvious. 30k BTC per day is good volume on Coinbase. Hell, even 20k is good. We've been trading at 30k-50k BTC per day for quite a while now, so this current volume is absolutely legendary. All we have to do is wait for the market to cool off and volume to drop back to the normal 10k per day level. Once it gets to like 8k: a drop in price is all but guaranteed.

Using the summer bull run as the closest metric, we see that it can take an entire quarter for volume to drop off a cliff and the market to crash. Wouldn't you know it... that would put us exactly in April. Go figure.

Bottom line:

There is no rush; just wait.

Posted Using LeoFinance Beta

Return from Gummy Bears to edicted's Web3 Blog