Just don't pay them, amirite?!

Seriously though, because crypto is such an explosive new technology, there are like a million loopholes people can go through to avoid taxes. Some of them involve breaking the law, but a lot of them don't; that's what I'd like to focus on here.

Investopedia: Capital Gains Tax 101

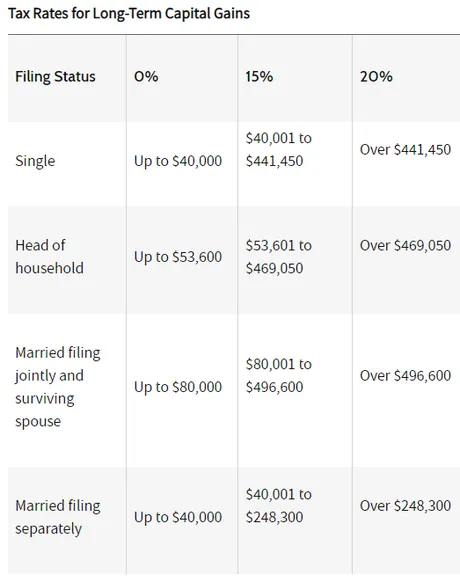

The last time we talked about this we learned something very important: you can actually legally pay 0% capital gains tax in certain situations.

https://www.investopedia.com/terms/c/capital_gains_tax.asp

If, like me, you are filing single, that means you can legally pay 0% tax on long-term capital gains if you are making less than $40k a year.

A long-term capital gain is when you hold an asset for a year or more and it gains value and you sell it for a profit. That money can not be considered income, so theoretically you've already paid income tax on it when you bought the asset (or perhaps you got the money by paying taxes on another long-term capital gain). I wanted to confirm this with someone who actually knows what they are talking about.

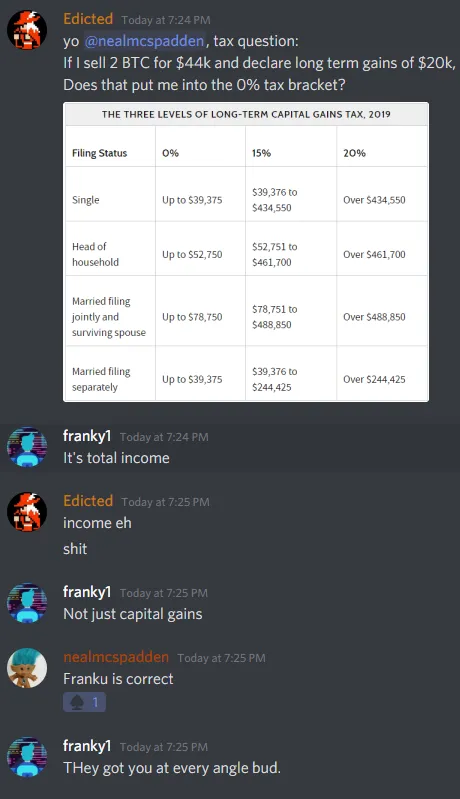

@nealmcspadden (tax guy & Excel guru)

Funny story

Even if I declared $20k capital gainz this year I'd still be under $40k income. I personally can pay 0% capital gains this year no matter how much I sell off (as long as I've held the assets for a year or more). I went on this little crusade because @geekgirl was asking me some tax questions in Discord and I realized I'm a noob.

But the conversation continued

And this is where it gets interesting.

Because apparently the IRS is defining crypto as "property", which is obviously ridiculous. It would be great to know why all these governments refuse to classify "cryptocurrency" as "currency". Currency must have some pretty nice loopholes and regulations people could jump through, so they are trying to avoid that. Perhaps @nealmcspadden can clarify.

https://dc.law.utah.edu/cgi/viewcontent.cgi?article=1018&context=ulr

Good information in this link but too lazy to read right now.

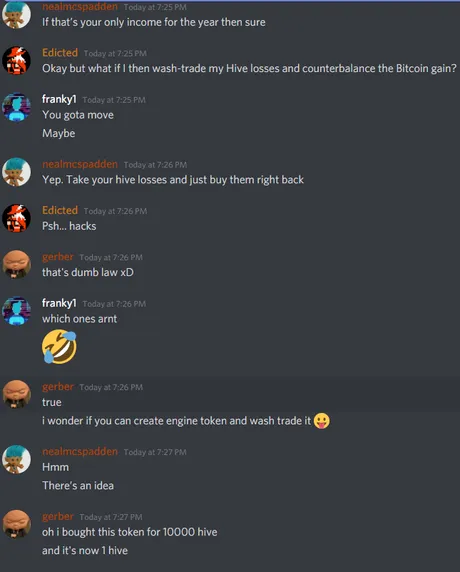

Property

From what I'm hearing, because crypto is legally property, that means you can wash trade your losses because the same regulations don't apply as stocks or commodities.

If I recall correctly, in order to declare a loss with stocks or commodities you must keep that money out of the market for at least 3 months. With property there is no limit, because property normally has extremely high overhead costs to trade and bad liquidity. Obviously crypto is the exact opposite of that. This is a tax exploit that everyone should be aware of.

Therefore, for everyone who's salty that they lost money on their Hive investment, there's a silver lining. You can leverage that loss (or any other crypto loss) into paying no taxes.

All you have to do it sell the asset and then buy it back immediately. You sold the asset at a loss, you can record that loss to offset taxes. You can then buy back the asset immediately because the wash-trading laws do not apply to property. Of course I'm not a professional so you can't take my word for it, and would have to confirm for yourself that this is true. I'm not taking any responsibility here.

