Introduction

Contrary to what Twitter has to say on the trending tab, no, Elon Musk is not the richest person in the world. The richest PEOPLE in the world are the ones who control USD. When you can create money on demand there's no need to flaunt your wealth. Much better to let the world think that toolbags like Zuckerberg, Bezos, and Musk are in charge. The corporate upperclass are simply the keys to power for the central bankers. The richest people don't even need a bank account.

Ask literally anyone you know who the richest people in the world are. None of them will list any of the names above. Why? Because when you've made it to the top tier, you don't actually want people to know that you're the ones in charge.

Let them think the corporations are in charge... good one.

Off-topic

But that's not what I want to talk about. I want to talk about HBD some more. Specifically: how the 10% haircut for HBD is a mistake.

Now, for those who realize exactly how HBD works and what happened in 2018, what I'm proposing here may sound like a mistake. Therefore, we must first explore why the 10% haircut exists to begin with.

HBD is a really awesome asset for the Hive ecosystem, because it allows us to print inflation without devaluing the native currency: Hive. Without HBD in circulation, all that money would have been printed as Hive tokens and it would become devalued due to more coins in circulation.

However, obviously accumulating too much debt is a very bad thing. Everyone knows this. In the case of HBD, if there is no demand for the token and it breaks to the downside, it can be destroyed in exchange for Hive in what we call a "conversion" process.

This process takes 3.5 days and uses witness USD price feeds to calculate an average value for Hive. Once the average price for Hive is determined, each HBD is exchanged for $1's worth of Hive, and the HBD vanishes from the ecosystem. This is one mechanic that makes HBD superior to DAI if we implement the CDP smart contracts. As it is currently impossible to purposefully destroy DAI for the governance token Maker, and likely will remain this way.

Death Spiral

The death spiral as it pertains to crypto is a negative feedback loop that has to potential to destroy a network or at least cause severe damage in the form of a Black Swan event.

In the context of Bitcoin, the death spiral is usually referenced in relation to the halving event:

- Cutting inflation in half reduces mining incentive.

- Less miners means less blocks being produced.

- Less blocks being produced means a lower token valuation.

- Lower token value means block rewards are even less.

- Lower block reward reduces mining incentive.

- Hashpower dips again.

- Less blocks being produced.

- Rinse and Repeat.

- Bitcoin is dead.

Of course this has never even come close to actually happening. It is highly theoretical. I for one think it's impossible because the Bitcoin network is extremely resilient and some miners will mine at a loss just to keep the network from dying. Many miners also pay for power in advance so they might as well use the energy anyway, as it's already been paid for. Many miners also use renewable sources of energy. Also the ability to purchase coins off-chain on an exchange means there will ALWAYS be a market to buy on even if the chain is locked for a while.

Off topic again.

In the context of HBD, a death-spiral is when conversions of HBD into Hive continue to push the price down lower and lower and we print an obscene amount of unwanted inflation.

Example

Hive is trading at $10 during a mega-bull run. This causes millions upon millions of HBD to be printed because half of all rewards are printed in HBD. Because Hive itself is so expensive, that means that much more HBD must be printed to be equivalent to half the reward.

For example, let's compare 10 cent Hive to $10 Hive. Let's say I get paid out $40 for a blog post (what a haul!) when Hive is trading at 10 cents a pop. Half of that ($20) will go to curators. The other half will be split 50/50 between Hive and HBD. This means 10 HBD will get printed in addition to 100 Hive powered up for my author reward.

This is backwards thinking.

It is a mistake to think that blog posts are paid out in dollars just because the front-ends portray it that way. Based on the upvotes I received for that $40 post, what's actually happening on the backend is that the post in question is generating 400 Hive of inflation total. 200 goes to curators, 100 gets powered up to my account, and 100 is printed as 10 HBD instead of Hive. This is the proper way to think about it.

Looking at the $10 example...

The network doesn't care that Hive is trading at $10 except when calculating how much HBD to print. So in this situation the post still generated exactly 400 Hive worth of inflation, but instead of printing 10 HBD it will print 1000 HBD, because it calculates how much needs to be printed from the witness oracle price feeds.

