The actions of the SEC (and just gov in general) against the cryptocurrency ecosystem have been downright criminal for over a year now. Everyone can see it, but no one really does anything about it, nor can they. It is what it is. Those who make the laws can often break them without consequence. More often than not: they never have to break the law in the first place because they've already manipulated the system to suit their best interest. This is the magic of regulation & permits.

Crypto is very much shattering this paradigm in that it is forcing entities that make and enforce the law to break their own rules. It's become blatant and wide out in the open for everyone to see. The SEC purposefully does not provide regulatory clarity and instead attempts to lord over the space with arbitrary enforcement that is often imposed years after the initial infraction.

Operation Chokepoint 2.0?

It can't go unnoticed that the three biggest bank failures in recent history were all banks that serviced crypto exchanges. At least one of them did not deserve to be shut down, and then immediately after it happened a backstop was put into place that would prevent any kind of collateral damage beyond these three implosions. Everywhere we look crypto is hunkering down in a defensive position just trying to whether the storm of blatant regulatory overreach.

Of course it could actually be much worse, and Gary Gensler often signals that he is not actually trying to wipe out the entire industry, but rather rough up the currently entrenched players in order to let his Wall Street buddies come in and corner the market. This is crony capitalism at its finest.

But what has prompted such outrage from yours truly?

Ah well basically the realization of not being able to use Binance Cloud liquidity pools via Mandala is really getting under my skin today. I'm scouting out other potential ramps and they are all pretty sub-optimal (as if Mandala & Binance Cloud weren't suboptimal enough). I can see why people have been complaining about liquidity for a while now. Definitely had my blinders on while I still had access to relatively decent liquidity in conjunction with 0.1% fees. And just like that: poof: my access has vanished in a puff of smoke. These things happen.

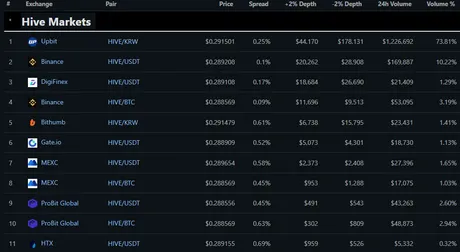

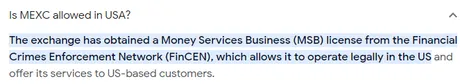

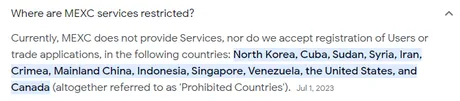

Looking at the aggregated data from Coingecko tells a pretty bleak story. Definitely not great optics when one of the richest countries in the world doesn't have access to the top six liquidity pools by volume. In fact when I went to the MEXC website today it instantly booted me saying my IP was blocked... when did that happen? Last time I used MEXC it was licensed properly. At some point during this year they decided to throw down an IP block, which I immediately circumvented with a VPN into Mexico but still it's a very bad sign of things to come.

It's also worth noting that last time I used this platform it was possible to margin trade with Hive (although it was a really bad deal and cost like 30% APR for a 105%+ overcollateralized loan). Still it was at least a possibility. It has since been delisted from this type of futures trading.

So I'm logged into MEXC right now.

This is an exchange I haven't messed with since I went long on BTC at $30k; a position that got annihilated by the FTX collapse. Oops. At the time the amount of money I was gambling with seemed like a small number, but if I'm remembering correctly it would have been enough to pay for an entire year of living expenses. lol bull markets sure make us do stupid shit don't they? Fun stuff.

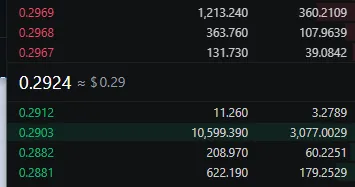

In any case the first thing I see is this boast of 0% fees on the spot market. Ironically that's the last thing I want to see. Anyone with experience with these business models knows that exchanges that don't have trading fees are forced to monetize their data, which means a heavy financial incentive exists to manipulate markets and sell trading data to sharks looking to eat your lunch. It also means that the exchange itself has little financial incentive to provide direct liquidity to the markets, and the current 1.9% spread between buyers and sellers on Hive/USDT certainly seems to reflect that theory.

Gee would I rather pay an upfront 0.1%-0.5% fee that goes directly to the exchange or a hidden 2% fee that exists as a gap between buyers and sellers... let me think on that and get back to you. When taking this into consideration simply cashing out through HiveEngine is actually a competitive option at this point, which is pretty crazy considering that has never been the case. It certainly is more convenient to use HE at this point, and the profits from arbitrage go directly into Hive users' pockets instead of a centralized exchange.

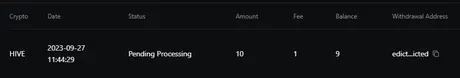

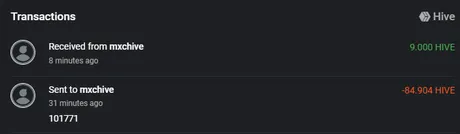

Another random thing I noticed on MEXC was the withdrawal address. lol check it out they just automatically put the first five and last five digits of the wallet. I wonder if it would bug out if my username was only four characters long. It's moments like these that often remind me how advantageous it is to have our usernames double as literal wallet addresses.

In any case I tested sending money to MEXC and transferring it out again. Works, and the site claims I can withdraw an absurd amount from the platform... something like 30 BTC a day without KYC. How is that even a thing? So silly.

