This is what bear markets are for.

What is buidling?

So we got a nice bump from this bottom-out in the market recently. That's all well and good. Market is extremely volatile and unpredictable still. Luckily early February has historically always been a "bullish" time. Even though it's usually just a dead-cat-bounce until we head into tax season.

I'm a bit annoyed that I again didn't buy RUNE when I wanted to at $3.50. Already back up to $4.40. Pretty wild. And here I stare at the price knowing that if I don't buy the price will keep going up but if I do buy it will drop. How maddening; this is why we DCA.

I'm very much annoyed that I also didn't buy back into Hive at 80 cents like I said I was going to. Still waiting on all those soon™ launches before I make any real moves. Hive price is in a pretty precarious spot though, being batted down by resistance at the MA(200).

With the MA(200) at 94 cents just slapping us down like that it feels like Hive is still on very thin ice. Checking current liquidity on exchanges shows potentially heavy slippage in both directions. The liquidity problem continues.

Speaking of liquidity.

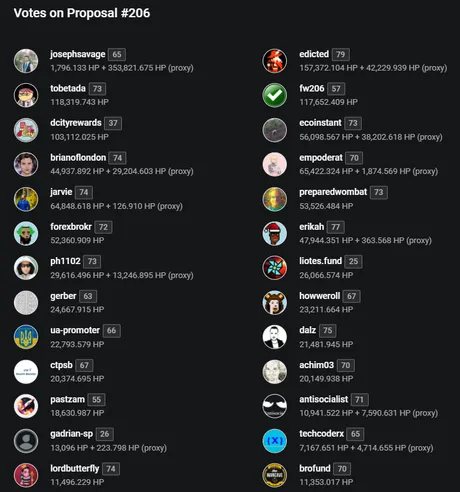

@ecoinstant published a proposal to allocate DHF money to the HBD/BUSD pair on Hive-Engine because of one of my posts on the issue. Pretty cool. It obviously won't get funded, even though it should, but sometimes it's still smart to play the game even if you know you're going to ultimately lose. This will stand as a political statement that we can point back to later as leverage for our cause. All the best gains in strength come from failure, not success. Bear markets are for building.

It has a little more support support since last I checked (from 1M to 1.6M) but that's a long way off from the 27.7M required. Got a lot of familiar names voting for it. Good stuff.

I think a lot of people around here don't consider just how much governance goes on with DPOS infrastructure. The name of the game in DPOS is stakeholding. Those who bring the most value to the network have the biggest vote. And while it's easy to claim that there are a few big whales out there that don't contribute anything whatsoever to the ecosystem... they aren't dumping, are they? If the value exists as powered up Hive, and not a Lambo, that person gets a bigger vote, plain and simple. Just something to consider.

HBD/BUSD

This is actually a great AMM pool to allocate yield to, because no one complains about BUSD not being stable. In fact, no one even considers the variance of value in USD like other things because USD is the unit-of-account measurement we use to calculate the value of everything around us. Hard to get around such a psychological hurdle.

In any case, allocating yield to HBD/BUSD is a great idea because if there is a ton of liquidity within that pair, HBD won't dip like it has been during these dumps. Why? Because anyone can just transfer their HBD to BUSD for very little slippage and exit for $1. More importantly, when HBD gets dumped on another market below the peg the HBD/BUSD pool would be used to arbitrage that market and bring it up to the correct value.

Again, I'd like to point out that it's not even possible to buy/sell 10k HBD, on any market in existence today, instantly without severe slippage. In the world of crypto, that's a small amount and the lack of liquidity here is fully what causes the peg to break to the downside.

Yield/liquidity ratio.

The interesting thing about a double stable-coin pairing is that we already know in advance around how much liquidity it will get. Do we want $5M worth of liquidity here? The math to get that outcome is actually pretty simple. We already know that the pool itself will have a yield between 10%-20%.

How can we guarantee a yield between 10%-20%?

Well, HBD already offers 12% in the savings account (which is locked for 3 days and not liquid), and looking at other options in DEFI we see the same outcomes. Stablecoin/Stablecoin pools are more competitive and higher liquidity because they are shielded from volatility and offer yields x50 higher than banks.

If we wanted $5M worth of TVL in the HBD/BUSD AMM pool, we simply need to allocate $1M a year in yield to it to get the guaranteed result. Once $5M were locked in the pool that would be a yield of 20%, which is the target we were expecting. That kind of liquidity would massively anchor HBD to an actual stable value, which in turn incentivizes more people to actually hold HBD as a stable coin, which in turn allows Hive to outsource more debt and pump the price up of Hive itself.

Is $5M a lot?

Yeah it's quite a bit actually. The CUB/BUSD pool only has $1.1M locked in it, and I can extract thousands upon thousands of dollars from it with very little slippage. Given this fact, we know that we only need to allocate $100,000-$1,000,000 a year to a stable coin pairing with HBD to greatly stabilize it in both directions. The more we allocate, the more stable it becomes. This is an extremely cheap solution and there really is no excuse for not doing it. Proposal 206 only asks for $120,085 ($329 a day) so this is very much on the low end of the spectrum.

These are honestly pretty basic economic principals and it's actually embarrassing that @aggroed created these diesel pools and no one seems to be actually using them for their intended purpose. The 1% entrance/exit fee doesn't help with arbitrage but still I feel like there should be a lot more collaboration and cooperation here. Oh well, these things take time. BXT (BeeSwap) token is making some progress. When our stablecoin can crash 10% instantly you'd think we'd move to fix this problem more quickly, but I guess not. All in good time.

I'll take HODL for $400, Alex.

This McDonalds meme token was created with an interchange with Elon Musk on Twitter.

Only up 285000% in a couple days?

Those are rookie numbers.

Gotta pump those numbers up.

Only up 285000% in a couple days?

Those are rookie numbers.

Gotta pump those numbers up.

I'll take HODL for $800, Alex.

This is the ultimate top signal.

What is mainstream adoption.

Again I think it's funny how mainstream adoption is happening right before our very eyes, but it's not happening in the way that crypto enthusiasts envisioned, and therefore this must be a "top signal". Again, there is no top signal. These people are not prophets, the top signals are only known in retrospect or if you claim every signal is a top signal and go back in time and ignore the 100 other times top signal was declared but ended up being wrong.

One thing is quite certain: the economy is on extremely rocky terrain, and crypto, like all other assets, is connected to the river of liquidity that binds everything. 2022 is going to be a very uncertain year. We had best hedge in both directions.

Posted Using LeoFinance Beta

Return from I'll take HODL for 200 Alex. (HBD/BUSD) to edicted's Web3 Blog