Therefore, if the witnesses just decided, right now this second, to tell their nodes that Hive was worth $10, they could do that... TODAY. It doesn't matter that it's actually trading for 12 cents. They can set the price feed to whatever they want. And if they set it high like that artificially tons and tons of HBD would get printed out of thin air as rewards for blog posts. Think about that for a second. We trust our witnesses quite a bit and don't really think about how the network actually operates until it's broken.

Death-Spiral Part 2.

So in the case of Hive and HBD, if we print too much HBD that will lead to the following death-spiral:

- HBD gets converted to Hive.

- Hive becomes devalued.

- HBD gets converted to even more Hive due to lower price of Hive.

- Hive gets more devalued.

- Now even more Hive is being printed...

In 2017, we printed like 13M HBD (formerly called SBD) that the network could not sustain. Once those HBD became worth less than $1 they started being converted for Hive, but because Hive was worth much less at this time way more Hive was printed than should have been otherwise.

Say we printed 10M HBD when Hive was trading at $10... we'd expect on average that 1M Hive would get printed over the long-run should this debt get converted back into the native currency. However, if the price of Hive happens to flash crash 99% down to 10 cents... now the network is totally fucked because when those 10M HBD get converted into Hive we have to print 100M Hive instead of 1M to pay back the debt.

Not cool!

This is where the 10% haircut comes in: to avoid the death-spiral scenario. If the USD market cap of Hive (according to witness oracles) is less than x10 the number of HBD we printed, then conversions will be haircut down to a lower level.

Imagine Hive's market cap is $50M but we have 10M HBD in circulation. This means that HBD is 20% of our market cap... very bad... therefore when HBD is converted you'd only get 50 cents on the dollar.

Let's use random numbers.

If I'm interpreting the information correctly, let's say our market cap is $77 million and we've printed 9.24M HBD. That means HBD is 12% of the total market cap. In this situation I believe the haircut would be set to around 83.33 cents (1000/12). In the absurd scenario of 77M HBD (100% debt) being in circulation I think the haircut would calculate to 10 cents per HBD (1000/100). Don't quote me on that... I'm still not totally sure.

So as we can see, the haircut breaks the tokenomics of HBD, lowering the peg, but prevents Hive from entering the death-spiral. This is the tradeoff.

The problem with this entire scenario is obvious: Hive has been haircutting HBD on and off FOR THE LAST THREE FUCKING YEARS. This is a wholly unacceptable outcome, because the haircut only exists as a rare failsafe to prevent the network from imploding. It does not exist to be used as a constant crutch as the network limps painfully forward.

How did this happen?

The ultimate problem here is that Hive is really good at making sure HBD doesn't break to the downside (less than $1) but absolutely fucking terrible at making sure HBD doesn't spike to the upside. I'm going to go ahead and be racist here and blame this one on "The Koreans". Just look at them doing it all over again on Steem with $3 SBD! WTF is wrong with those guys.

JK I love Koreans even more than I love Starcraft!

So yeah obviously it's no one's fault if our "stable coin" has demand and we aren't printing enough. That is obviously the network's fault. No one to blame but Hive consensus.

This is why we absolutely need to be able to print HBD on demand using the MakerDAO/DAI collateral system that's already been up and running for years now. It's the perfect template for Hive, and we can improve it and blow their crappy system out of the water.

How did this happen: part 2.

Okay so in 2017 there was a HUGE demand for SBD, which spiked the value of a coin to a whopping $13. This was absolutely incredible at the time; literally no one complained. Blog posts were making thousands of dollars for a single post; it was insane. No one realized (foolishly) what happened next: that we had just royally fucked up big time. Of course there was going to be a steep price to be paid after the fact... duh!

Because as soon as Hive/Steem starts crashing, HBD/SBD crashes as well, but because our stable coin was so overbought it did not return to the $1 peg for an entire year. That means an entire year of printing stablecoins that shouldn't really exist. If the system had been working properly, the stable token would have dipped under $1 immediately after we peaked and the network would have been immediately converting SBD/HBD for Steem/Hive back when the token was valued at $7, $6, and so on.

