Obviously Bitcoin is doing "quite well" right now in terms of local price action. Of course if we look at the macro trendline Bitcoin is well below the level we'd expect. Funny how that works out; everyone has a short term memory when it comes to these things. It wasn't that long ago that people didn't want to sell Hive at $1.40 because it had just peaked at $3.60. Wen moon amirite?

Time has a way of changing that mentality. We get used to the current price no matter how volatile or different it was a year ago. If anyone had the opportunity to sell BTC for $50k right now they'd do it without even thinking about it, even if they had to agree to being locked out of the market for two years. Spoiler alert: BTC will be much much higher than $50k in two years. Guaranteed.

We have absolutely no reason to believe that the 4-year crypto market cycle has been broken. It's been shockingly accurate since long before I even entered the game. In fact it's been a thing since Bitcoin's inception. The first halving event caught everyone off guard in 2013 and took six months for the fundamentals to kick in, but now without fail the market tries to price it in early. And of course the market fails every time because that's not how fundamentals work. Greed simply makes the spot price even more volatile than it would be otherwise.

A busted market and a Buster Sword are the same thing yeah?

A busted market and a Buster Sword are the same thing yeah?

This is actually kinda sad when you think about it.

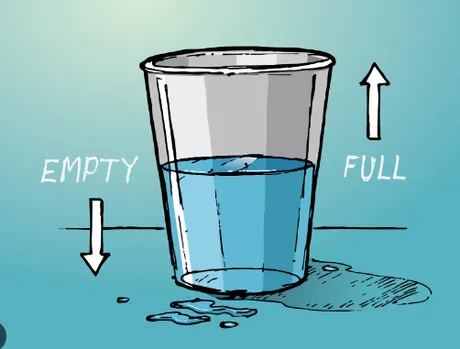

Greed shouldn't make the market more volatile. It should do exactly the opposite. Buy low; sell high. Simple equation, eh? Well if people were actually doing it correctly then Bitcoin wouldn't be very volatile at all. Pumps would get sold and bring the price down and dumps would get bought and bring the price up. Except it never seems to happen that way does it?

Instead what we see is that most people are so bad at trading and managing their finances that the vast majority of everyone is buying high and selling low over and over again thinking they're a genius. Bitcoin is a particularly hilarious asset to pan to in this regard because bad traders still make money on average. It's the one and only type of gambling where you can be terrible at it and still win. If BTC goes x10 a terrible trader can still x5 their stack and continue thinking they're doing it right. They can even lose over half of it during the bear market and still think they nailed it. Doubled up, tell ya hwat.

Halving event.

A LOT of fuss is being made over the next halving event. People have been talking about it for the entire bear market. I guarantee it will be an excellent opportunity to capitalize on the blind zealous nature of ignorant Bitcoin maximalists.

The only thing good about the Bitcoin network is that it does one basic thing very well. It transfers value from one account to another with very high security. And who pays for that security? The network does to the miners through the process of inflation via block rewards.

So imagine you were running a business.

Let's say the business has something to do with security. I don't know maybe it's an armored car service that transfers large quantities of money around. Now imagine that some dipshit executive in the corporate office has the "amazing" idea of slashing salaries in half.

Wow, what an amazing idea! If we slash salaries in half then we'll make twice as much money! This is how Bitcoin maximalists think, because they are idiots. They don't even consider for one second that perhaps dramatically slashing the income of the people who operate the entire business is maybe perhaps a bad idea with diminishing returns.

So now instead of two armed guards securing the trucks you only have one. Oh look what happened. You just got robbed. Who could have seen that coming? Literally anyone that was actually paying attention. People in crypto seem to think they can get something for nothing. Welcome to the real world, friends.

It is PAINFULLY obvious that the halving event is actually quite bearish in the short term. The next halving is particularly bearish because the hashrate of Bitcoin has been extremely suspect during the entire bear market. How is it that Bitcoin keeps hitting all time high hashrates while the price trades flat or down? The cost to mine keeps going up while the reward to mine keeps trading flat or down. It doesn't take a genius to realize that something very fishy is going on here.

And again if you ask a maximalist about this they are predictably delusional thinking everything is all good. Higher hashrate = more security bruv! So bullish! I swear to god these fucking people would spin a 51% attack into a bullish narrative. That's exactly how a 51% attack happens: the hashrate skyrockets in a way that doesn't make logical sense from an economic standpoint.

Am I saying that's what going on right now?

No it's quite impossible to say why hashrate is so crazy. We don't know which corporations, institutions, and governments have silently jumped into the mining game. I mean hell just look at El Salvador. They are talking about mining BTC with "volcano energy". It stands to reason that miners have found some very cheap sources of energy combined with more efficient hardware. That would explain the higher hashrates without being a threat to the network, but it also points to centralization.

If the only entities that can mine Bitcoin are gigantic centralized entities with access to limitless free energy then obviously that's not the best outcome. Albeit such an outcome is totally expected. Many would call this "centralized", but it's obviously not. Bitcoin already only has like 5 big mining pools.

This notion that millions of entities need to be independently participating and running their own node is downright false. It only has to be decentralized enough to avoid corruption and prevent cheating to keep all the players honest. It does not matter how centralized it appears on paper if it continues to operate as intended. I feel like this should be obvious to people but many tend to get hung up on theory rather than the reality of the world we are living in.

Conclusion

The next halving event is in April 2024 (moved up from May due to unexpected hash rates). It's creeping up on us. Only ten months away now. Don't be surprised if BTC is trading at absurd valuations around that time. The market is completely irrational and hangs in anticipation of this event. The buildup has been consolidating for over an entire year now. Take note that events like a Blackrock ETF can only catalyze this process to create an even bigger boom and bust. You guys remember Bakkt? Yeah me neither.

The halving event is clearly bearish. Paying 50% less for security on a network whose primary function is security is not something to celebrate. Fortunately the price of Bitcoin going up offsets this loss which reincentivizes the miners to double down, but until such times the halving event is a wildly volatile clusterfuck in which anything can happen. It's only bullish in the long term and will take at least a year for the actual fundamentals to catch up to the speculation.

My guess is that Bitcoiners will do what they've been saying they're going to do for over a year now. "Halving mega bullish". Everyone will be caught up in the FOMO during that time and make a bad move. We should try to take the other side of that trade, which means DCA selling 7-12 months down the road. Of course whether or not that's a solid plan will be much more clear when we can actually see what the price is. Until then it's all pure speculation.

What isn't speculation is that most people who trade crypto think they know what's going on when they really have no idea. People think they know how banking and politics and the economy work, and that's more dangerous than just admitting these topics are very complex and hard to parse.

Instead most will go in the opposite direction and oversimplify everything like they have it all figured out. Humans gonna human. Traveling with the rest of the herd seems to always lead to flying off a cliff. If your friend jumped off a bridge, would you? The answer is 'yes' apparently.

Return from Halfenninging to edicted's Web3 Blog