Example

You bought one BTC for $10k in 2019 and you sold it here for $23k. You made $13k in capital gains, and your total income pushes you up above $40k, meaning you have to pay 15% capital gains tax on the $13k ($1950). Not cool!

However, you also bought 50000 Hive at 40 cents and now Hive is worth only 13 cents. You can sell the 50k Hive, declare a loss of $13500, and then buy the Hive back, paying a 0.1% fee twice on Binance in the process ($13). Instead of declaring a capital gain of $13k, you can actually declare a loss and pay nothing.

It's important to note in this scenario that because no gains were made the assets in question don't even have to be held for a year.

So you pay $13 in exchange fees to save $1950 in taxes. Pretty sweet deal.

And if you notice in the Discord conversation, we could be creating tokens to evade taxes legally like this on purpose. You put your money into a fake token, your colluding friend dumps on you. You declare the loss and then get your money back from your friend. You can then do the same thing for him, and with crypto this could be set up in a permissionless way where you wouldn't even have to trust each other.

This is the definition of disruption.

This is exactly why I have requested multiple times for core devs (currently @blocktrades) to add an optional feature to the network. This would allow anyone on Hive to transfer liquid coins and they would become permanently powered up at the destination.

Now I've received a lot of pushback from this idea. "Why would you do that?" "That's stupid." "That's a bad idea." Which is obviously ridiculous. If you don't want to use an OPTIONAL FEATURE then don't use it. Duh. You don't get to tell me which features have value. This is opt-in governance and the feature doesn't affect you unless you opt-into it.

However, after this post I would hope that this feature's worth has been showcased. First of all it would function as a way to give people stake knowing that said stake would never hit the market ever again, and second there are likely tax implications here.

How is the IRS going to tax you on "property" that is impossible to transfer?

Is that even "property" by definition?

Say I start a business, and part of my business-model is to support the community by powering up every coin. Now, imagining crypto as property, I started at ground zero here. My account was worth zero dollars and has zero Hive in it.

Property tax.

When you buy a house, how do you know how much taxes you need to pay on it? Does someone come along to appraise the value of the house every year so that you know how much it's worth and then pay your property tax?

No

The value of your property is decided the day you bought the house, until you die or sell the house. That's how it works. Which is why a family member dying and the question of inheritance can be such a nightmare with property, as the property tax often skyrockets due to the value of the house being appraised at a much higher number.

In the context of my Hive account, what was the initial cost again? Oh right, zero. So if the government wants me to pay property tax on my account, whatever percent of zero is still zero, as that was the value of the property when I acquired it. This may come into play later.

So now I build up my business and coins start flowing into my account. Is this income? The government thinks so, and they want to tax it. However, perhaps with a kickass lawyer the argument could be made that my "property" (aka Hive account) is simply gaining value over time just like real estate would, and my taxes owed are zero because I bought the property for zero.

This argument becomes even more relevant with powered up stake and other smart contracts. The IRS might look at my account and say:

IRS

Hey I see you have all this Hive Power here, why haven't you paid taxes on it?

Me

Actually that is a common misconception. Hive Power is an illusion. I don't own any "Hive Power", we just call it that so that noobs don't get confused. What I really own are something called VESTS, and VESTS have no value because they are untradeable and there is no possible market for them.

IRS:

Okay, but now you're being ridiculous, because you can "power down" the VESTS into this exact amount of HIVE which is worth this much money, so you obviously owe us. Stop dicking around.

And they might be right and they might be wrong. The argument can continue from there for quite a while in court. They might win or lose depending on how good the lawyer is and any kind of precedence that's been set. Although there is very little precedence in crypto because it's so unique, so that leaves these opportunities open to be won.

However, what happens if those VESTS COULD NOT BE powered down? Then what could the IRS say? What if I received the VESTS as VESTS and I never had control of any Hive ever? The value of vests is... what?

You wouldn't know the answer to that question unless you tried to sell the "property" (aka my business' account), so my lawyer would then claim that the value of my property is either technically ZERO or completely unknown because, again, there is no market for such a thing. The value would have to be determined at the time of sale.

And then there is the issue of inflation/curation. The IRS sees my business account is distributing inflation to the users, and may even claim that some of those users are myself by proxy. Yeah? Prove it...

Thus we enter the realm were big Hive users create mafioso type strategies (like Binance) to protect themselves in these situations. Because even if you aren't trying to break the law, the law is going to be broken because crypto is so explosive it can do nothing but flip this idiotic jumbled system on its ear.

What happens if the asset has no USD value?

What if your community creates a coin that has no link to USD on purpose? How will they tax you if the crypto has value, but there is no way to determine that value in USD? If you can't get the crypto into USD, how can anyone pay taxes? Will the government open an account and demand taxes be paid in the native currency to their government account? What is to stop the community from blacklisting that account so the government can never spend the money?

You see? These scenarios are endless and we are still sitting on square one.

Conclusion

These are the kinds of examples going forward that are just going to absolutely wreck the regulators and the tax collectors. Government is a lumbering beast, and the agility of crypto is going to outmaneuver them at every turn. By the time the laws are changed to plug the exploit, ten new exploits will be discovered and utilized.

Again, I take no responsibility here. If you blindly take this advice and just assume it's true and then proceed to get destroyed by an audit, don't come crying to me. Do your own research or hire a professional. This is one of the few times I would unironically say "not financial advice".

Posted Using LeoFinance Beta

Return from How to pay zero crypto taxes this year. to edicted's Web3 Blog