Not sure how many times I need to post this:

April 1 April 1 April 1

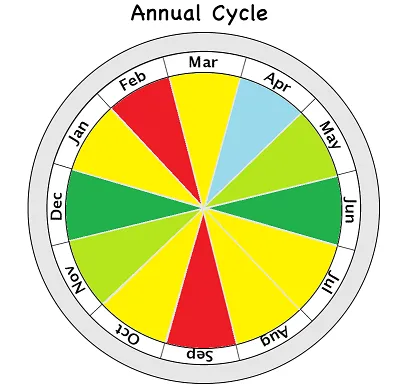

I keep saying April 1st is one of the best days to buy BTC. The price dumps right before April 1st and people are surprised? Stop living moment to moment on this financial roller coaster. Get a grip, FAM.

woonomic Tweet:

Exactly...

Think about all the corporate entities that bought into Bitcoin at the $10k-$20k levels. Wouldn't it be nice for those boys to show the world how smart they were by taking gainz right before the end of the quarter? Quarterly reports are a thing, guys.

Q1 is always a garbage quarter, and Bitcoin has essentially gone x5 over the last 6 months. That's a pretty good return, eh? Better lock in those gainz! Think about how many new users with deep pockets have entered the market lately. Think about what kind of responsibilities those people have: on a professional level and otherwise.

Most people have a very micro view of economics. Number go down, people panic. Many only see what's right in front of their faces. To be fair, trying to parse the tea-leaves of the global economy is a fool's errand. There are so many variables at play no one will ever guess right.

Still, it's worth a shot to at least try to figure this stuff out and make some generalizations to guide these decisions we have to make. If Q1 is a bad quarter in general, and Bitcoin went from $30k to $50k during that time period, we can probably assume that Q2 is going to be even better.

It doesn't really matter what we think about The Pandemic or these vaccinations or the lockdowns or the New Normal or the Great Reset. People have gone stir-crazy over the last year, and this summer may be the first time a lot of people feel like they get to take a break from the bullshit. A lot of emotionally charged money is going to be trading hands over the next 3-6 months.

If we look back to the 2017 bull run, x3 gains were made in the three weeks leading up to December 6th. This is how these things happen. FOMO kicks in and the vast majority of market cap gains are made right at the end before the blow-off top.

So where do I think Bitcoin will be at the end of the year?

x10 to x15 the doubling curve.

Bitcoin Doubling Curve

| 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 |

| 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| $3200 | $6400 | $12800 | $25600 | $51200 |

By my count Bitcoin's baseline value will only be $25.6k at the end of the year, but it will be trading at $256k - $384k. Again, considering this is one of the strongest-looking bull runs of all time, I lean towards the $400k unit-bias level being the ultimate resistance for Bitcoin at the end of the year.

So where does that put us in Q2?

I've been thinking we trade in the $100k-$120k range for a while now. A local peak often comes in June with sideways trading in July and August that often yield insane alt-markets.

Interestingly enough, if the price of BTC is around that $100k-$120k level come Q4, that x3 FOMO right at the end brings us right back into a pocket that we'd expect given the other information we've been presented ($300k-$360k).

All roads lead to Rome.

So when I see people crying about a "crash" to $50k it's simultaneously infuriating and sad at the same time. You're either that greedy or that crushed by the current economic system that you live day by day on this volatile roller coaster. Take a break, friends. If x5 gains in 6 months isn't good enough: reevaluate your position.

The only real threats I see here are selling too early due to constant panicking or FOMOing way too late after the ship has already sailed.

Dat corporate FOMO

Most of the major tech companies haven't even bought in yet. Honestly I'd be surprised if they even did by the end of the year but we'll see. This FOMO is going to strike at everyone this time around.

I was thinking corporations and tech CEOs would be stronger hands than retail, but with these kinds of gains on the table everyone is gonna go a little crazy.

Bear market

This idea that the next bear market won't be as bad as the last one because corporations are going to foot the bill is pretty ridiculous. Corporations know how to short the market just as well as anyone else (better even). It's silly to think that they'll just keep buying as the market bleeds out. Lot's of people gonna get fired in 2022 for gambling their asses off. Bitcoin has that affect on people; doesn't matter who you are. Especially if you've just entered the market and have no actual experience with it.

Just look at Dave Portnoy

LOL... panic sold at $11k? Idiot.

That's going to happen again and again in these markets, because volatility is fucking terrifying. Doesn't matter who the person is: the market knows how to get inside their heads and make them do stupid shit.

Take CUB for example. I had a pretty good idea it would crash to $2 on Wednesday. I had the price and the exact date correct, and I STILL FOMOED in a day early... lol. How did this happen? Crypto gonna get ya!

Conclusion

It is vital that we continue to remain vigilant and attempt to distance our emotions from these violent day to day movements of the market. I'm always trying to rebalance from the short to medium term and beyond.

At the end of the day Q1 is normally a garbage quarter and we still had legendary gains. No one seems to care. Greed is infinite.

Q2 should be a very interesting time for the markets. We are on the brink of reopening a stir-crazy economy. Money is sure to fly around like mad in the face of "freedom" and infinite money printing.

Posted Using LeoFinance Beta

Return from Haven't you heard? Q1 is supposed to be bad. to edicted's Web3 Blog