This is just a friendly reminder that you should probably be powering up 100% of your Hive rewards rather than receiving a liquid payment of 50% HBD.

HBD

Hive Backed Dollars are broken tokens that we will eventually fix the mechanics for. Doing so might even x10 the price of Hive, as having access to a stable asset directly on chain creates the environment for some amazing opportunities.

The problem with HBD is the peg breaking below the $1 peg. This failed mechanic reduces the demand to hold HBD and increases the number of conversions to Hive by destroying the HBD. There are several ways this can be fixed.

I've explained in extensive detail how this can be accomplished.

https://peakd.com/hivedev/@edicted/more-on-stabilizing-hbd-sbd

Essentially we'd be implementing an advanced version of the MakerDAO system used on Ethereum to create DAI stable coin. Except here on Hive, this asset would be much more advanced and robust than DAI could ever be for various reasons.

First of all, we already have the infrastructure to easily bring this system to life. The first thing any network needs to accomplish minting stable-coins with collateral is a smart-contract that locks tokens. We literally already have this in the form of savings accounts... these things have been around since the beginning and we've never used them.

Incentivizing the savings accounts

First, I believe the obvious move to get capital to flow into the bank accounts is to get rid of the 15% of Hive inflation that gets allocated to stakeholders and redirect that income to the savings accounts.

As it stands now, that 15% inflation gives stakeholders about 2% APR in ROI. No one cares about this 2%. This is essentially wasted inflation that doesn't do anything. No one powers up their coins for this mechanic, they do it for a bigger upvote. We need to reallocate this inflation to a place where it has more value, and the obvious answer is the savings accounts.

Now you might be thinking... how can 15% of 8% inflation give a return of more than 2%? 0.15 x 0.08 is closer to 1%. How is it possible that this number gets doubled?

Ah, I'm glad you asked!

The answer lies in the power of VESTS. You see, when you power up Hive that Hive is no longer Hive; it becomes VESTS. Only VESTS can control inflation on Hive (besides block rewards and the dev fund; 10% each).

This means that all that liquid Hive being dumped on exchanges or sitting around not powered up is being devalued by inflation constantly. This is exactly why all investors on Hive should want more inflation, not less:

https://peakd.com/hive-167922/@edicted/bitcoin-is-the-stablecoin-we-need-to-print-more-inflation

Why would I want more inflation?

Because if you power up your stake you leech value from anyone who holds liquid coins. It's just free money sitting there waiting to be taken by anyone looking to support the network. That's why anyone who says we need to reduce inflation to build value here is totally full of shit. Investors want to control more inflation, not less. That's the main advantage of crypto over fiat currency: the inflation isn't controlled by a corrupt centralized entity.

Multiplier

So back to this multiplier. Even though 15% times 8% is 1.2%, these numbers assume that EVERYONE on the network is receiving this ROI, which is simply not true. Only someone who controls VESTS (Hive Power) is eligible for this money. Therefore, because there are 380M tokens in circulation, but the number of tokens powered up is only is 142M, this creates a multiplier of 380M/142M = 2.676

This 2.676 then gets multiplied by the 1.2% to increase APR for stakeholders to 3.2% a year. This is a prime example of stakeholders leeching value from the liquid supply. The number has been increasing lately as more accounts power down and move their liquid tokens to the exchanges and whatnot.

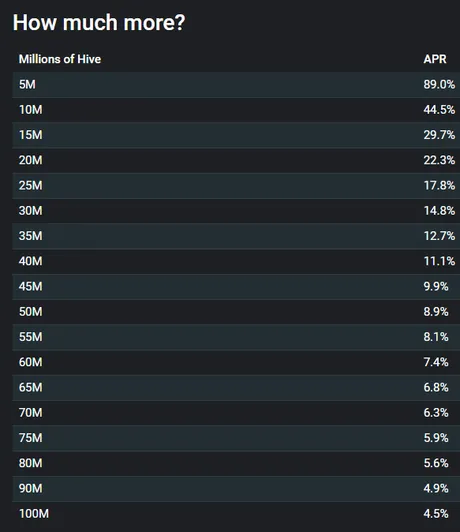

This multiplier is EXTREMELY important, because if you reapply it to the savings accounts where there is very little money allocated, the multiplier becomes a huge honeypot that will incentivize MILLIONS of tokens to flow into the savings accounts. I did the math in my "Can I get a Witness?" post.

We see here that if only 20M Hive was sitting in the savings accounts and we applied the 15% inflation there, everyone with stake locked in these accounts would earn 22.3% APR passive income. A huge honeypot indeed.

This mechanic is all but guaranteed to increase Hive token price and also increase the reward pool because passive income comes at a premium.

But wait, there's more.

