In this case we won't take the road less traveled.

HF25 is alive!

Shoutout to all the Hive devs who made this happen.

Including my own @hextech witness team.

It's crazy to think that we used to have a full-on corporation who's job it was to roll these things out, and we seem to be doing a better job than they ever did. Kudos to @blocktrades and everyone else.

RIP Steemit Inc.

Live and let die.

In my opinion this is the best hardfork Hive has ever seen in terms of functionality and keeping it simple. Many of the "economic incentives" imposed by our Steemit overlords have been rolled back, and I couldn't be happier about it.

- Convergent curve eliminated

- Curation curve eliminated

- Hive >> HBD conversions

- Increasing yield on HBD; quarantined to savings accounts.

- Recurring payments.

- RC pools coming soon™

Convergent curve gone

Everyone's upvotes on comments has just been doubled.

My 1% upvote has gone from 2 cents to 4 cents.

Pretty wild.

Curation curve gone

There's no longer an extreme competitive element during the curation process that gets exploited by bots. We can now upvote any comment or any post within a large window (one day) and get an automatic 50% kickback just like with HiveEngine tokens.

Apparently voting on day 2 or day 3 results in a curation reduction of 50%, while voting on day 4-7 results in a huge penalty of 87.5%. This penalty is funneled into the pockets of those who vote first, but seeing as the vast majority of users will vote on day one it seems unlikely that these other tiers will have much impact in the grand scheme of things. For the most part curation is simply a 50% kickback to the upvoter now.

Hive to HBD conversions

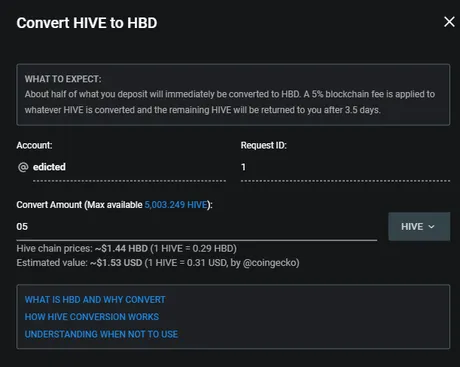

It takes 3.5 days to convert 1 HBD to about $1's worth of Hive, now it takes 3.5 days to convert Hive to HBD with a 5% penalty. This mechanic will greatly stabilize HBD and largely prevent HBD from breaking to the upside. If said breakout does occur, anyone can burn Hive at a profit to mint more HBD as necessary.

This simple solution solves a lot of the looming stability problems with HBD and makes it a lot more functional. Kudos to Peakd for hitting the ground running and already having the option right there on the frontend.

This is a huge win as it should greatly stabilize the network as a whole (hive included). In 2017/2018 we printed way too much HBD due to the broken peg and this sent the token price soaring downwards due to months and months of conversions that should have never happened in the first place.

Now that HBD will be pegged to the topside to $1.05, instead of spiking up to $13 and taking forever to return to the $1 peg, we will get back to the $1 peg immediately after the market peaks, reversing the conversion process much sooner than before. Theoretically this will make the next bear market a bit less devastating. Hopefully the days of 10 cent Hive are long gone. We deserve a higher floor than that with all the development/decentralization that's happened over the years.

Increased HBD yield.

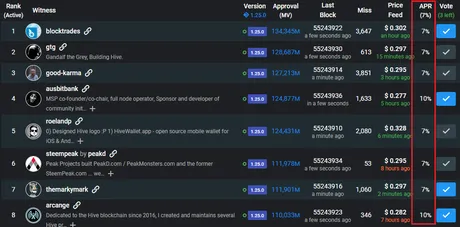

Users now have a much higher incentive to lock HBD in the bank account to farm yields (currently 7%). This yield can be raised and lowered on demand by the witnesses and is totally separate from our other inflation mechanics like the reward pool. Used to be this inflation was allocated to all HBD, but now this yield is quarantined to the 3-day timelock in the savings accounts, which feels like an improvement.

This is a nice start but it's not very competitive when compared with current DEFI protocols. Personally I think this yield should be competitive rather than a flat rate set by the witnesses. This would require a separate reward pool and make the yield variable based on stake in the pool like other dapplications.

I've been pretty vocal about how yield farming is the future and inflation minted in this way creates a lot more value than it saps, but at the end of the day we can't make too many changes to the network all at once so I guess I'll table that conversation for later.

Recurring payments

Pretty self explanatory, but I don't know much about the details. People seem excited about it, but I don't really plan on subscribing to anything anytime soon. Still, it's a nice development for potential subscription models to allocate Hive. We'll see who adopts this function.

RC pools (soon™)

This is arguably the biggest upgrade to the network to a pretty wide margin. I'm told it should be implemented before the end of the year, which will be perfectly timed if we end up getting a big wave of adoption (assuming a mega-bubble on a 4-year cycle).

The reason why this is such a big deal is that every user needs RCs to use Hive. As it stands now users without any Hive must be delegated actual tokens in order to get the RCs. Not only is this unsustainable, but it is also exploitable when token price goes up and the USD value of small delegations adds up to real money worth exploiting (happened in 2017/2018).

RCs pools separate the bandwidth resource from the governance token, something that very very (if any?) networks have accomplished. It's a pretty big deal that's usually largely understated from a backend functionality point-of-view (much like account recovery).

Conclusion

Again, in my opinion this was the best hardfork yet by a wide margin, and it was implemented more smoothly than perhaps any hardfork I've been around for.

Kudos to all the developers who made it happen (quite a few).

Hive is going places.

Posted Using LeoFinance Beta

Return from HardFork 25 Goes off without a hitch to edicted's Web3 Blog