Before this most recent dip I was gonna say that we were out of Bart Simpson territory... but it appears as though I am mistaken.

One mini-dip later we are fully back within retrace territory.

How low will it go? Ah well it appears like $18800 is a likely target, which is still significantly higher than the FTX contagion range so I'll take that as a good sign.

If we are going by actual market sentiment the FTX collapse was the ultimate rage moment for this run. After it happened the legal speculators came in saying that SBF could be charged with a triple life sentence for his crimes. Many chimed in that they agreed this was a suitable punishment for degen gambling with user funds. I am on record ask saying... a triple life sentence is a wee bit extreme.

I haven't actually thought about it until now but... how much jail time would I actually give SBF if it was up to me? Probably like 5 years in white-collar prison. Not so bad. Punishment fits the crime IMO. Most people don't even see any jail time for all the shady stuff they are doing around here. Especially true for financial crimes within largely unregulated industries.

But this is neither here nor there.

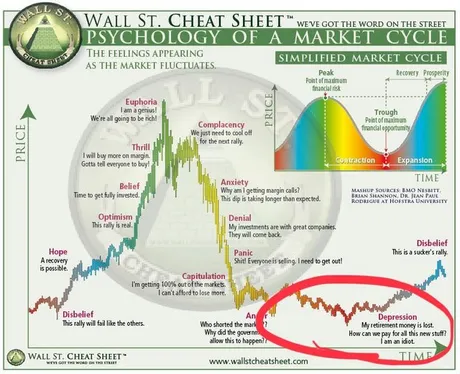

The ultimate question is not what actually happens in the real world but how retail FEELS about it. That's what this Wall Street cheat sheet is all about: capitalizing on other people's emotions and fear as you siphon their money into your pocket. The FTX collapse was clearly the ultimate anger moment, which I mentioned several times as it was happening. The mob was absolutely furious. Obviously this doesn't guarantee the market will bottom but... there was a good chance.

Did we skip depression?

If FTX was anger then a perfect replay of the cheat sheet would lead us to a slightly lower low before ultimate capitulation ($14k). At the same time, there are a ton of bears on crypto Twitter all echoing the same message:

This is the sucker's rally.

They are all in disbelief that we may have already seen the bottom. "No, but it can't be!" They still need to make an x2 on their short before they go bullish... good luck with that... bears.

At the end of the day bears always lose.

I mean... think about it. If most day traders lose money on average, bears must lose so much more than that within an atmosphere of exponential adoption and value growth. Notice how people get the most bearish at the bottom? You'd think a price decline would incentivize people to get more bullish and buy the dip, but that is exactly the opposite of what actually happens. Once people buy the dip three times, run out of money, and the market just keeps dipping, they tend to turn bearish at exactly the wrong time. The market has our number. She's a psychic vampire ready to steal all our money away from us. hodl.

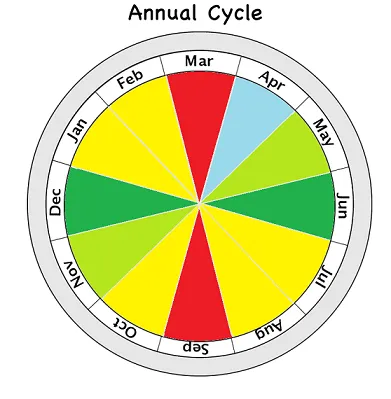

Although my annual cycle cheat sheet has proven to be largely garbage when taken at face value... I think it still has some truth to it. Everything seems to be flipped these days, and the timelines add up to an interesting February and March this time around. Chinese new years doesn't mess around and often triggers strong reversals in the market (both up and down). Of course if the next run is anything like 2019 (four years ago) we'll get the bulk of the action in May, but the small pump we had recently may be evidence that it's coming a bit sooner. Who knows.

Ultimately the target I'm looking out for before I take gains is around x3 the lows on Bitcoin. So if the price is in the $45k-$50k range on Bitcoin... gonna have to make some hard decisions about what to sell and where to park that value... although there is a very strong chance I'd park it in HBD for the free 20% yield and zero counterparty risk. Still one of the best places to put our money and nobody does it. Everyone's a degen at heart I tell ya. Everyone wants an x10 not a measly 20% APR. Even though the 20% APR is a professional grade yield on average. Crypto's gonna crypto.

Conclusion

So is this the suckers rally? Or are we entering a windup for ultimate depression and capitulation at $14k? As a permabull you know my sentiment, but that sentiment means very little because for me the bull market is always on. How could it not be in an industry that is only up except for one year out of every four? Just saying.

It's also quite nice at this point that Bitcoin did end up topping out at $69k and didn't end up hitting the insane $200k-$300k valuations that so many people such as myself were peddling. Less volatility means less volatility. A 77% retracement is much easier to stomach than an 85% retracement, and the only reason it can play out that way is because the market FOMOed less this time around than in previous bull markets. Or perhaps it was just the recession that stopped it from happening, or the 3 MT GOX level events happening in succession, or everything colliding at once in one of the weirdest mix of variables I've ever seen. Probably that.

In any case we should be expecting some kind of retest on either the $20k or $19k levels fairly soon. A bounce off $20k would be pretty bullish considering the circumstances... and hell that dip may have already happened with the dip to $20.4k twelve hours ago. Where ever we end up finding support will likely end up being favorable in the short term. History tells us the bear market is over, but the recession still looms as the ultimate wildcard. Exciting times, and also a terrible time to trade on leverage in either direction. Spot only.

Posted Using LeoFinance Beta

Return from How Low Will the Retest Go? to edicted's Web3 Blog