Because like I said, this post is about allowing users to create HBD out of thin air. As stated, we already have a smart-contract up and running in the form of the savings accounts.

When money enters the savings accounts, they become locked for 3 days. This is even better than MakerDAO loans which can be moved around instantly if there is no underlying debt locking up the money. By forcing Hive to stay locked in the savings account for at least 3 days, these accounts are the ultimate collateral buckets.

Using this collateral that people are going to park there anyway for the passive returns on APR interest, we can add the MakerDAO template to them as well.

Example

You're going to go on vacation and aren't going to be upvoting people on Hive. You'd like to get some passive income while you're away. Perhaps we even create a smart-contract that allows people to swap their VESTS into the savings account instantly and keep them time-locked for the full 13 weeks. Anything is possible.

In any case, you move your stake into the savings accounts. There are currently 30M coins total in the savings accounts so you're earning 14.8% APR... not bad! Way better than a traditional bank by leagues. Much better than a lot of stocks even.

Once the MakerDAO system is in place, you'd also have the option to print HBD out of thin air. Say you had $10,000 in the savings accounts (100,000 Hive) and printing HBD out of thin air required 1000% collateral. You could print 1000 HBD out of thin air... maybe you even use this money to fund your vacation. Who knows.

At this point, you will not be able to unlock your 100,000 Hive until you pay back the 1000 HBD and destroy it. That's how these collateralized debt positions operate. If you pay back and destroy 500 HBD you'd be able to withdraw half of your money (50k).

If the USD value of Hive increased (determined by witness feed oracles), your collateral would be worth more than 1000% and you'd be able to unlock some without paying back any money. Conversely, if Hive lost value your collateral percent would be reduced below 1000% and before you could start unlocking your Hive you'd have to boost that above 1000%.

What's up with 1000%? Why so high?

On the MakerDAO system the required collateral percent is only 150%. Turns out this is also the liquidation price. Combining these two variables into a single variable is a huge mistake. By separating them we create a gap between minting coins and liquidation that greatly stabilizes the system.

For example, we should start the system out with very very safe numbers so it is impossible for the system to collapse due to bad debt. If we require 1000% collateral users will use the system regardless of that high price, because their money was going to be inside the savings accounts anyway collecting passive income. This is yet another reason why HBD can be superior to DAI in literally every way:

- 3 second blocks and free transactions

- More stable system

- More resistant to black swan events

- Collateral collects huge passive RIO bounties.

- Locked stake increases the reward pool, making upvotes bigger.

- Greatly increases chance of positive feedback loop FOMO.

- Greatly increases the HBD peg to $1.

- Allows USD devaluation to enrich stake holders.

That last bullet point is super important and hard to understand. We all know that USD and debt-slavery go hand in hand. The value of USD slowly decreases every year, bleeding the value of citizens into the pockets of the central bankers. Well on Hive, the stakeholders are the central bankers.

HBD is pegged to USD, and the Hive network gains all the exploits of the traditional imperialist system. Imagine HBD was a much more trusted asset. That means instead of having 4M-5M HDB minted the network could support hundreds of millions if not BILLIONS of HBD in circulation.

HBD is the debt of Hive because half of our inflation is printed in HBD which will eventually be converted for Hive if that HBD can not justify its existence. This means that the more sustainable our debt is, the more value we can leech from the users that hold it. HBD needs to actually work and be trusted so it has demand.

Imagine if instead of 4.5M HBD we had ONE BILLION. That's a billion dollars, possibly losing 5% value a year. This is value that goes directly into Hive stakeholder pockets in the form of inflation reduction... because when we print inflation in HBD (debt) once that debt gets paid back later (conversion burn)... that debt has less value at the later date. Therefore all that value that USD/HBD lost over that time just evaporates, and less Hive is created during the conversion process than would have been if the inflation was printed directly into Hive. Best case scenario, the HBD we print never gets converted.

I hope someone understood that.

Because even I don't fully understand it. It's pretty crazy when you actually start thinking about it.

The bottom line is that when Hive has an expanding economy and can justify more sustainable debt, our inflation rate gets cut in half because half of that inflation is printed in HBD... which obviously isn't Hive (yet). And it might NEVER be Hive if our economy doesn't contract. Imagine printing 1 billion HBD and NEVER having to pay it back (AKA never forced to convert that HBD into Hive). That's just free money for the network.

In fact, we should be strongly considering printing 100% of our inflation in HBD, because if we can justify the growth of the network then our inflation becomes 0... and isn't that what all you guys want? Zero percent inflation? We can have our cake and eat it too. We can print a ton of debt and never have to pay it back if that debt has demand to actually be used in the form of a stable asset that's losing 5% value every year.