Not quite

Looking at the charts it appears that we returned to $1 in August 2018, but it doesn't matter, the damage had been done. By this time Steem had crashed to 80 cents from $8, and all that bogus debt we'd been printing for the entire bull run needed to be paid back. Instead of converting our stable coin back into the governance token constantly we hit the pause button for 8 months during the biggest bubble in history (literally the worst thing we could have done). The network has been reeling from the increased inflation ever since.

We currently sit at only 4.5M HBD printed, so we have mostly gotten over the problem, but at what cost? We've been in a bear market for 3 years, and a lot of that has to do with our positive feedback loops flipping into negative loops that greatly increase the volatility of the network. Great for gambling... really really bad for good faith and retaining users.

I believe if we never had a haircut to begin with users wouldn't of converted so much HBD. Hell, I would hold HBD if I knew for a fact it wasn't going to dip under $1. HBD would be my primary and only stablecoin. Why use anything else when you have an on-chain asset with 3 second confirmation?

Especially when you know the token has no cap to the upside (yet)... It would be dumb to not hold it when trading at $1 in that scenario; the only stable-coin that can also moon. Instead we have haircut HBD down to 60%, and thus 60 cents, multiple times. Not... worth... we should have just ate the inflation costs to support the peg.

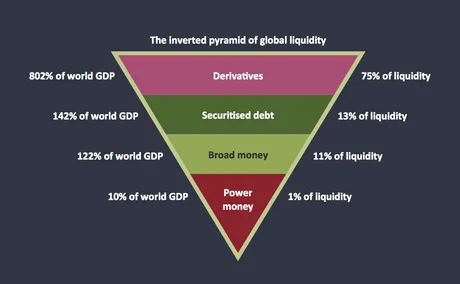

We probably don't want to fall into the same trap as the legacy debt-based economy, but at the same time we shouldn't be terrified of debt. The world has been operating on debt and the inverted pyramid for quite some time. Some would say if Hive could last that long we'd be doing a good job. Perhaps there is some value in allowing debt to exist, eh? Is it really smart to only allow 10% debt when our current economy can somehow stand on 1000%?

MakerDAO

DAI only requires that tokens be over-collateralized by 150%. That would be the equivalent of Hive allowing the haircut to go as high as 67% (100/150). This is reasonable considering the circumstances. However, on Hive, with a 10% haircut, we are basically signaling to the world that we are only comfortable with debt if we are collateralizing it by 1000% maximum (100/1000 = 10%). Kind of ridiculous when you think about it. If the collateral required on MakerDAO was 1000% , DAI would trade for much higher than $1 because it would be so difficult to mint, thus a greatly reduced supply with high demand. In fact, this is something that can only be determined by the free market, with a collateral percentage that varies over time with supply/demand constraints.

In fact, I believe that once Hive implements the self-loan CDP system that we will find that HBD is constantly above the 10% haircut line, and it might even hold the peg even though conversions are not profitable. How will it hold the peg? Because CDP smart-contracts give more incentive to buy and hold HBD than current conversions do. Like the ability to buy back HBD for cheaper than you sold them in order to pay off self-loans. The haircut might be nerfing conversions to 60 cents per HBD, but users would buy them at a higher price to pay back their loans and unlock their stake.

Side Note on Manipulation

Now imagine a whale coming in and wanting to spike the value of Hive, but they want to do it in a safe way. What would happen if that whale had say 1M Hive, but they were having trouble buying more because of a supply crunch? How could this whale get the most bang for their buck?

The answer is simple if Hive had CDP loans: Just buy more HBD. In fact, this whale could likely safely transfer all of their stable-coins and/or USD/fiat into stable asset HBD. What would happen then?

Well, imagine a situation where creating HBD out of the CDP requires 300% collateral. This is a good place to start, but it could even be higher... let's say 500%. Okay, so that means that EVERY DOLLAR that the whale puts into HBD needs to be collateralized by $5 worth of Hive. Do you see how INSANE that is?

A whale could buy and hold a bunch of HBD just to force people on the network to lock five times as much Hive into the CDP contracts. Not only do they have the benefit of having a secure stable reserve, but they also are forcing millions of coins to be locked and out of circulation. If that's not a good way to lock up coins, I don't know what is.

