Oh Hi Resistance

In a shocking upset... I've been calling the market pretty well. 24 days ago it seemed a bit obvious that we would get slapped down.

Dump from here, amirite?

Now, all the technical analysists on CT are making a big deal about crossing past the year-long downtrend recently. Why? Look at the slope of that line. In a couple of months it's going to be at zero. This trendline means nothing.

So we crossed the line, lo-and-behold.

Nothing happened. Duh... because that's not the triangle we are trading inside of.

This is the one to look at:

And once again, we can see we are trading directly on the resistance line, for three days in a row no less. Pressure is building, but will it be enough to crack it? We are almost out of runway as the triangle comes to a point. Who's ready for an Uptober breakout? Will be interesting to see how high it can get by the end of the month.

Before I forget...

Someone actually filed to create an inverse Cramer ETF that will bet against Jim Cramer. It has to be a joke right? How would something like that possibly work? The whole inverse Cramer thing has become so popular that I've been seeing a lot of fake tweets recently that make it look like Cramer has said something that he hasn't. I even saw one about him saying there wouldn't be a nuclear war. Yikes. Full on meta meme status at this point.

Guess who took his Hive username?

Hive Username: @jimcramer Posting Key: 5JjR8huq4ewT5eCwmo3CZtfBF43i7vTdqRFgxiEXQqtAF1TZ6gg

gg indeed

It's nuts to see all these people bearish on crypto.

I mean it's actually not. The legacy economy is clearly hammered dogshit, but all the metrics tell a different story. More and more corporations jumping into the mix. Disney issuing NFTs. Highest number of wallets above 1 BTC. Constant all time high on hashrate. The list goes on and on. Crypto adoption is still spiraling upwards exponentially, but most are too blind to see anything but the spot price.

U.N. Calls On Fed, Other Central Banks to Halt Interest-Rate Increases

The United Nations telling the Federal Reserve to stop raising rates? What version of clown world is this? As if the Federal Reserve can't see what's going on here. Like I said it seems like they want to create a recession on purpose.

On the same side of that coin, inflation has been the big narrative for raising rates, and the lagging indicator that is the CPI seems to be the metric (or excuse) being used to justify everything. I believe the next CPI report comes out Oct 9, which is only 3 days. Last one was 8.3%, so if it comes in low enough perhaps they will be 'forced' to reverse course. Even if they don't reverse course or taper or what-have-you, A good CPI report will be littered with speculation, meaning Uptober could continue unabated even in the event that the FED does not pump the brakes.

But at this point, I don't think any of this matters. It's all just noise. The Bitcoin bear market ended 3 months ago, it's just that nobody realizes this yet. They certainly will in retrospect when the price stays above $17600. We can still drop 15% and be above that level. That's a nice buffer considering where we find ourselves.

Given the volume and price action as of late, I believe that there is infinite buying pressure protecting BTC from a bear market extension. By all accounts, we should have already crashed lower... and we didn't.

Bulls are not yet willing to pump the price with taker orders, but they seem more than willing to fill the gaps when bears try to tank the price. In the grand scheme of things, Bitcoin's liquidity is very tiny compared to other global markets. Hell, even Apple market cap is over x6 the size of BTC at these levels. Can you believe it? Apple... six times bigger than the entire Bitcoin market cap... that's insane.

Seeing this pattern of very high volume and very low volatility leads me to the conclusion that whoever is buying right now has extremely deep pockets. So deep that rather than make waves and spike the price, they are more than willing to simply quietly stock up on BTC as the bears continue frantically dumping their bags at this local low. The big players buying today are being very sneaky right now and very much hiding how much dry powder they carry within their back pocket. Given the confidence of the current support combined with retail FUD, I assume there is a monster stack of USD lurking in the background.

Full moon October 9...

I conflated the dates of the full moon and the CPI report. Oops. Guess we still have to wait another 7 days for the report to come through. I gotta say I am weirdly interested in how it affects the markets... not because I'm trading any of this, but just out of curiosity.

Regardless, seeing everything I'm seeing, a breakout to the upside appears highly likely. Or if the CPI report is abysmal we grind on rock bottom again for a while. I don't know though, like I said before, I feel like the triangle we are trading inside of is highly significant and it's giving me hardcore April 2019 vibes, which again I called perfectly. A broken clock is right twice a day. Will this be my second victory? Bitcoin can spike up on the flick of the legacy economy's finger, and can only go down if whales that already own Bitcoin sell with no one to buy it.

It's also worth noting that the geopolitical landscape is pretty nuts at this moment. If it's not obvious by now, USA is engaged in a proxy war against Russia. As soon as this thing started I was calling out that it was extremely shady and weird. Now it is blatantly obvious that America has been lurking in the shadows this entire time. Of course they gave it away instantly with such aggressive propaganda on day one.

It's crazy that we can basically start a war, make it look like Russia started it, give all our crony friends in the military industrial complex a bunch of money to send weapons to Ukraine, and then blow up a Russian pipeline in a terrorist attack, and then blame that terrorist attack... on Russia. lol. And everyone just goes along with it. Amazing.

Make no mistake... nobody died in this attack directly. They just blew up a pipe in the ocean. No big deal, right? Yeah well, I wonder how many will die indirectly as we attempt to make Germany dependent on our power instead of Russia's. I'm guessing a significant amount. Even if people don't die many will suffer or be impoverished or whatever else. Empires gonna Empire. Just remember this is totally 100% Russia's fault. Putin is a madman, and we are all simply the victims of his irrational insanity.

Look what you made me do.

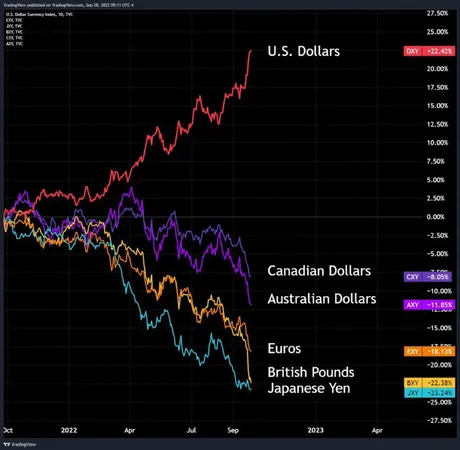

Extrapolation

USA knows that during times of war and economic hardship, the entire world is heavily incentivized to stock up on dollars. The government knows we are in a recession and denies it so badly that they try to change the definition of what a recession is. You know what's great for a recession? War. And now we are basically outsourcing a ton of our debt and inflation to other countries during the worst possible time for the rest of the world. It's not a coincidence. A lot of this stuff is premeditated. Again, I'm quite interested to see how the FED reacts to recent events.

At a certain point the "inflation" narrative isn't going to hold any weight. What's the point of fighting inflation if the problems we cause are worse than the inflation? We seem to be coming to that inflection point very soon, but soon could be next month... or the end of the year... so there is that. We can only outsource the problem for so long before the entire world economy starts to break down and creates much worse problems.

Conclusion

Keep stacking those sats.

Return from Hello Resistance, My Old Friend to edicted's Web3 Blog