Still, I'm not sure if I'm too keen on using this platform because of the terrible liquidity and zero fee situation. Also it's just obnoxious that they charge 1 Hive to move money off the platform when everyone else charges 0.01 Hive and it's a 100% free transfer.

Lightning BTC (LBTC)

Also I'm just realizing how absurd it is that Coinbase literally has their own EVM chain but they don't even accept payments from the Lightning Network. Ha, how ridiculous is that?

Up until recently, major crypto exchanges, including Coinbase and Binance, had no intent to adopt the layer-2 solution as many community members argued that LN integration offered fewer incentives for exchanges' income.

As good a reason as any I suppose... capitalism!

Although I don't really understand the logic considering that Coinbase can charge fees in any way they see fit. Seems like a wasted opportunity to me but then again the LN is weird and overly complex. Can't Coinbase just leverage LN as a vehicle to consolidate thousands of transactions into a single transaction and then charge a service fee for unwrapping LBTC into BTC? @brianoflondon would know.

There's also ThorChain

I see that ThorChain and associated Rune token have incorporated BSC directly into the network. Although it was already indirectly connected with the ability to convert BEP20 tokens into BEP2 on Trust Wallet "permissionlessly". So a path does exist between LEO's bHive token, but that's a lot of hoops to jump through. Hive >> bHive >> BNB/BUSD >> ThorChain >> Coinbase. I must admit that it's a bit disappointing that getting a direct listing like HIVE/RUNE seems to be a very low priority around these parts. I don't know much about what it would take but assume the technical complexity of such a marriage would be quite high.

@bnb-hive

There's also the issue of Hive collateral stored for bHive existing off-chain and impossible to audit. There's over 150k bHive in existence, and less than 5k actual Hive collateral being stored on chain. The optics are quite bad for anyone looking to support trustless networks.

@bnb-hbd

This account is also very much illiquid, but at least we can see 186k HBD is locked inside the savings account. I'm told there's an upgrade being pushed through that will better secure this liquidity pool and allow normal operations to continue.

SPK network

We're also being promised a decentralized liquidity pool to BTC through the SPEAK network. Still unclear as to exactly how that will work or when it will come online, but I thought I'd mention it anyway.

Multisig

Somewhat related to this topic is this post by @stoodkev letting us know that Hive now has multisig. This has a lot of potential applications, including liquidity pools and outside connections to other chains. Multisig can be leveraged in a lot of ways including oracles and extending DPOS in ways which we haven't been able to previously.

Example

Hive is already quite comfortable letting 20 witnesses be in charge of consensus. We can use multisig to extend this paradigm and create other trusted groups of our choosing. I want to call them proxy witnesses but perhaps that's not the best title for this tech.

In any case it would be pretty 'easy' to create a service (say a decentralized exchange) where the exchange's account on Hive gave active key authority to 20 different accounts on Hive, each with a weight of 1 and a threshold of 10. This would mean the only way for Hive to be transferred out of the account is if it gets 10 valid signatures that have all signed the exact same transaction.

This is not what @stoodkev has created. The ability to set weights and thresholds for accounts to enable multisig on Hive has existed for as long as I can remember. I'm not even sure which hardfork it was implemented in, and it could have been even before I got here in 2017.

Rather, what it looks like @stoodkev has created is an API that exists on top of Hive that allows nodes to talk to each other and organize these signatures off-chain so they don't take long to create and won't fill up our blockspace with a bunch of garbage. Sure, multisig on Hive has always been a thing, but how does one actually use it?

Like if I want to spend money from a joint account that requires multiple signatures... how do I get those signatures? I think it's assumed that anyone who previously wanted to use this feature on Hive simply needed to figure it out themselves and provide their own infrastructure. This API acts as a middleman of sorts that should make multisig a lot more accessible to the network.

Technically even I could use something like this for the witness node that I share with @rishi556 & @sn0n. We basically just trust each other at the moment and we all control all the keys to the @hextech account. Which is totally fine thus far. When someone wants to cash out a tiny bit from the account (not I) that person takes out three times as much and gives that amount to all 3 accounts.

But what if I wanted to do something crazy like put $10k of my own money into the account for whatever reason? I might not be comfortable with that level of trust required. Being able to employ multisig on an account like that would be pretty useful, especially for things like changing the owner key or recovering the account. It's very possible that technology such as this will end up being quite useful while falling into the background and increasing the security of the accounts that truly need it.

Conclusion

Hive is really being forced to address this issue of liquidity given the current climate of blatant regulatory overreach. There are multiple valid paths being pursued and I hope that we can expect some real results within the year of our lord 2024.

A strong connection to Bitcoin is very important even if that connection results in relatively high on-chain fees. Once we have that we can branch out to other chains that aren't so prohibitively expensive on the security side of things. Perhaps even a cheap Lightning Network pairing will be an option soon, but I won't hold my breath on that front. Again it's kind of flabbergasting that even Coinbase doesn't run a LN node. Really?

It will also be quite interesting to see how much the regulators change their tune on crypto (and more specifically Bitcoin) once Blackrock has become entrenched in the market with their spot EFT bid. Will they ease up a bit or will they continue on business as usual? I assume they'll have to loosen their grip sooner or later, especially after getting slapped over and over again in the court of law in ways that are frankly kind of embarrassing on a professional and legal level. I guess we'll see.

Return from Hive has been Cut Off to edicted's Web3 Blog