Now you might be thinking, but wait... isn't that market manipulation, and isn't market manipulation bad? Not... really. If a whale is holding millions in HBD that also means they are just losing free money to the Hive stakeholders, because USD is losing value every year and that debt becomes worth less and less over time, guaranteed. This is a win/win on both sides and the entire network at large.

This entire system would have a massive synergy effect that would likely x10 or even x100 the value of Hive from where it is today. And I'm not talking pump and dump mechanics; I'm talking a sustained x10 or x100... forever. This network can eat the lunch of every single stable coin out there on the market. That's a lot of scratch being left on the table.

Imagine HBD being listed on every exchange because it's the most popular stable coin that can't be regulated because it's fully decentralized. Because of all the unique mechanics of Hive, we can compete as a master's level while the other children continue playing in the sad Web 2.0 pen. The days of Web3 are here.

10% haircut is too low.

So imagine we are throttling the value of HBD with the required collateral percent, and the network finds that 300% collateral is a good place to peg HBD to $1. Are we seeing the problem here? If the haircut is set to 10% but the free market values Hive debt higher than that, we have a big problem.

HBD as a product.

Many who understand this network quite well think of HBD solely as the debt of the network. Afterall, that's what the whitepaper says, and that's how the creator of the network describes it, and it makes sense in that context.

However, HBD is also a product, and that product is on-chain stability. It is more than possible that on-chain stability is worth far greater than 10% of Hive's total market cap, be it in the middle of an epic bull run or during the worst of Black Swan events. It is in this way that HBD is actually much more than just Hive's debt. HBD is only debt when considering the conversion mechanic... which technically doesn't even have to exist once we have CDP smart-contracts (but we should keep it around so we have a robust system with multiple checks and balances).

Imagine dozens or even hundreds of businesses being built on Hive, and all of them use HBD because they don't want to gamble their livelihood on the extremely volatile asset that is Hive. Doesn't it stand to reason that the sum total of businesses built on Hive could be worth more than Hive itself? Isn't it quite possible that the demand for Hive's "DEBT" exceeded the entire market cap of Hive? It's very possible. That's exactly how the legacy economy works. Except with our system, because it is community controlled, it doesn't become unbalanced and implode from greed. Again, checks and balances.

So we really need to stop thinking of Hive's "Debt" as a bad thing. It's actually a really good thing that makes everyone a lot of money, as long as it is sustainable. That means being able to create and destroy it on demand according to said demand to maintain the peg.

Analysis

It doesn't matter how low we set the haircut percentage of HBD. Allowing less debt on the network will not magically make that debt work the way it's supposed to in terms of tokenomics (stable asset). The only way to make sure HBD doesn't fuck over the network and print inflation that it isn't supposed to, is to make sure it can be printed on demand when demand is high and burned in the same way when the floor falls out. This means CDP smart-contracts.

Not only will this completely stabilize HBD and greatly increase it's demand, but it will also lock millions and millions of Hive in the smart-contract (aka savings accounts).

Unfortunately, there is no way a system like this is going to go live in time to make the next mega-bull run. That means we just have to hope that no one is going to pump HBD because there is no way for the network to counter that "attack vector". Luckily the dev fund prints 100% of its inflation in the form of HBD; that's a good start, but I think this network needs to consider printing 100% of our inflation as HBD (even block rewards). There's really no reason not to and it gives us the chance to build use-cases for HBD that allow the network to expand so that we very rarely have to pay back debt (if ever).

In fact, it's more likely that, if we were to print 100% of inflation as HBD and we had CDP contracts, these CDP contracts would act as a huge buffer to make sure the network wasn't printing too much inflation. In the case of a mega bubble and millions of HBD printed all at once from a mooning Hive price and authors earning hundreds/thousands of dollars per post, what happens when the bubble deflates and the network contracts? Users are forced to pay off their debt and HBD gets destroyed instantly, rather than having to wait months for the price to deflate organically from lack of demand.

In fact, HBD would be getting destroyed in both ways: paying back CDP loans in addition to conversions, because the price of HBD would never break the peg in the first place. I guess I'll have to make a stink about this again during the mega-bull run when the world goes crazy the second time around.

Posted Using LeoFinance Beta

Return from HBD: 10% Debt Haircut is Too Low to edicted's Web3 Blog