Yesterday I sold 25% of my Bitcoin (not much) at $11,600. I was expecting a pullback at $12k. I was watching Coinbase Pro liquidity in real time just to keep an eye on things. In any case, when the price hit $12.2k with seemingly zero resistance I chickened out and bought back in. Ate the loss. Bad bear! Bad!

Funny how I wake up in the morning to find the price has gone up another $1000. All bets are off at this point.

I have a very very hard time knowing when crypto is overvalued. I know what this technology can do; most of us here are in the same boat. It can replace our entire way of life as we know it. Armed with this information, how could you ever justify shorting such a potentially life-changing technology?

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 | $3200 | $6400 |

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $3467 | $3733 | $4000 | $4267 | $4533 | $4800 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $5067 | $5333 | $5600 | $5867 | $6133 | $6400 |

This is the only metric I currently have to go on to make a Bearish case for Bitcoin. If Bitcoin ever goes x10-x15 higher than its base doubling value, then I can start worrying about a bubble being formed. The value of Bitcoin is already doubling every year. This isn't parabolic growth; it's exponential.

That puts Bitcoin right around $50k-$60k before you have to worry about it crashing back down to the base. On the same note, if the people buying today are long term hodlers, the crash will never happen. A lot of the up-and-coming corporate and institutional investors aren't going to be swing/day trading. They'll lock in and stay locked in for at least a full cycle (4 years). These people don't surf the waves; they create them.

Everyone is going to be looking at past bull runs to project where this one is going. Spoiler alert: this bull run will be nothing like the previous. The landscape has completely changed. Hold on to your hats!

Global Financial Crisis Worse than 2008 Driving BTC Prices

Today we’re in uncharted territory with central banks & negative interest rates – arguably more so than post ’08 financial crisis. This means policymakers are leaving fewer tools to fight the next downturn that inevitably will occur. Investor psychology is notoriously fickle.”

A lot of people are trying to say Facebook and Libra are the ones driving this run up. No... so much no. That's just a drop in the bucket. Consider this spike a precursor to rats swimming away from a sinking ship.

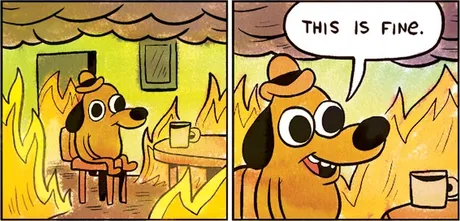

This is what the world economy looks like right now, and 99% of the world is blind to it.

When has Bitcoin ever existed during such a crisis? Never. There is no telling how this is all going down, but I expect to see a lot of flame.

Due diligence own research financial advice blah blah blah

Return from I Make A Terrible Bear. to edicted's Web3 Blog