LEO is faster

But we don't have any of this infrastructure... do we? Yeah well, if Hive doesn't do it (@blocktrades?) Someone else will... Looking at you: LEO. That's right, if LEO keeps developing at this rate we are going to the damn moon and we'll make all this shit on the side... think of it as a testnet.

Once we have the money to finance the endeavor, we can create a system that allows LEO to be locked in exchange for another token. This token will be our stable asset, and will be pegged to $1, or whatever we want. I've also flirted with the idea of raising the peg over time so that the stable asset is even more stable than USD. If the stable asset is pegged to USD but then increases in value 5% a year... it becomes the most stable asset on the planet. Call me crazy, but controlling and issuing the most stable asset on the planet might outweigh the gains of fleecing users for 5% a year.

1 lever to rule them all

How does one peg a decentralized asset to $1? Tether (not decentralized) does it artificially by buying back their own product when it's undervalued and printing it out of thin air when it's overvalued.

Dai maintains the peg (badly) with exploitative interest rates. They started out with a super low rate of 0.5% but then jacked up the price to like 10% when no one was actually using the token as a stable asset.

Basically everyone was using it to margin trade. They'd create DAI out of thin air and then just buy more Ethereum with it. This led to the token consistently trading under $1 (like 98 cents) which MakerDAO did not take kindly to, so they jacked up the usurious debt rate to 10% so discourage users from doing this as much.

When you think about it, this is ridiculous. Who the fuck do these people think they are? Charging me interest on MY OWN MONEY? Holy shit! Fuck you! DAI is over-collaterized at at least 150% (usually closer to 200%-300%)... therefore MakerDAO is charging their users interest on money that isn't even there's, and they get away with it because there is zero competition. Hive/LEO can blow them out of the fucking water. Guaranteed.

If anything, MakerDAO should be PAYING their users to park their collateral in their contracts. But that's just not how these venture capitalists think, so they do exactly the wrong thing. Competition is coming, and they're going to get wrecked. If not us, then someone.

So how peg?

Pretty simple: just require a higher collateral percent. In my example I used 1000%. Imagine how much a token would be worth if the collateral to create it was 1000% greater than $1... gee, I think the value of this token might be valued higher than $1 if users have to lock $10 just to create one... what do you think? The true answer lies in the free market.

Then the community slowly lowers this required collateral percent through voting or a system of trusted oracles (witnesses) to ensure that the market values the token near $1, and thus a totally unique decentralized stable token is born... something the world has never seen.

Liquidation percent

Now, what happens if the required collateral percent for minting the stable asset is 300%, but then the USD value of the underlying asset black swan crashes more than 300% and the collateral is now worth less than the stable coins that have been minted?

This is obviously bad, and the peg of the stable asset would break below $1 with very little recourse to fix the situation except hope that the market bounces back. This is exactly why MakerDAO has a 13% penalty for liquidating collateralized debt positions (CDPs) that dip under 150%.

This penalty gives incentive for community members to scoop up that bad debt and take the penalty money for themselves.

Example liquidation.

I have 10000 Hive worth $3000. I mint 1000 HBD with my collateral. That 1000 HBD is mine to do whatever I please; it can never be taken from me. However, My Hive collateral flash-crashes to $1099, which is less than the liquidation percent of say 110%. This allows anyone on the network to buy my debt, taking all of the Hive for themselves for a price of 1000 HBD.

By allowing anyone on the network to buy back bad debt at a potential profit, this greatly stabilizes the system so that the peg does not break to the downside. I say "potential profit" in this instance because, while the 10000 Hive collateral was bought for 1000 HBD and is theoretically currently worth $1099, the price of Hive may continue to black swan downward, and by the time this 10k Hive was sold on the market it's possible that it would be worth less than 1000 HBD. This is why buying bad debt is risky and must be incentivized.

This process would be an auction. Anyone on the network willing to buy the 10k Hive for more than 1000 HBD will be allowed to bid up the price until a winner of the bad debt is determined. Any HBD paid over the bad debt value (in this case 1000 HBD) would be refunded to the owner of the CDP. So say the debt was bought for 1050 HBD, 1000 would be destroyed and 50 would go to the person that just lost their collateral to the buyer.

This auction mechanic allows the network to set a high liquidation percent to secure the system if necessary, while at the same time mitigates the risk of collateral holders losing money that they shouldn't have.

For example, if the liquidation percent was 150% like Dai, it would be possible to lose $1500 worth of Hive on a 1000 HBD debt, but the chance of that happening is low because users on Hive would bid up the price heavily to buy the bad debt (assuming a devastating black swan is not happening) and close to $500 would be returned to the rightful owner.

This bidding system failed on MakerDAO during the COVID crash because gas fees ground the network to a halt; another reason why Hive is superior. Many investors lost their money simply because there were no competing bids on the clogged system. Hive solves this.

