The halving came and went; and that was that.

There's been very little price volatility thus far, which is honestly a bit surprising. I was expecting a pretty big dump after halving, but it may be a bit delayed considering it costs $30+ to move around BTC on-chain at the moment. What happened?

They've all gone crazy, haven't they?

In fact if we look directly on chain we can see that the halving block itself, #840,000... ended up with a total reward of 40 BTC. Someone even paid six figures (3.6M sat/byte) just to get their transaction finalized on the halving block.

For frame of reference the last time I put on operation on the chain I paid something like 10 sats/byte. My last Rune loan was 69 sats/byte (because you can't lower the fee on the Thorswap frontend) which ended up costing like $10. I wouldn't even think about using BTC in these conditions.

The blocks that followed the halving event were nothing short of insane as well. With the next one paying out 7.6 BTC even though the block reward was just reduced to 3.125. Then 10 BTC. Then 19... 27... 32... 26... 21... 15... 12.5... 20.7... 22... 20... 26...24... 22... and so on. HOW?!?

Bitcoin Runes Launch at the Halving: Here's Everything You Need to Know

Welp... turns out there's yet another fungible shitcoin product that just happened to launch on the halving event. It's called Rune 'etching'... and it's dumb. As per usual.

The Runes protocol picks up where BRC-20s left off. BRC-20 is a fungible token standard, which itself makes use of the Ordinals protocol and was developed by the pseudonymous dev domo. Runes is an attempt to make the process of creating fungible tokens on Bitcoin more efficient.

Ordinals “theory” as a “lens that you can view the Bitcoin blockchain through, and when you view it through that lens, these trackable satoshis pop into view like Pokémon in the tall grass.” So, in this sense, Runes similarly represent a new lens through which to view Bitcoin—but this time, with shitcoins.

The key difference between Runes and BRC-20s is that Runes, like Bitcoin itself, uses an Unspent Transaction Output (UTXO) model, as opposed to an account model—the same model used by some layer-1 chains such as Ethereum.

That's the gist of it...

More needlessly stupid shitcoins directly on the BTC chain even though there is absolutely zero reason shitcoins would require that type of security under any circumstances. But it is what it is... we can't stop them from doing it now that the Taproot hardfork is live. Price of doing business. Maybe something good will come of it one day. Or maybe this bandwidth attack will end up being a good thing in the long run as the BTC network learns to better defend itself.

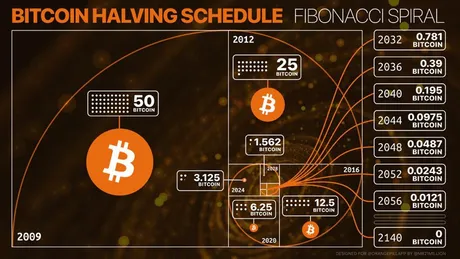

Here we see the situation spun into the direction that this is good for miners and keeps them in business even if the halving event was supposed to cut their wages in half. Clearly the miners are loving this action as they get paid these massive bonuses for minting blocks. Sure, it won't last forever but it also shows how BTC doesn't need a block reward to survive long term.

More insight to the situation

Many of the users trying to Etch these Runes are constantly outbidding one another in order to get whatever it is they are trying to get. When the block goes through there can only be one winner, but the losers can't drop their operation from the chain. The miners will prioritize these losing operations on the next block because they are paying the highest fees. That operation will then fizzle and do nothing. This has led to the entire network getting clogged up during the initial mad dash to etch these Runes.

A day later things seem to have calmed a bit and fees are slowly going down, but it's still annoying to see this kind of shitcoinery needlessly clog the most secure chain in the world. What's the solution to this? Well the bigger block forks of BTC like Bitcoin Cash would say this is why Bitcoin needs bigger blocks... but that would be false. Bitcoin does not need bigger blocks... yet. It will one day but bigger blocks aren't going to stop garbage like this from getting posted to chain. In fact that would only incentivize more.

Many Bitcoiners are delusional

Even Satoshi himself is quoted as saying that blocksize should obviously increase over time in lockstep with technological inflation/progress. However we've reached a situation where the blocksize has never been increased so that seal has to be broken before Bitcoiners are comfortable doing it regularly.

My guess is that they'll start when BTC gets flipped on the market cap or (probably more likely) the low-end cost of fees becomes extremely high (something like $50 minimum). As long as there are opportunities to move BTC around for a couple bucks at least once every couple of months it's not a big deal if they spike out of control once and a while.

The Bitcoin chart itself it casting off many bullish signals in the wake of the halving event. It seems to be catching support off the dotted red line and that purple line forged back in February could have marked a bottom. My target was always $58k and $60.5k is pretty damn close. We could be on the way up soon, but I'm still expecting one final flush before that happens. If we can get to April 25th before that happens I'll assume we dodged a bullet.

Other bullish factors?

- Hong Kong in-kind ETF

- Futures market has flipped short and funding the longs.

- Showing strength against stonks.

On top of April coming to an end and a potentially bullish summer... there are quite a few signals that point to bullishness. For starters... the halving trendline continues to tower above $100k. If that metric is still valid it will continue to act as a magnet. Hong Kong has launched an ETF within a market with $30T worth of capital locked inside. That certainly can't hurt the situation.

The S&P 500 index and other stocks have been showing weakness recently as well, and Bitcoin hasn't been dumping. Not being correlated to the stock market is always a massive victory for BTC. And finally, the funding rate for the futures market has flipped negative, which means that now longs are getting paid by the shorts to go long. It's a very good sign that traders have flipped bearish in this way as they have a knack for making exactly the wrong decisions. Always trade against the herd.

Conclusion

The halving is here and nothing notable has happened yet except for absurd fees on the Bitcoin blockchain. Could these fees be deterring users from transferring their coins to exchanges to sell? Could be, but also there are a ton of other bullish indicators (including shitcoinery apparently). We very well may just need to get past this historically sideways month before the volatility and trend can continue unabated. If not then summer will be disappointing and we'll have to weather the storm until the end of the year. That wouldn't be fun but we've all dealt with worse.

Tick Tock Next Block.

Return from Halving Aftershock: Fees Moon on BTC Runes Rollout to edicted's Web3 Blog