Market still green across the board.

Looking to dump my hedge the second this thing dips. I want my BNB back, damn it :D. Liquidity is good and the bottom appears to be in. Full Moon Jan 17th with late January being theoretically bullish.

Wait, are we still in the mega-bubble foothills?

If we are still inside of a mega-bull market bear-trap shakeout, eventually Bitcoin will spike up massively. But how much could it spike before expectations become absurd? After all, there's going to be a lot of resistance at $100k.

2022 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $27733 | $29867 | $32,000 | $34133 | $36267 | $38400 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $40533 | $42667 | $44800 | $46933 | $49067 | $51200 |

- 2013 mega-bubble went x11 the doubling curve.

- 2017 mega-bubble went x13 the doubling curve.

- I expect the next mega-bubble to go x9-x15 the curve.

- With a time frame of Q4 2021 this equated to $250k-$350k...

- However, a summer 2022 run boosts that up to $350k-$525k.

- Sounds pretty ridiculous, so I take that with a grain of salt.

Again, I actually don't want this to happen.

This would be bad for long-term growth. Better to just say inside a super cycle that floats above the curve.

Bullish short-term price targets.

$50k is massive. I think we have to be trading above $50k by the end of the month before I fully decide that this run is back on. Even then we'll have to maintain a price above $50k for at least a week to seal the deal.

As long as we are trading under $45k like we are now, that's still pretty bearish, but we have an entire moon cycle to crush that unit-bias resistance, so I'm not too worried there... it's really more about $50k in the grand scheme of things.

We've never seen a summer mega-bubble.

All the more reason to think we won't get one. Again, a normal bubble is around x2.5-x3.5 the curve.

That's $96k-$134k.

Clearly this is a much more reasonable price prediction. Especially with the bottom being right below the $100k unit-bias laser-eyes level and the fact that institutional money will probably not allow the price to spike that high. Sharks know how to take gains. Retail is no longer in control.

Again, a mega-bubble takes six months.

A regular bubble takes 3 months. Assuming a bull market in summer, we'll know which one we are in by the end of March. If we do something crazy like spike up to $96k in February, and then crash to $69k in March, we'll know we're in a mega-bubble. If we make new lows in March ($30k-$35k) then we'll know at best we can expect a normal bubble.

Again, this all assumes that this cycle of 18 months between bull markets going back to 2016 is going to continue on. Of course this may not be the case, but everyone loves their daily dose of hopium.

But as the title implies, this post was actually supposed to be about Hive.

I was truly not expecting this...

Hive still has a chance to avoid all the death-crosses.

Support at the MA(99) $1.285 Resistance at the MA(25) $1.515

While we trade between these two moving averages, this band will continue to narrow, and we will breakout in one direction or the other. Should be interesting.

But honestly I'm leaning bullish now... we rarely ever seen Hive recover this quickly.

The HIVE/BTC chart is also interesting.

Here we tower above the MA(99). Hive is doing very very well in comparison to Bitcoin for quite some time now. I bought Hive sub 400 sats last January. Now we above 3000. Legendary.

Important to note that the MA(99) here likely acts as a flash-crash support. Sitting at 2442 sats, that means Hive hopefully would dead-cat-bounce at $1.07 given the current market evaluations. Might be smart to place some buy orders at 2500 sats just in case. Assuming you hold BTC on an exchange that lists Hive.

This strategy definitely worked out nicely when @acidyo Gave Me 2500 Steem on January 26th, 2019. Ended up scoping 2500 Steem at 111 sats each (4 cents per Steem). Was epic. I'm guessing dumbass Ned accidentally dumped ninjamined stake on the market that day. Or at least that's what I tell myself.

THE FED!

Dirty dirty federal reserve. Truly they are controlling the market right now with the fear of tightening fiscal policy. They increase tapering on QE and tell everyone they're raising interest rates, and everyone loses their minds.

However, as we have already seen from @taskmaster4450, the FED is constantly trapped in a corner with very little wiggle room. There's just as good a chance that the FED comes out and says JUST KIDDING and the market spikes back up again on the news. I feel like a lot of the FUD is priced in as we move into late January (often a bullish timeframe for crypto).

Conclusion

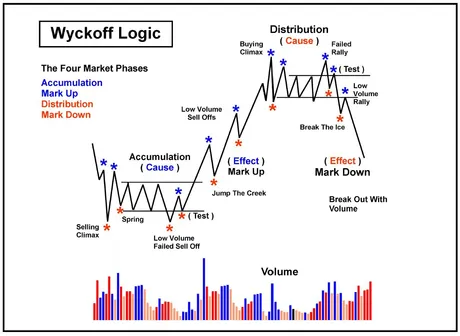

More hopium and rampant speculation? Sure, why not? Honestly though this market is being very weird. The macro head-and-shoulders pattern is still fully in play, so it should not be discounted, but at the same time if we bounce up from here we'd still likely look back at this point in time and say that the head-and-shoulders pattern did in fact complete the last leg down. From $40k back to $40k, it very well may already be complete, with the move from $30k to $40k simply being the completion of the previous Wyckoff cycle.

Hindsight is always 20/20

All we can do is hedge our bets and smile in either direction. Lower your volatility and your expectations and you'll be happy.

Posted Using LeoFinance Beta

Return from Hive Price Surprisingly Re-Enters the Pocket to edicted's Web3 Blog