The tradeoff here is simple. Do we want to protect HBD holders or collateral holders? High liquidation percent prevents bad debt from existing on the network and the peg will be maintained, while a low percent makes investors, gamblers, and anyone else giving themselves a loan happy.

The network could even vote to reduce the liquidation percent to less than 100%, which would signal that bad debt is allowed to exist and there is no monetary incentive for users to buy and liquidate bad debt. This probably sounds odd, but that's exacly how Hive works already with the 10% haircut rule.

This haircut rule exists to mitigate debt spiral damage, but I suspect it has done far more harm than good. The haircut rule is the only reason why HBD breaks the peg to the downside, and thus it is the only reason why HBD is such a failure as a stablecoin. This failure has lowered its demand to garbage levels and likely hurt the network more than it stopped us being devalued by inflation. If the haircut did not exist way less HBD would have been destroyed because it has more value and purpose.

However, we don't need to remove the haircut, we simply need to add more mechanics that boost the value of HBD. Dai was given massive value and demand with the advent of Uniswap. Also the ability to buy debt at a cheaper price to pay off CDPs is quite enticing.

Buyer of last resort

In the event that purchasing the bad debt is too risky and no one is willing to buy it (perhaps because the liquidation percent is too low or the Black Swan event is too volatile) then we'll be left with a situation where bad debt is just sitting on the platform.

In this situation, imagine I took out a 1000 HBD loan with the 10k Hive but now that 10k Hive is only worth $500. Financially it is not worth it to for anyone on the network to pay back this bad debt, and the value of the stable coin will suffer and break to the downside by a vote of no confidence.

This is truly where Hive can really shine, because we've already been in this situation with HBD multiple times. Hive is very very comfortable with simply allowing bad debt to exist until the ship rights itself. Because Hive has multiple mechanics for creating and destroying HBD, it can get away with things like this, whereas networks like DAI absolutely can not.

When this happens on the MakerDAO network, holders of the governance token make a promise: they will be the buyers of last resort and print more Maker governance tokens to buy back the bad debt. This has actually already happened once, and Maker holders were super pissed. I think the main reason it happened is because Ethereum is slow and the gas fees are obscene when a Black Swan event is occurring. This is obviously a problem that the Hive network will never have, seeing as we have 3 second blocks and free transactions.

Credit Scores

I also believe that Hive is so advanced that we could eventually create credit scores that take the form of NFTs. Because every account on Hive is an NFT (as I have explained in a previous post) this means that credit scores can be applied to every account.

It's quite possible that if enough dapps use these credit scores to measure the trustworthiness of an account, that in the case of my bad debt ($500 worth of Hive securing 1000 HBD) I would still be incentivized to pay off the 1000 HBD even though the underlying collateral was worth much less than 1000 HBD at the time.

Imagine peer-to-peer loans being implemented on credit scores... or even airdrops based on credit scores. It could be EXTREMELY valuable to have a high credit score on Hive, so paying back bad debt could be massively incentivized in this way if the network had the infrastructure to guide this kind of behavior. Self-governing systems is what crypto is all about.

Conclusion

I hope it's obvious at this point that crypto itself is still totally on square one. The Hive network can bring it, and we can bring it hard. And if Hive can't do it, LEO can. Fuck it.

We can reduce Hive inflation to zero without having to sacrifice our vote power or passive ROI. All we have to do is print all inflation as HBD and generate enough demand for HBD so that no one is even incentivized to convert it for Hive. HBD is our debt, and if we can generate enough demand for our debt then our inflation will be effectively reduced to zero while our value skyrockets out of control. This is not an impossible task... it's actually quite probable with a healthy tech network that's building value every year.

If Bitcoin is doubling in value every year, then so can we.

But the reason I started writing this rant is because we don't have any of these things. That means you should not receive inflation as HBD, and should instead power up 100% of your rewards.

Why?

HBD gets haircut to 10% of Hive's debt. We are at the haircut level now. If Hive drops in price, so does HBD. This makes holding HBD totally pointless, as it does not act as a hedge for volatility.

In addition, when you covert HBD to Hive during a haircut, you simply would have received more tokens simply powering up 100%. The opposite is true if HBD is trading above $1. In that situation powering up 100% is throwing away free money.

If we had collateralized debt positions on Hive we wouldn't have to worry about any of this. In fact, we could eventually transition to a system where 100% of inflation printed is HBD debt. And again as I have stated, with enough demand for that debt the network never has to pay it back. I repeat, Hive can evolve to print billions of dollars in debt that never has to be paid back. How's that for profit sharing and "reduced inflation"?

#thinkbig

Posted Using LeoFinance Beta

Return from HBD Collateralized Loans: How to reduce Hive inflation to zero percent without hurting the reward pool. to edicted's Web3 Blog